- United States

- /

- Real Estate

- /

- NasdaqGM:EXPI

eXp World Holdings Welcomes ERS Real Estate Group, Is It A Game Changer?

- eXp Realty is welcoming ERS Real Estate Group, a high-performing Midwest team that closed US$170 million in 2024 sales, and will support ERS as it launches an all-in-one real estate ecosystem with fintech, mortgage, title, insurance, and home services after a US$70 million merger with Good Life Capital.

- This marks a significant shift, combining top agent production with the rollout of an AI-powered platform designed to streamline the homeownership journey nationwide.

- We'll explore how the addition of an integrated fintech and leading team could expand eXp’s platform-driven real estate model.

eXp World Holdings Investment Narrative Recap

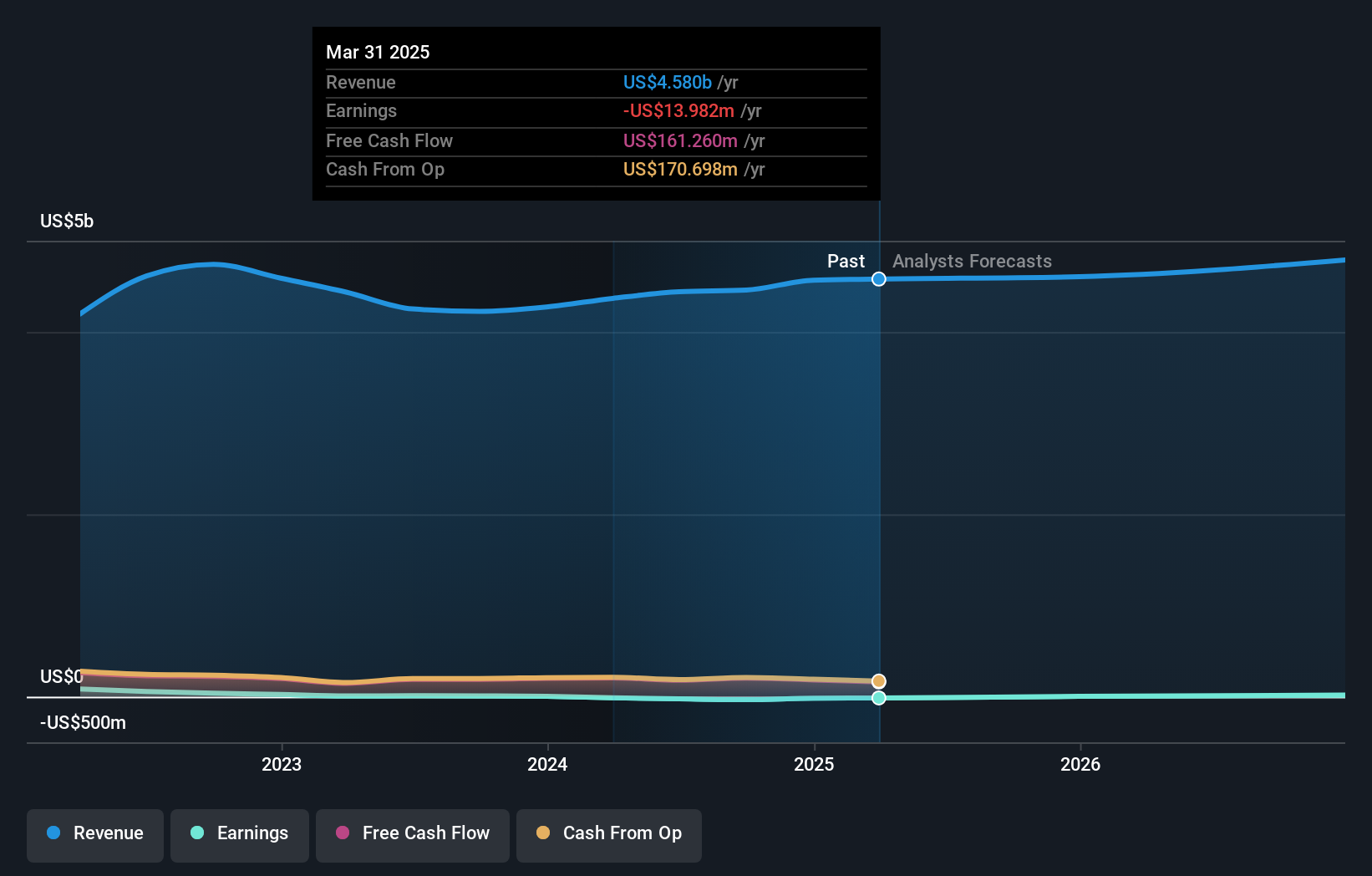

Shareholders in eXp World Holdings typically believe in the company's ability to scale a tech-driven, agent-led real estate model nationwide. The recent addition of ERS Real Estate Group and its integrated fintech ecosystem is a potential near-term catalyst, but the primary risk remains eXp's ability to turn improving sales into sustainable profits given ongoing net losses. At this stage, the ERS deal strengthens the growth narrative, but its impact on immediate profitability appears limited.

Among the recent company announcements, the Q1 2025 earnings stood out, with eXp reporting increased sales but still posting a net loss of US$11.02 million, albeit less than the same period a year prior. This result underlines how revenue growth and new partnerships like ERS can support the platform, but also highlights the importance of monitoring whether these moves lead to sustained positive earnings.

Yet, while new partnerships expand market reach, investors should also be aware of...

Read the full narrative on eXp World Holdings (it's free!)

Exploring Other Perspectives

Simply Wall St Community members estimate eXp’s fair value between US$10 and US$13.61, reflecting a wide spectrum of opinions from just two contributors. This diversity highlights both potential upside and the need to consider ongoing profitability challenges when weighing the company’s outlook.

Explore 2 other fair value estimates on eXp World Holdings - why the stock might be worth $10.00!

Build Your Own eXp World Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes , extraordinary investment returns rarely come from following the herd.

- A great starting point for your eXp World Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free eXp World Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate eXp World Holdings' overall financial health at a glance.

Searching For A Fresh Perspective?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Uncover 19 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:EXPI

eXp World Holdings

Provides cloud-based real estate brokerage services for residential homeowners and homebuyers.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success