- United States

- /

- Real Estate

- /

- NasdaqGS:ASPS

Altisource Portfolio Solutions S.A. (NASDAQ:ASPS) Shares Fly 37% But Investors Aren't Buying For Growth

Altisource Portfolio Solutions S.A. (NASDAQ:ASPS) shares have continued their recent momentum with a 37% gain in the last month alone. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 61% share price drop in the last twelve months.

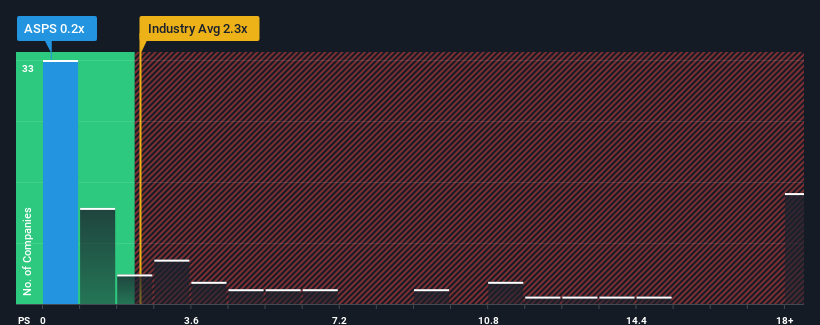

Although its price has surged higher, Altisource Portfolio Solutions may still look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 0.2x, considering almost half of all companies in the Real Estate industry in the United States have P/S ratios greater than 2.3x and even P/S higher than 11x aren't out of the ordinary. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Altisource Portfolio Solutions

How Altisource Portfolio Solutions Has Been Performing

Revenue has risen at a steady rate over the last year for Altisource Portfolio Solutions, which is generally not a bad outcome. Perhaps the market believes the recent revenue performance might fall short of industry figures in the near future, leading to a reduced P/S. Those who are bullish on Altisource Portfolio Solutions will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Altisource Portfolio Solutions will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Altisource Portfolio Solutions' to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 5.2% last year. However, this wasn't enough as the latest three year period has seen an unpleasant 23% overall drop in revenue. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 17% shows it's an unpleasant look.

With this information, we are not surprised that Altisource Portfolio Solutions is trading at a P/S lower than the industry. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. Even just maintaining these prices could be difficult to achieve as recent revenue trends are already weighing down the shares.

What We Can Learn From Altisource Portfolio Solutions' P/S?

Altisource Portfolio Solutions' recent share price jump still sees fails to bring its P/S alongside the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of Altisource Portfolio Solutions confirms that the company's shrinking revenue over the past medium-term is a key factor in its low price-to-sales ratio, given the industry is projected to grow. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. If recent medium-term revenue trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

Before you take the next step, you should know about the 4 warning signs for Altisource Portfolio Solutions (3 are a bit unpleasant!) that we have uncovered.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ASPS

Altisource Portfolio Solutions

Operates as an integrated service provider and marketplace for the real estate and mortgage industries in the United States.

Moderate risk and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion