- United States

- /

- Real Estate

- /

- NasdaqGS:ASPS

Altisource Portfolio Solutions (ASPS): Losses Down 33.9% Annually, Deep Valuation Discount Spurs Debate

Reviewed by Simply Wall St

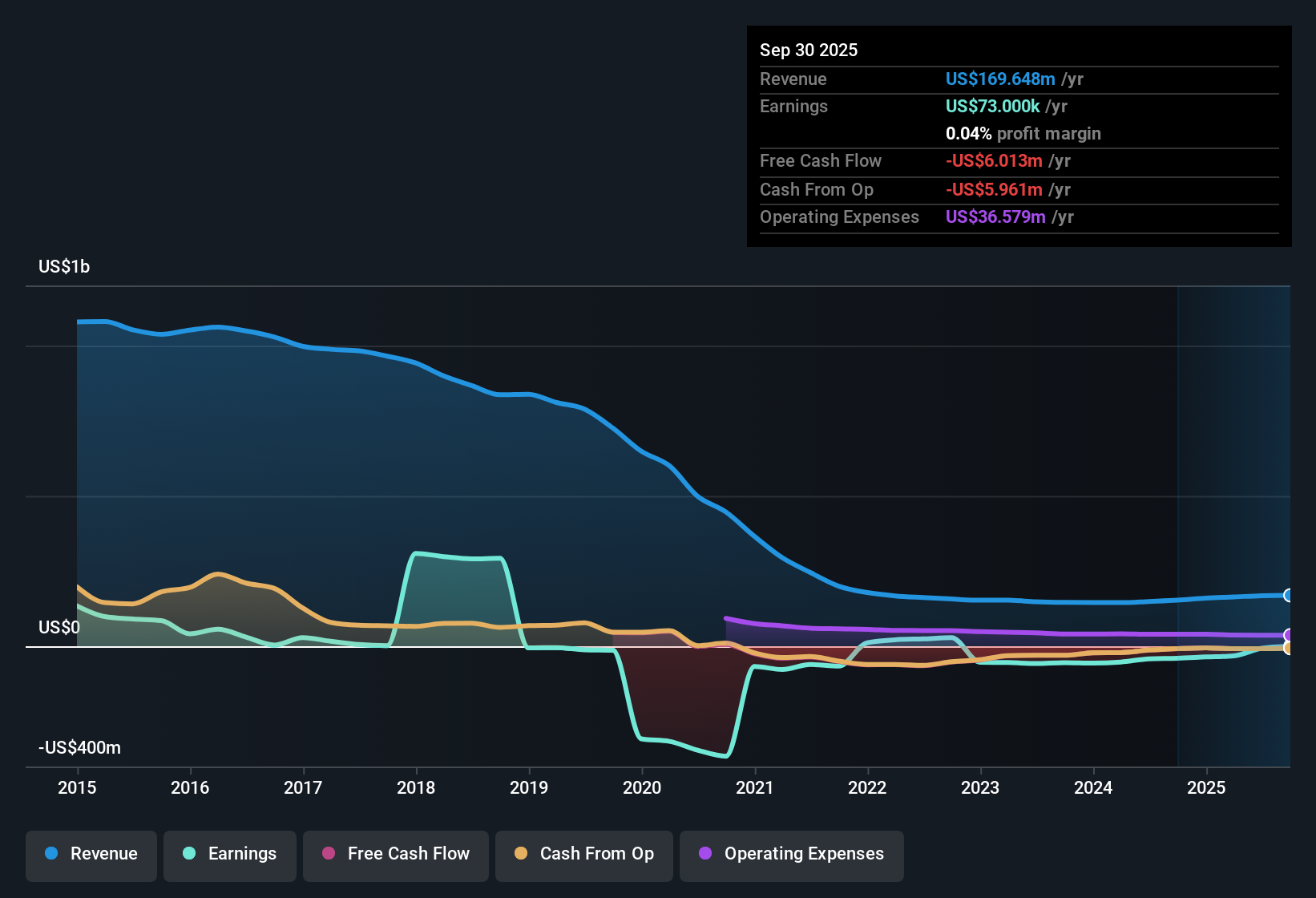

Altisource Portfolio Solutions (ASPS) remains unprofitable but has managed to reduce its annual losses by 33.9% per year over the past five years. While the company’s net income has not turned positive and profit growth has not accelerated recently, its Price-To-Sales Ratio of 0.8x stands well below the peer average of 3.4x and the US Real Estate sector average of 2.6x. Investor attention is likely to center on operational progress and revenue momentum, even as shareholder dilution and negative equity continue to pose notable risks.

See our full analysis for Altisource Portfolio Solutions.Next up, we'll see how these numbers hold up against the consensus narratives shaping market expectations. A few popular views may get reinforced while others could be called into question.

Curious how numbers become stories that shape markets? Explore Community Narratives

Cost Cuts Drive 33.9% Loss Reduction

- Annual losses have decreased by 33.9% per year over the past five years, reflecting meaningful cost-cutting and operational streamlining even as Altisource has not yet reached profitability.

- What is surprising, relative to the prevailing market view, is that despite persistent negative net income, this consistent loss reduction suggests underlying business stabilization is taking hold.

- Where critics might have expected ongoing deterioration due to sector headwinds and industry risks, the pace of improvement in loss reduction runs counter to worst-case scenarios and hints at nascent turnaround potential.

- However, with no profit growth acceleration in the most recent year, any bullish interpretation remains cautious until a clear shift to positive earnings emerges.

Dilution and Negative Equity Weigh on Sentiment

- Shareholder dilution over the past year and the company’s negative equity position stand out as persistent structural risks that are likely to influence both market confidence and future capital raising efforts.

- Bears argue these red flags could continue to overshadow operational progress, especially as dilution erodes per-share value and negative equity may constrain access to financing.

- In the face of these concerns, management’s task is to demonstrate balance sheet resilience and restore equity without further diluting existing shareholders.

- Notably, despite a reduction in losses, these balance sheet risks remain unresolved and are front of mind for risk-averse investors.

Price-To-Sales Discount Signals Deep Value

- With a Price-To-Sales Ratio of 0.8x, Altisource trades at a substantial discount to both the peer average of 3.4x and the US Real Estate sector average of 2.6x. This suggests the market assigns a steep risk premium but also hints at possible overlooked value for those willing to weather volatility.

- Building on this, the prevailing market view points out that value investors often zero in on such wide discounts as potential entry points, betting that any catalyst, such as revenue momentum or sector stabilization, could lead to rapid multiple expansion.

- However, this deep discount also reflects skepticism around ongoing profitability challenges and balance sheet strain, which will need to be addressed before the gap can narrow.

- For those tracking sector context, mortgage servicing and distressed asset management players are highly sensitive to these valuation swings, making it crucial to monitor for earnings inflection points.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Altisource Portfolio Solutions's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Altisource’s ongoing net losses, persistent negative equity, and recent shareholder dilution highlight unresolved financial health risks and balance sheet instability.

For investors seeking stronger foundations, our solid balance sheet and fundamentals stocks screener (1984 results) helps you quickly discover companies with healthier balance sheets and less exposure to the capital risks weighing on Altisource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ASPS

Altisource Portfolio Solutions

Operates as an integrated service provider and marketplace for the real estate and mortgage industries in the United States.

Moderate risk and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion