- United States

- /

- Real Estate

- /

- NasdaqCM:AEI

Alset Inc. (NASDAQ:AEI) Might Not Be As Mispriced As It Looks After Plunging 33%

Alset Inc. (NASDAQ:AEI) shareholders won't be pleased to see that the share price has had a very rough month, dropping 33% and undoing the prior period's positive performance. For any long-term shareholders, the last month ends a year to forget by locking in a 79% share price decline.

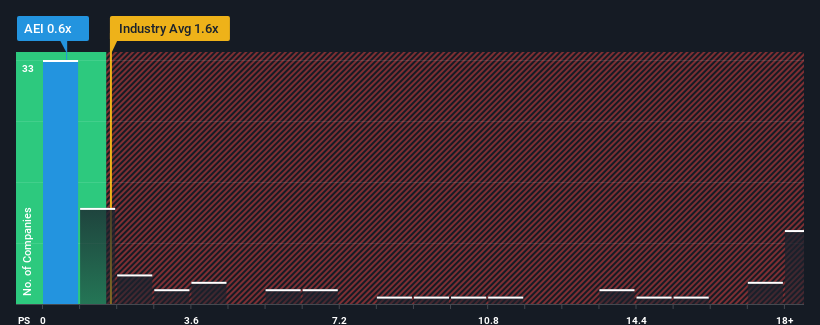

After such a large drop in price, Alset's price-to-sales (or "P/S") ratio of 0.6x might make it look like a buy right now compared to the Real Estate industry in the United States, where around half of the companies have P/S ratios above 1.6x and even P/S above 11x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Alset

How Alset Has Been Performing

With revenue growth that's exceedingly strong of late, Alset has been doing very well. One possibility is that the P/S ratio is low because investors think this strong revenue growth might actually underperform the broader industry in the near future. Those who are bullish on Alset will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for Alset, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as low as Alset's is when the company's growth is on track to lag the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 106%. Pleasingly, revenue has also lifted 86% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Comparing that to the industry, which is only predicted to deliver 10% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

In light of this, it's peculiar that Alset's P/S sits below the majority of other companies. It looks like most investors are not convinced the company can maintain its recent growth rates.

What Does Alset's P/S Mean For Investors?

Alset's P/S has taken a dip along with its share price. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We're very surprised to see Alset currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. When we see strong revenue with faster-than-industry growth, we assume there are some significant underlying risks to the company's ability to make money which is applying downwards pressure on the P/S ratio. At least price risks look to be very low if recent medium-term revenue trends continue, but investors seem to think future revenue could see a lot of volatility.

We don't want to rain on the parade too much, but we did also find 4 warning signs for Alset (1 shouldn't be ignored!) that you need to be mindful of.

If you're unsure about the strength of Alset's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:AEI

Alset

Engages in real estate development business in the United States, Singapore, Hong Kong, Australia, South Korea, and the People’s Republic of China.

Flawless balance sheet with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success