- United States

- /

- Pharma

- /

- NYSE:ZTS

Zoetis (ZTS): Assessing Valuation After a 30% Drop in Shareholder Returns

Reviewed by Simply Wall St

See our latest analysis for Zoetis.

While Zoetis's 1-day share price return was only slightly negative, the real story is its longer-term momentum. A 30% drop in total shareholder return over the past year signals that sentiment has clearly shifted. Concerns about future growth are weighing more heavily than any near-term recovery, giving investors pause as they assess whether downside risk or rebound potential will dominate in the months ahead.

Looking beyond animal health? Now is a timely moment to expand your investing perspective and check out our See the full list for free..

With the stock trading well below analyst targets but concerns about growth lingering, the key question emerges: is Zoetis now undervalued, or is the market already factoring in every risk and future rebound?

Most Popular Narrative: 35.6% Undervalued

Zoetis’s most widely followed narrative values the stock much higher than its current price of $120.82, implying significant potential for upside if the narrative’s assumptions hold. This presents a direct challenge to today’s market sentiment, especially considering the sharp declines of recent months.

Ongoing innovation and accelerated R&D output, with expectations for a major new product approval in a key market every year over the next few years, positions Zoetis to expand addressable markets, launch higher-margin products, and protect market share, positively impacting organic revenue growth and net margins.

Want to see which bold growth forecasts push this fair value so far above the current share price? One part of this narrative rests on transformational innovation and ambitious future profits, defying industry norms. Curious which financial levers are behind the valuation gap? Dive in to discover the key numbers supporting this undervalued thesis.

Result: Fair Value of $187.70 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slowing adoption in key franchises and heightened competitive pressures could challenge Zoetis’s ability to meet ambitious growth and profitability expectations.

Find out about the key risks to this Zoetis narrative.

Another View: Comparing Earnings Multiples

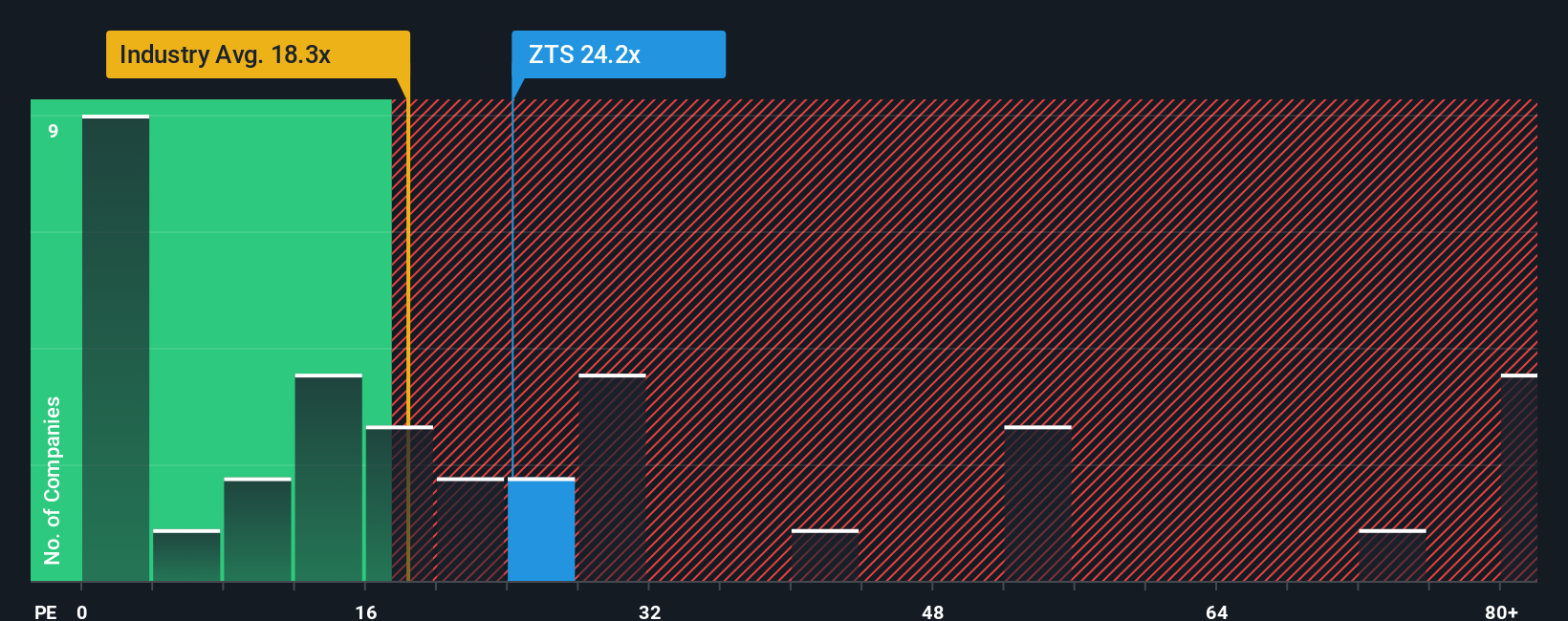

Taking a different approach, Zoetis’s price-to-earnings ratio stands at 20.1x, which is higher than the US Pharmaceuticals industry average of 18.8x but lower than the peer average of 22.7x. This suggests that Zoetis appears more expensive than the broader industry, yet less costly compared to similar peers. Notably, this valuation is still below the fair ratio of 22.8x, indicating some room before the market fully prices in future growth. It raises the question of whether the market is being overly cautious or if further changes might push the ratio closer to, or even above, that fair level.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Zoetis Narrative

If you’re not convinced by these perspectives or simply enjoy doing your own homework, you can easily piece together your own narrative in just a few minutes. Do it your way

A great starting point for your Zoetis research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Winning Ideas?

Thousands of investors are spotting their next big opportunity using the Simply Wall Street Screener, and you should not miss out on these smart picks.

- Tap into the explosive potential of artificial intelligence with companies that are already changing industries through these 25 AI penny stocks.

- Grab solid yields and consistent returns by checking out these 16 dividend stocks with yields > 3%, which delivers over 3% payouts.

- Ride the growing wave of healthcare innovation by exploring these 32 healthcare AI stocks, a group at the forefront of medical AI.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zoetis might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ZTS

Zoetis

Engages in the discovery, development, manufacture, and commercialization of animal health medicines, vaccines, diagnostic products and services, biodevices, genetic tests, and precision animal health products in the United States and internationally.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives