- United States

- /

- Real Estate

- /

- NasdaqGS:NMRK

Assessing Newmark Group (NMRK) Valuation After Launching Middle East Advisory Practice in Dubai

Reviewed by Simply Wall St

Newmark Group (NMRK) is making a strategic move by setting up its Middle East Advisory practice in Dubai. This follows its recently launched Valuation & Advisory regional office. The company has brought in new leadership with experience from top industry firms.

See our latest analysis for Newmark Group.

Momentum has picked up sharply for Newmark Group this year, with the share price up 55% since January and a robust 34.9% gain over the past 90 days as its Middle East expansion fuels renewed optimism. Looking longer term, the total shareholder return has soared 146% over three years and an impressive 322% over five years, signaling that the company's growth strategy is striking a chord with investors.

If you're interested in what else is making moves beyond real estate, now is a great time to discover fast growing stocks with high insider ownership.

But with so much growth already reflected in Newmark’s soaring share price, the key question is whether the stock is still undervalued or if the market has already priced in all of its future upside.

Most Popular Narrative: 2% Overvalued

Newmark Group’s latest fair value estimate stands at $19.05, just below its last close at $19.48. This razor-thin margin is shaping the current debate over whether further upside remains.

Accelerated expansion in alternative asset classes such as data centers, supported by robust demand stemming from AI and digital infrastructure, is driving above-industry revenue growth and higher-margin capital markets activities. This is positioning Newmark for long-term top-line and earnings expansion.

Want to know why this valuation pushes boundaries? The narrative hinges on future earnings power, driven by rapid growth in both revenue and margins. There is a bold projection underlying the fair value that could surprise cautious investors. Ready to uncover which assumptions set this price target apart?

Result: Fair Value of $19.05 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, challenges remain, as rapid global expansion and heavy tech investment could pressure future margins and slow down earnings growth if not carefully managed.

Find out about the key risks to this Newmark Group narrative.

Another View: Discounted Cash Flow Model Shows Value

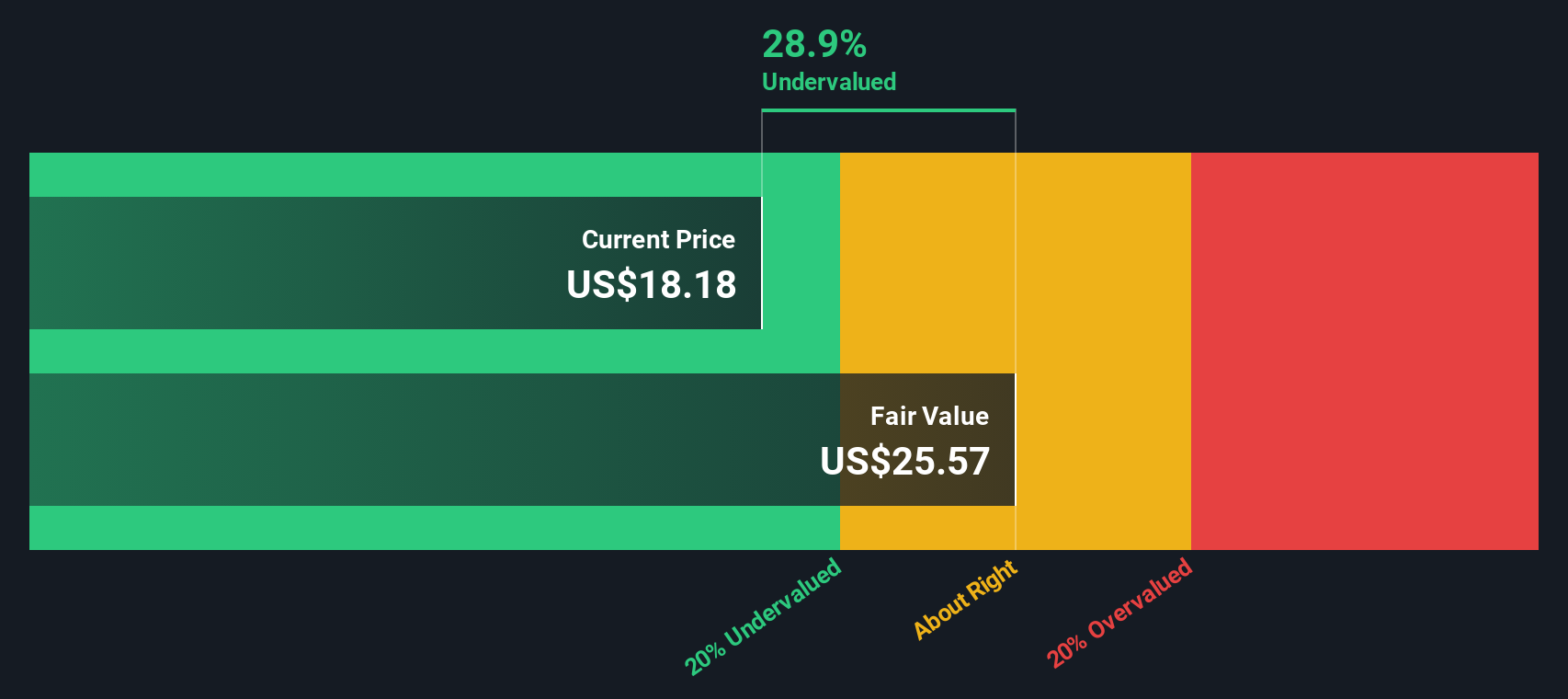

While analyst targets suggest Newmark Group is slightly overvalued, our SWS DCF model estimates a fair value of $25.58, which is about 24% above the current share price. This raises the question: Is Wall Street being overly conservative about Newmark’s future growth, or does the DCF assume too much?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Newmark Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Newmark Group Narrative

If you want a hands-on approach or want to challenge these assumptions, you can dig into the numbers and write your own story in just a few minutes. Do it your way

A great starting point for your Newmark Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Seize your chance to broaden your investment perspective. These unique stock opportunities could be the key to your next portfolio win, so don’t let them pass you by.

- Uncover long-term income potential and tap into the power of compounding yields by checking out these 17 dividend stocks with yields > 3% offering attractive returns above 3%.

- Spot groundbreaking companies shaping medicine’s future as you browse these 33 healthcare AI stocks driving advancements in healthcare and artificial intelligence.

- Catch market inefficiencies before they disappear by reviewing these 872 undervalued stocks based on cash flows where some of today's best value opportunities may be waiting.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Newmark Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NMRK

Newmark Group

Provides commercial real estate services in the United States, the United Kingdom, and internationally.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives