- United States

- /

- Real Estate

- /

- NasdaqGS:NMRK

Newmark Group (NMRK): Evaluating Valuation Following Strong Q3 Earnings and Upgraded 2025 Growth Outlook

Reviewed by Simply Wall St

Newmark Group (NMRK) just reported strong third-quarter results, with both revenue and net income climbing well above last year. The company also revised its 2025 revenue guidance upward and is projecting roughly 18% growth at the midpoint.

See our latest analysis for Newmark Group.

It’s been an eventful year for Newmark Group, with headline earnings growth followed by fresh appointments to its European Finance team and high-profile conference appearances that signal a company on the move. The 2025 revenue outlook was raised just days after third-quarter results topped expectations, lending support to the positive sentiment. While the 37.9% share price return year-to-date highlights rekindled momentum, the company’s one-year total shareholder return of 11.3% shows that the long-term story remains in play for investors willing to look past short-term moves.

If Newmark’s recent surge caught your attention, now could be an ideal moment to broaden your watchlist and discover fast growing stocks with high insider ownership

But with shares already delivering a strong run this year and analyst targets pointing to modest further upside, investors must ask whether Newmark is still undervalued or if the market has fully priced in its growth story.

Most Popular Narrative: 12.7% Undervalued

Despite Newmark Group’s closing price of $17.29, the most widely followed narrative points to a fair value of $19.80. This sets the stage for fundamental growth drivers that separate this company from its peers. What exactly underpins this valuation? The narrative draws on recent catalysts and bold projections for both revenue and margin expansion, with striking assumptions that could redefine investor expectations.

Accelerated expansion in alternative asset classes such as data centers, supported by robust demand stemming from AI and digital infrastructure, is driving above-industry revenue growth and higher-margin capital markets activities. This is positioning Newmark for long-term top-line and earnings expansion.

Want to see what’s propelling this double-digit upside? The narrative is built on some especially aggressive forecasts, hinting at a rapid transformation in profitability and growth. Curious about the financial and strategic leap behind these numbers? Dive in to discover the metrics that might unlock the next phase for Newmark Group.

Result: Fair Value of $19.80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rapid international expansion and heavy investment in technology could bring integration and margin challenges. These factors may potentially undermine Newmark Group’s bullish growth narrative.

Find out about the key risks to this Newmark Group narrative.

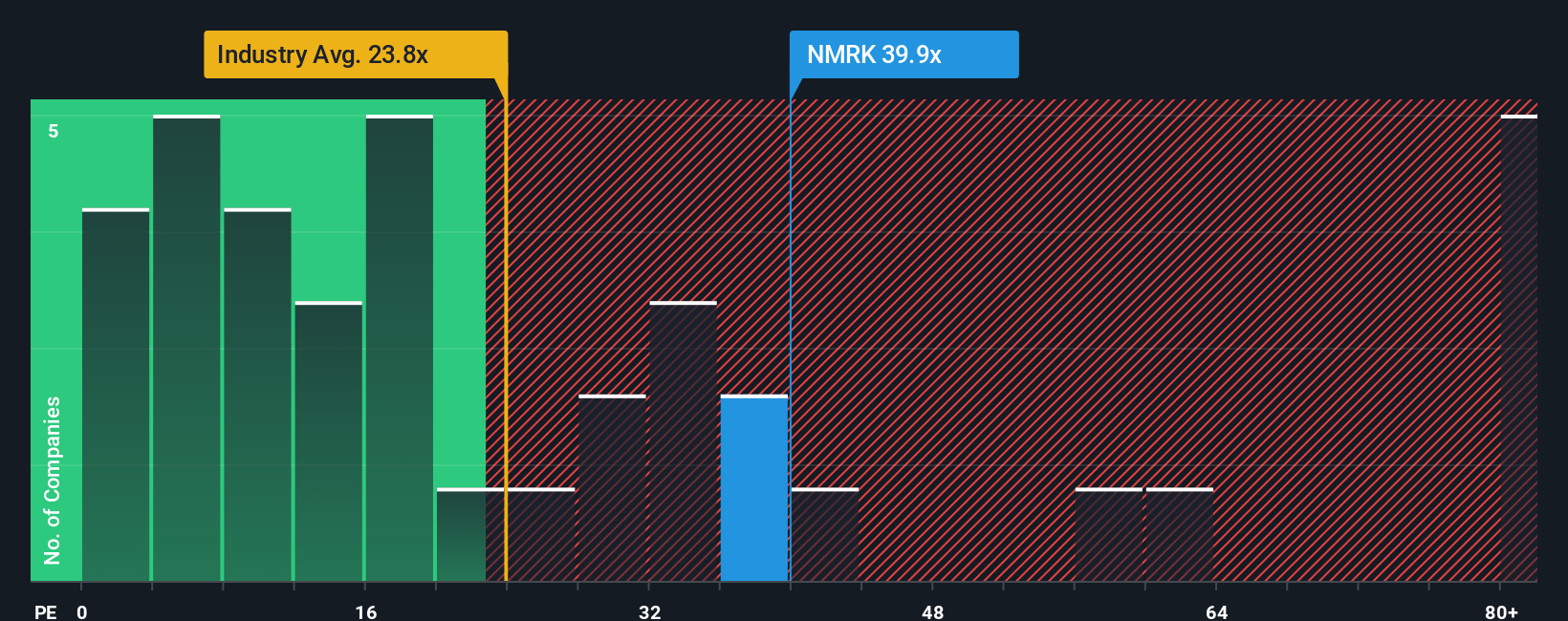

Another View: Comparing Market Multiples

Our quick look at Newmark Group’s price-to-earnings ratio reveals some mixed signals. While its 30.1x is slightly higher than the peer average of 29.1x, it is just below the broader US Real Estate industry at 30.8x. However, compared to a fair ratio of 22.6x, shares still appear expensive. Does this set a cap on upside, or is the market betting on future growth?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Newmark Group Narrative

If you want to dig deeper, challenge the numbers, or shape your own perspective, it takes just a few minutes to do it yourself. Do it your way

A great starting point for your Newmark Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Why stop at just one winning opportunity? Get ahead of the herd by scoping out stocks that match your goals with handpicked ideas from our screener tools.

- Unlock steady income potential and uncover strong yield opportunities through these 14 dividend stocks with yields > 3% with a history of rewarding shareholders.

- Ride the wave of innovation and gain exposure to the technology shaping tomorrow by checking out these 25 AI penny stocks.

- Jump on promising opportunities that markets may be missing by hunting for strong value plays using these 865 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Newmark Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NMRK

Newmark Group

Provides commercial real estate services in the United States, the United Kingdom, and internationally.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives