- United States

- /

- Real Estate

- /

- NasdaqGS:NMRK

The Bull Case For Newmark Group (NMRK) Could Change Following Advisory Role in $4 Billion AI Data Center Deal

Reviewed by Simply Wall St

- Blue Owl Capital, Chirisa Technology Parks, and Machine Investment Group recently announced a US$4 billion joint venture to develop an AI-focused data center campus in Lancaster, Pennsylvania, with advisory support from Newmark Group.

- This collaboration not only strengthens the region's position as a Mid-Atlantic hub for high-density AI infrastructure, but also highlights Newmark's growing involvement in large-scale digital real estate transactions.

- We'll assess how Newmark Group's advisory role in such major AI infrastructure projects may influence its broader investment narrative.

The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Newmark Group Investment Narrative Recap

For shareholders in Newmark Group, the core investment thesis centers on the firm’s positioning within high-growth alternative asset sectors, especially AI-linked digital real estate. The recent US$4 billion data center joint venture underscores Newmark’s ability to secure major advisory mandates, providing a near-term boost to the narrative around its capital markets expertise. However, this project by itself is unlikely to materially change the most important short-term catalyst, which remains the pace and scale of expansion into alternative asset classes. The key risk, potential overexposure to cyclical sectors like data centers, which could face future supply gluts, still deserves close attention.

Among recent announcements, Newmark’s strategic alliance with Mountain West Commercial Real Estate (August 2025) stands out. This agreement significantly increased Newmark’s transaction volume and presence across the U.S. West, aligning with its broader catalyst of expanding into new markets and asset types, and reflects the importance of diversification as highlighted by its data center activity.

Yet, unlike the growth potential of digital infrastructure, investors should not overlook the lingering risk that comes from...

Read the full narrative on Newmark Group (it's free!)

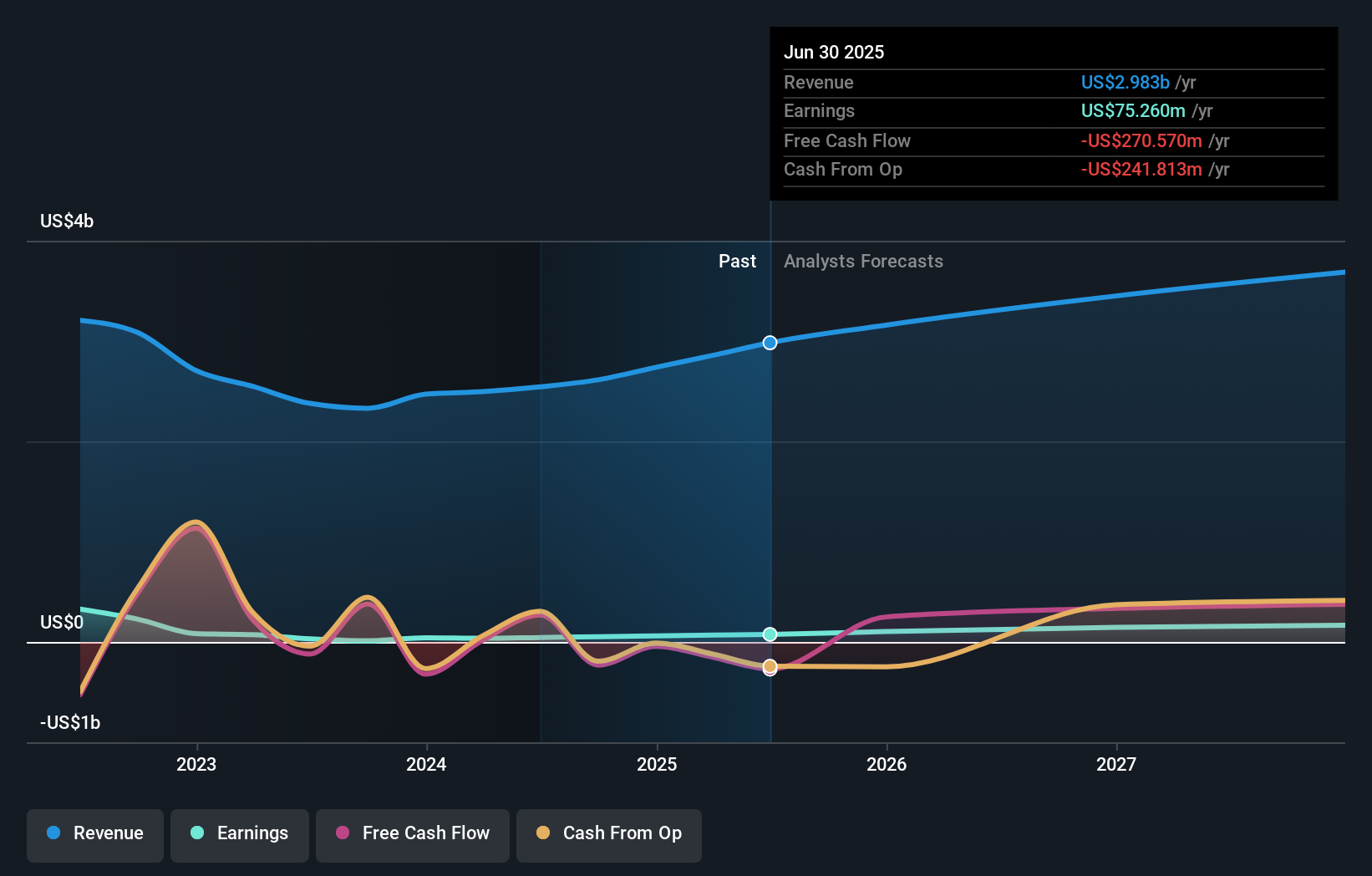

Newmark Group's outlook anticipates $3.8 billion in revenue and $201.7 million in earnings by 2028. This reflects 8.2% annual revenue growth and a $126.4 million increase in earnings from the current $75.3 million.

Uncover how Newmark Group's forecasts yield a $18.45 fair value, in line with its current price.

Exploring Other Perspectives

Community members from Simply Wall St assigned fair values for Newmark ranging from US$11.81 to US$18.45 based on their own forecasts, reflecting widely varying views across just two submissions. While optimism centers around Newmark's expansion in alternative assets, the possibility of sector oversupply could impact near-term performance, something you might want to consider from several different angles.

Explore 2 other fair value estimates on Newmark Group - why the stock might be worth as much as $18.45!

Build Your Own Newmark Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Newmark Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Newmark Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Newmark Group's overall financial health at a glance.

Searching For A Fresh Perspective?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 23 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Newmark Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NMRK

Newmark Group

Provides commercial real estate services in the United States, the United Kingdom, and internationally.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives