- United States

- /

- Pharma

- /

- NYSE:ZTS

Zoetis (ZTS): Evaluating Valuation After Health Canada Clears New Lenivia Osteoarthritis Therapy

Reviewed by Simply Wall St

Zoetis (ZTS) just received Health Canada approval for Lenivia, its new injection therapy for canine osteoarthritis pain. This development broadens Zoetis’ portfolio and highlights the ongoing innovation within the business.

See our latest analysis for Zoetis.

Despite stepping up its innovation game and expanding its pain management line for pets, Zoetis' share price has struggled to gain momentum, with a 1-year total shareholder return of -17.94%. While the business fundamentals appear sound and the latest launch could fuel optimism, recent price action suggests investor caution is lingering as the market looks for clear signs of lasting growth.

If new animal health breakthroughs are on your radar, now is an ideal moment to discover more opportunities in the sector with our See the full list for free..

So with shares still trading at a meaningful discount to analyst targets, should investors view Zoetis as an undervalued leader in animal health, or is the market already pricing in future growth expectations?

Most Popular Narrative: 22.7% Undervalued

The most popular narrative sets Zoetis’s fair value at $188.83, a sizable premium over the recent closing price of $145.94. This separation highlights a story of untapped potential and places a sharp spotlight on expectations for future growth and profitability improvements.

Ongoing innovation and accelerated R&D output, with expectations for a major new product approval in a key market every year over the next few years, positions Zoetis to expand addressable markets, launch higher-margin products, and protect market share, positively impacting organic revenue growth and net margins.

What forecasts are they using to reach that bold price target? Discover the pivotal growth themes, profit projections, and valuation assumptions that make this narrative stand out. Curious what really moves the numbers? The full narrative reveals the financial blueprint driving Zoetis’s valuation.

Result: Fair Value of $188.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising competition and slower adoption of key therapies could quickly change the outlook and challenge even the most optimistic expectations for Zoetis.

Find out about the key risks to this Zoetis narrative.

Another View: Is the Market Already Pricing in Ambition?

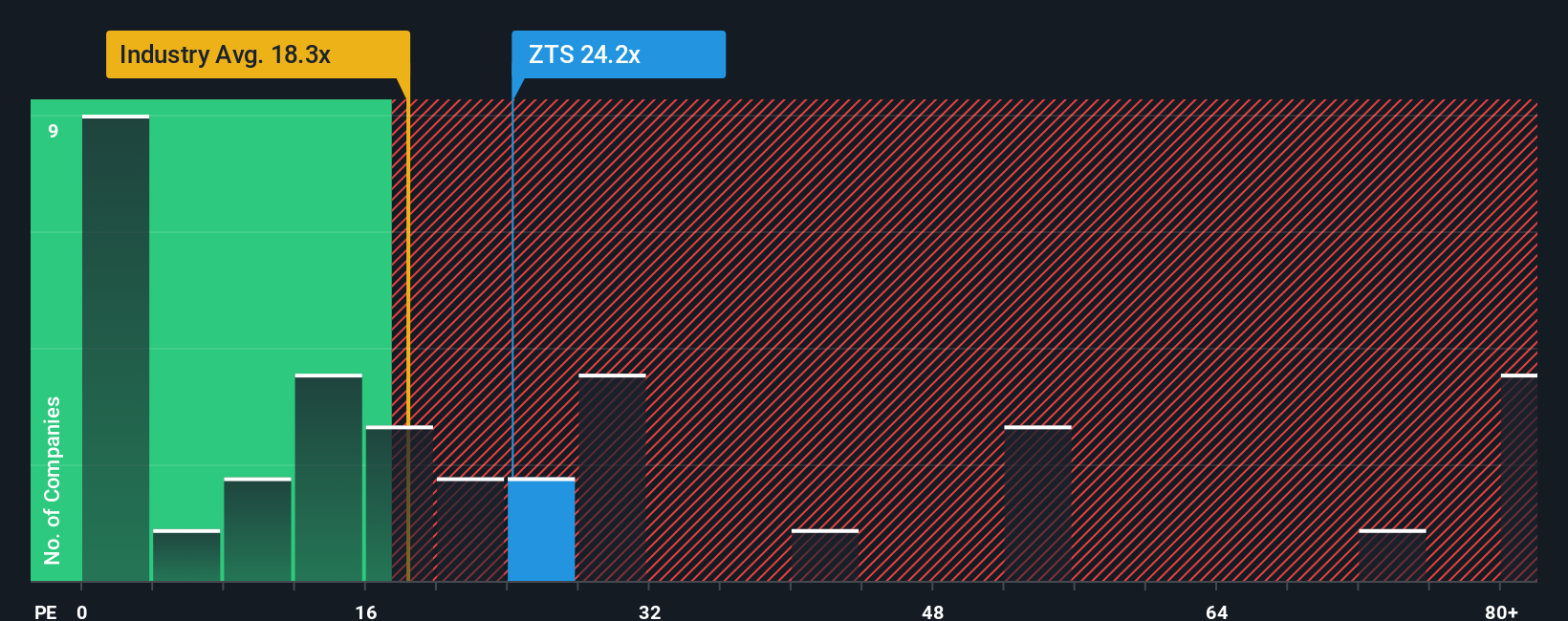

While the most popular narrative points to Zoetis being undervalued, a look through the lens of its price-to-earnings ratio tells a different story. Zoetis currently trades at 24.8 times earnings, which is much higher than the peer average of 15 times and the US Pharmaceuticals industry average of 17.7 times. Even compared to its fair ratio of 21.5, the current valuation looks stretched. This may indicate that the market is already pricing in a lot of future optimism. Does this premium suggest more risk than reward, or will earnings growth catch up?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Zoetis Narrative

Dig into the numbers for yourself and see if your perspective lines up, or forge your own story around Zoetis in just a few minutes. Do it your way.

A great starting point for your Zoetis research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you want to stay ahead, don’t settle for just one great stock. Uncover your next investment theme with these powerful screeners today.

- Target powerful passive income by checking out these 17 dividend stocks with yields > 3%, offering the yield and stability crucial for resilient portfolios.

- Spot undervalued opportunities hiding in plain sight with these 877 undervalued stocks based on cash flows, which could offer strong returns based on their cash flows.

- Capitalize on innovation by tapping into these 27 AI penny stocks, focused on breakthroughs in artificial intelligence across leading industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zoetis might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ZTS

Zoetis

Engages in the discovery, development, manufacture, and commercialization of animal health medicines, vaccines, diagnostic products and services, biodevices, genetic tests, and precision animal health products in the United States and internationally.

Proven track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives