- United States

- /

- Real Estate

- /

- NasdaqGS:OPEN

Will Opendoor (OPEN) Governance Reforms Mark a Turning Point in Its Leadership Credibility?

Reviewed by Sasha Jovanovic

- In September 2025, the U.S. District Court for the District of Arizona granted preliminary approval to a proposed settlement in the derivative action Gera v. Palihapitiya, et al., involving Opendoor Technologies and related litigation in Delaware courts, with the settlement including new corporate governance reforms and a full release of claims.

- This development highlights Opendoor's ongoing efforts to address legal uncertainties and strengthen their governance structure during a period of operational transformation.

- We'll now examine whether the adoption of new governance reforms could reshape Opendoor's investment narrative and outlook.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Opendoor Technologies Investment Narrative Recap

To be a shareholder in Opendoor Technologies, you need confidence in their shift toward an AI-powered real estate platform and their ability to manage risks tied to inventory, market volatility, and capital needs. The recent court-approved governance reforms may enhance transparency and oversight, but they do not materially affect the primary short term catalyst, successful margin optimization, or the biggest risk, which remains exposure to slower housing demand and inventory overhang.

Among recent announcements, the appointment of Kaz Nejatian as CEO stands out, bringing new leadership focus just as the company faces heightened scrutiny over governance and operational execution. Leadership stability and new strategic direction could influence how Opendoor leverages governance reforms to support margin and product initiatives, even as macro uncertainties persist.

In contrast, investors should be aware that despite governance progress, the company's financial flexibility could still be constrained if...

Read the full narrative on Opendoor Technologies (it's free!)

Opendoor Technologies' narrative projects $4.7 billion revenue and $239.7 million earnings by 2028. This requires a 2.9% yearly revenue decline and a $544.7 million earnings increase from current earnings of -$305.0 million.

Uncover how Opendoor Technologies' forecasts yield a $1.14 fair value, a 85% downside to its current price.

Exploring Other Perspectives

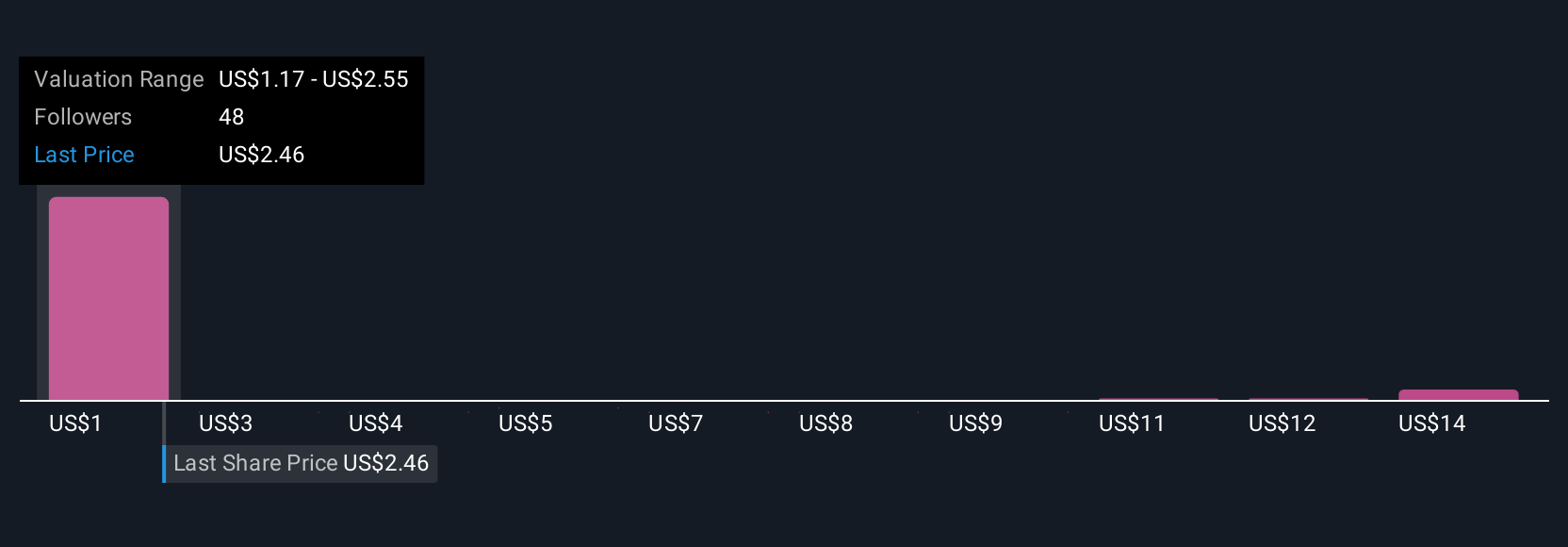

Fair value estimates from 23 Simply Wall St Community members span a wide spectrum, ranging from US$0.70 to US$30.94. Many see new revenue streams as a potential catalyst for performance, but opinions about Opendoor’s prospects differ sharply, explore the alternative views for crucial context.

Explore 23 other fair value estimates on Opendoor Technologies - why the stock might be worth less than half the current price!

Build Your Own Opendoor Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Opendoor Technologies research is our analysis highlighting 2 important warning signs that could impact your investment decision.

- Our free Opendoor Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Opendoor Technologies' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OPEN

Opendoor Technologies

Operates a digital platform for residential real estate transactions in the United States.

Adequate balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives