- United States

- /

- Real Estate

- /

- NasdaqGM:EXPI

eXp World Holdings (EXPI): Assessing Valuation After UK Commercial Division Launch Expands Growth Ambitions

Reviewed by Kshitija Bhandaru

eXp World Holdings (EXPI) is drawing attention after eXp Realty launched its UK Commercial division. This move makes it the first agent-powered platform in the UK to offer both residential and commercial services under one model.

See our latest analysis for eXp World Holdings.

eXp World Holdings’ latest international expansion has caught the market’s eye, but momentum around the stock has yet to turn. The share price recently slipped 6.8% over the past month, and its 1-year total shareholder return is still deep in the red at -19.5%. Still, with operational growth efforts and strategic hires such as the Slocum Home Team, there are signs that management is focused on strengthening the foundation for a future turnaround.

If you’re curious about other opportunities beyond real estate, take the next step and see what’s out there with our fast growing stocks with high insider ownership.

Given all the recent momentum and new market opportunities, investors face a pivotal question: is eXp World Holdings undervalued at current levels, or has the market already priced in the company’s international expansion and growth ambitions?

Most Popular Narrative: 13.2% Undervalued

With eXp World Holdings closing at $10.42 and a narrative fair value set at $12.00, the outlook suggests notable upside remains if projections materialize. Narrative watchers are turning their focus to what is driving this conviction.

Accelerating global expansion supported by a scalable cloud-based platform is allowing eXp to rapidly launch into new markets (Peru, Turkey, Ecuador, Japan, South Korea) and capture productive agents quickly, which increases potential transaction fees and top-line revenue in tandem with the ongoing digitalization of commerce and work.

Want to know which growth lever has analysts this bullish? There is a bold, quantitative bet on profit turnaround, ramped-up international momentum, and a valuation metric not usually seen in traditional brokerages. Uncover the specific assumptions that could power this stock’s next act if they play out.

Result: Fair Value of $12.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, as shifts in demographics or accelerated commission compression could weigh on transaction volumes and impact eXp's commission-driven growth story.

Find out about the key risks to this eXp World Holdings narrative.

Another View: Discounted Cash Flow Model Adds Caution

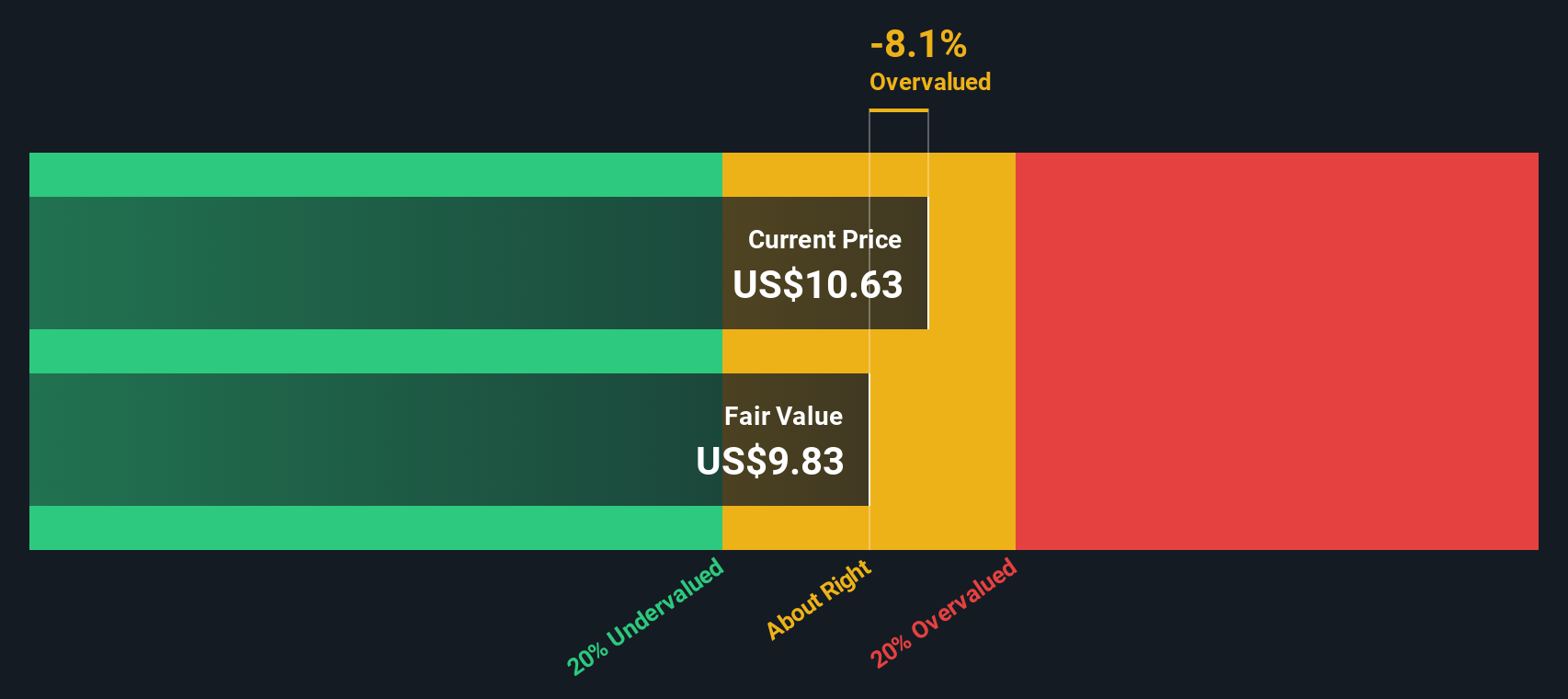

While the fair value narrative suggests eXp World Holdings has upside, our SWS DCF model offers a more measured outlook. Based on the DCF approach, shares are trading slightly above their estimated fair value, which raises the possibility that the market is not underestimating future cash flows at this time. Could analyst enthusiasm be running ahead of the fundamentals?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out eXp World Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own eXp World Holdings Narrative

If you see things differently or want to dig into the numbers yourself, you can easily put together your own take in just a few minutes. Do it your way.

A great starting point for your eXp World Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Seize your edge and spot tomorrow’s market movers today using our handpicked stock ideas. Don’t let great opportunities slip past while others take action.

- Build steady income, even when markets wobble, by tapping into these 19 dividend stocks with yields > 3%, which offers attractive yields above 3%.

- Jump on the next artificial intelligence breakout and stay current with these 24 AI penny stocks, making serious waves in tech innovation.

- Cement your portfolio’s value advantage with these 899 undervalued stocks based on cash flows, which our data flags as trading well below fair cash flow estimates.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:EXPI

eXp World Holdings

Provides cloud-based real estate brokerage services for residential homeowners and homebuyers.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives