- United States

- /

- Real Estate

- /

- NasdaqGS:CSGP

CoStar Group (CSGP): Reviewing Valuation After Recent Share Price Weakness

Reviewed by Simply Wall St

See our latest analysis for CoStar Group.

Despite some high-profile shifts in the broader real estate tech space, CoStar Group’s share price has lost momentum in recent months, slipping 18.2% over the past 30 days and ending at $69.38. With the 1-year total shareholder return down 6%, recent volatility has added to the pressure that has been building over the past year. This indicates that investors may still be weighing the company’s long-term growth thesis against evolving risks and valuation questions.

If you’re keeping an eye out for other major movers with potential, consider broadening your research to discover fast growing stocks with high insider ownership.

With the recent share price decline and mixed signals from fundamental metrics, investors are left to wonder if CoStar Group’s current valuation is a bargain or if the market has already accounted for its future growth prospects.

Most Popular Narrative: 26% Undervalued

With CoStar Group's most popular narrative assigning a fair value well above its last close, the stage is set for bold projections and ambitious growth levers. Market-watchers are debating if the platform’s reinvention and margin expansion can truly drive the next wave of returns.

Major investments in residential real estate, international expansion, and advanced analytics are unlocking new revenue streams and accelerating long-term growth opportunities.

CoStar’s path to this price tag is anything but ordinary. The narrative is betting on sizable margin expansion, elevated profit multiples, and revenue targets that would raise eyebrows for even the fastest-growing tech names. Which number, metric, or leap of faith gets analysts this bullish? There is only one way to find out.

Result: Fair Value of $94.06 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing disputes over data rights and rising competitive pressures could quickly undermine CoStar’s growth momentum and challenge these bullish forecasts.

Find out about the key risks to this CoStar Group narrative.

Another View: What Do Sales Multiples Say?

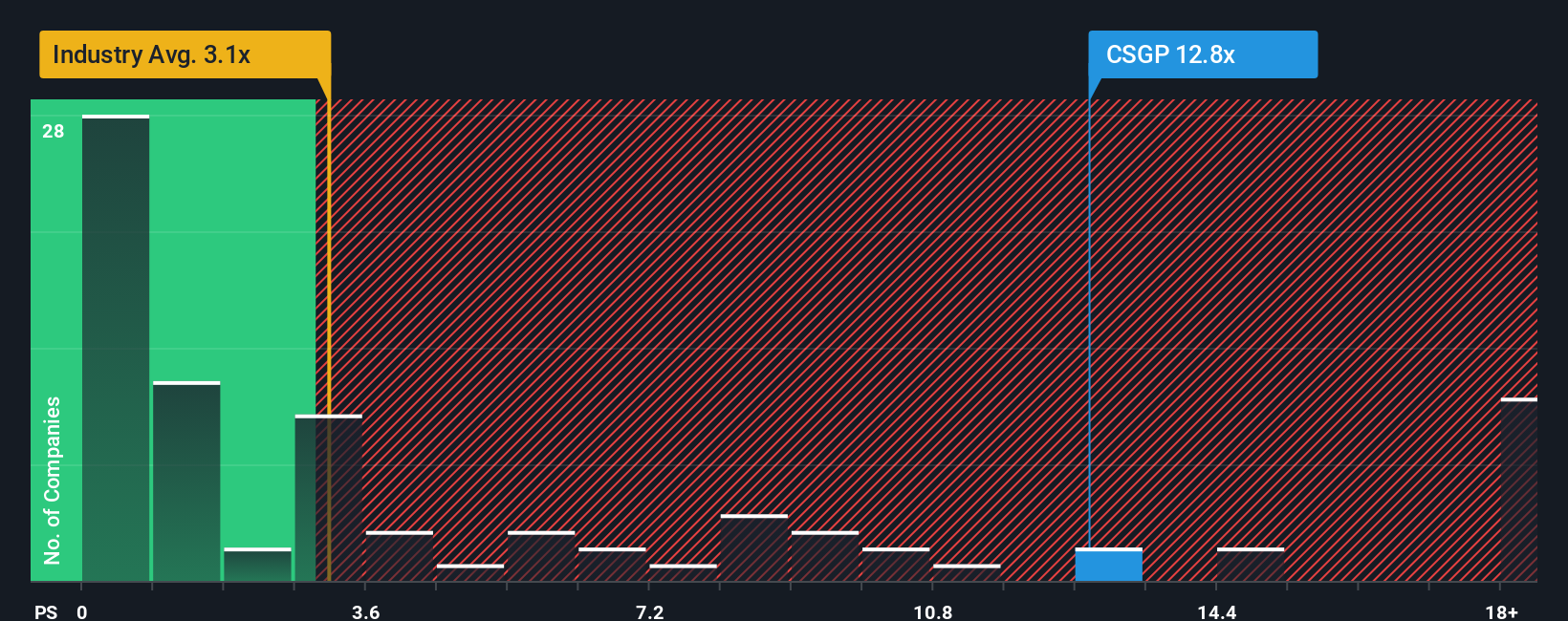

Looking beyond growth-focused narratives, CoStar's price-to-sales ratio stands at 9.6 times, which is much higher than both its industry average of 2.5 times and the fair ratio of 5 times. This suggests the market is pricing in a lot of optimism and may leave little margin for error. Is this a sign of belief in future dominance, or is it setting up valuation risks for the cautious investor?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own CoStar Group Narrative

If you want to challenge this viewpoint or simply prefer hands-on research, you can tap into the data and shape your own perspective in under three minutes with Do it your way.

A great starting point for your CoStar Group research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready for More Investment Ideas?

Smart investors never stop looking for their next opportunity. Don’t miss out on stocks with hidden value, sustainable dividends, or the next industry disruptor. There is always a market leader waiting for you.

- Target high-yield income by checking out these 18 dividend stocks with yields > 3%, where robust dividend payers shine with yields over 3%.

- Catalyze your portfolio with innovation when you research these 27 AI penny stocks making breakthroughs across artificial intelligence trends and technologies.

- Unlock stocks trading below their estimated worth by using these 840 undervalued stocks based on cash flows and surface companies undervalued based on future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CSGP

CoStar Group

Provides information, analytics, and online marketplace services in the United States, Canada, Europe, the Asia Pacific, and Latin America.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives