- United States

- /

- Pharma

- /

- NYSE:ZTS

Assessing Zoetis After Recent FDA Approval and Share Price Slide in 2025

Reviewed by Bailey Pemberton

Thinking about Zoetis and whether to hang on, buy more, or move on? You are far from alone; the stock has made some surprising moves lately and investors everywhere are asking the same questions. After a modest 0.5% gain over the past week, Zoetis is still sitting well below its recent peaks, down 3.2% over the last month and trailing by a hefty 24.5% versus this time last year. It's clear the risk perception around Zoetis has changed, perhaps spurred on by shifting sentiment in the broader animal health market and a cautious approach from institutional investors.

Of course, numbers like a -1.6% return over three years and -6.4% over five years tell their own story, but they don't always say what is coming next. With the latest close at $143.46 a share, it is more important than ever to figure out if Zoetis is undervalued or primed for a comeback. That is where valuation comes in.

By the usual checklist, Zoetis lands a value score of just 2 out of 6, indicating it only ticks two of the boxes for being undervalued right now. But what do those boxes actually mean, and how much can you really rely on traditional valuation metrics anyway? In the next section, we will break down the major methods for assessing a company's value, and I'll show you what matters (and what does not). Stick around, because later I will share a fresh perspective on valuation that can sometimes be even more telling than the standard math.

Zoetis scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Zoetis Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to today’s dollars. This method aims to calculate what the business is worth, based entirely on expected future cash generation.

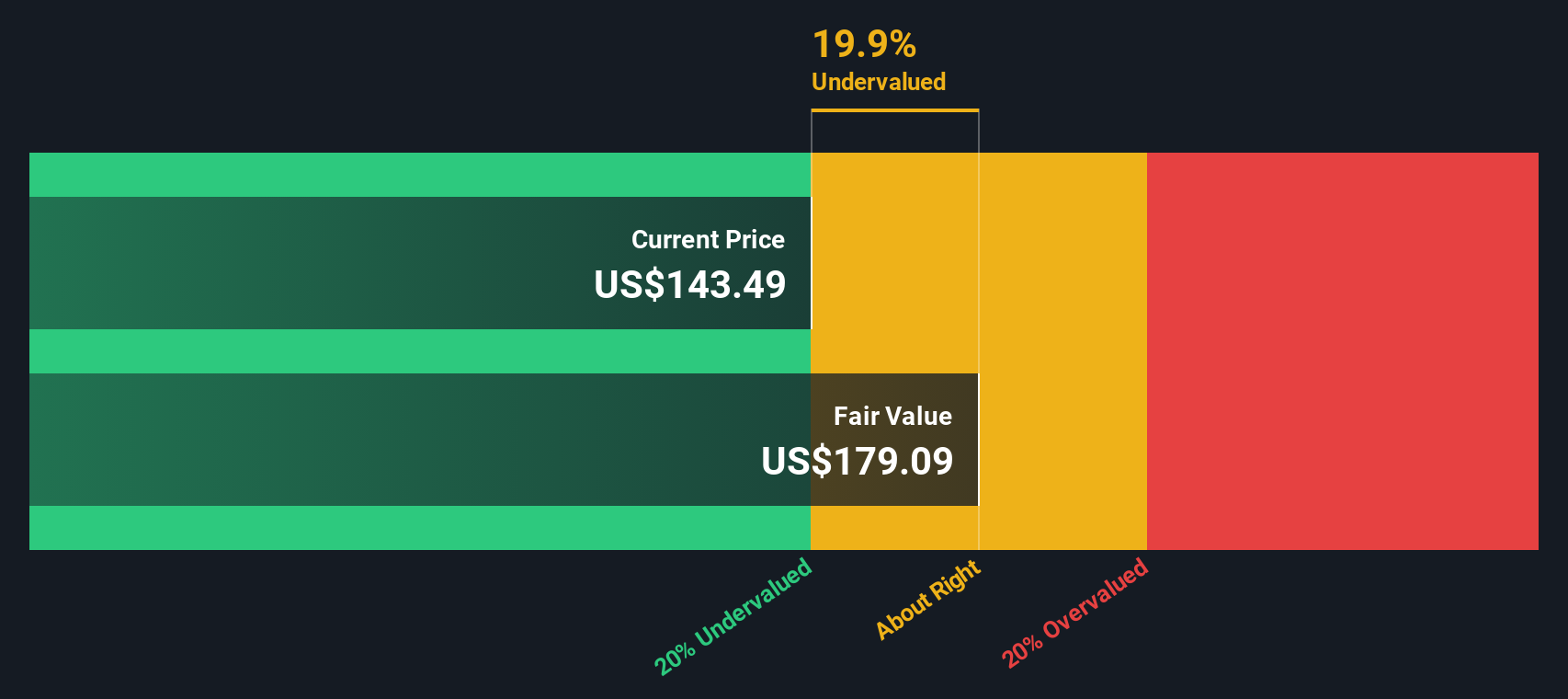

For Zoetis, DCF analysis starts with a look at its current Free Cash Flow, which stands at $2.21 Billion. Analyst projections go out five years, estimating ongoing growth in Free Cash Flow and reaching about $3.28 Billion in 2029. For years beyond that, Simply Wall St applies gradual extrapolation to estimate growth up to 2035, with Free Cash Flow expected to exceed $3.84 Billion. All projections and valuations are in USD, aligning with Zoetis’s reporting currency.

Based on these cash flow projections and the 2 Stage Free Cash Flow to Equity model, the estimated intrinsic value for Zoetis is $178.63 per share. With Zoetis currently trading at $143.46, the DCF model suggests the stock is about 19.7% undervalued at present.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Zoetis is undervalued by 19.7%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Zoetis Price vs Earnings

For profitable companies like Zoetis, the Price-to-Earnings (PE) ratio is one of the most popular ways investors assess whether a stock is expensive or attractively priced. The PE ratio helps show how much shareholders are paying for each dollar of current profits, making it particularly useful for firms with steady and visible earnings.

Of course, a “normal” PE ratio can differ based on factors such as how fast a company is expected to grow, how steady its profits are, and how risky the business looks to the market. Higher expected growth or lower risk often justifies a higher PE, while slower growth or more uncertainty tends to push a fair PE lower.

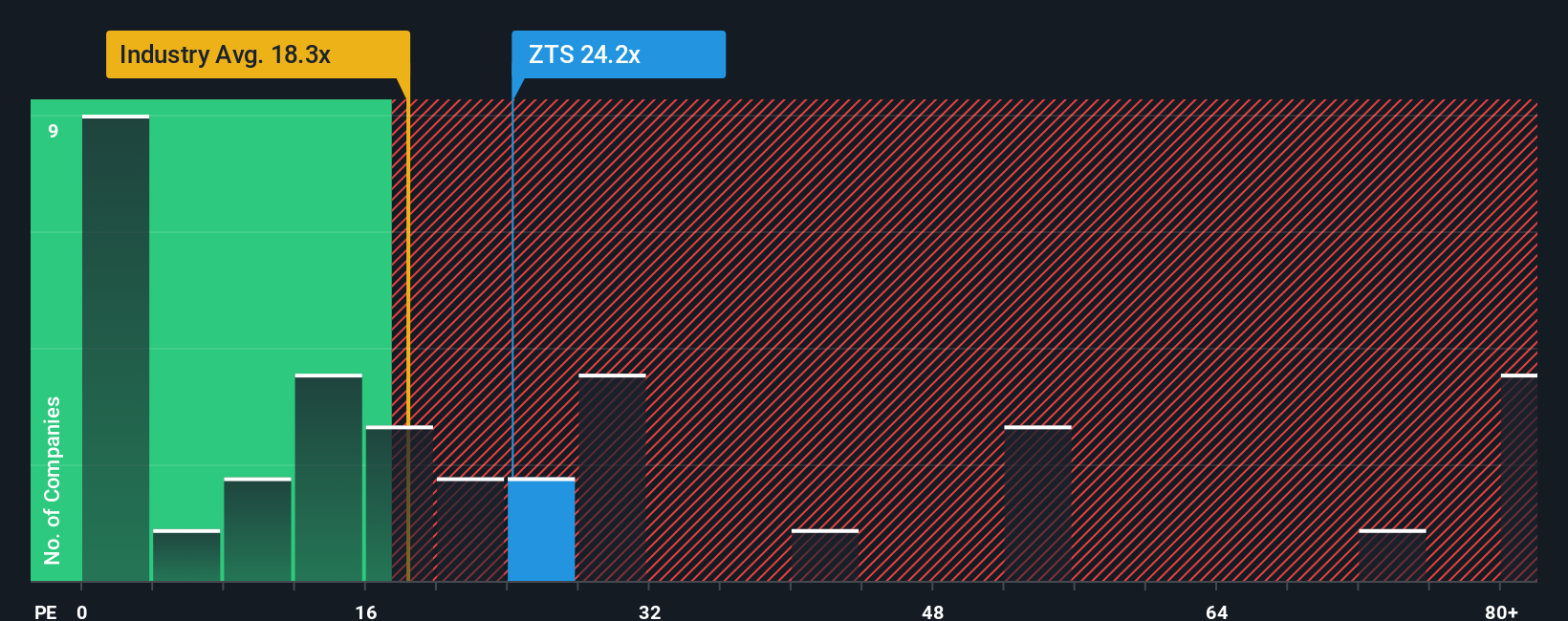

Zoetis currently trades at a PE ratio of 24.3x, compared with the Pharmaceuticals industry average of 18.1x and a peer average of 14.7x. On the surface, that looks fairly expensive. However, not all companies are created equal, and these basic benchmarks can miss crucial context.

This is where Simply Wall St’s proprietary “Fair Ratio” comes in. The Fair Ratio for Zoetis is 21.5x, which reflects factors specific to the company, including its earnings growth rate, profit margins, position within the industry, and its market cap. This tailored approach provides a more relevant comparison than simply stacking Zoetis up against peers or a broad industry average.

Comparing Zoetis’ actual PE of 24.3x with its Fair Ratio of 21.5x shows the stock is trading above its calculated fair value, suggesting the market may be a bit optimistic about its prospects right now.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Zoetis Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. Rather than relying on just ratios or models, Narratives allow you to tell the story behind your numbers by combining your perspective on Zoetis's business, industry risks and drivers with your own expectations for its future revenue, margins, and fair value. A Narrative links the company’s story, your financial forecast, and the resulting fair value into one clear, actionable thesis. It is a powerful yet approachable tool available right now on Simply Wall St’s Community page, used by millions of investors to make smarter decisions.

With Narratives, you can compare your estimated fair value with the latest share price, helping you decide when the odds are in your favor, whether to buy, hold, or sell. Best of all, Narratives auto-update as new news, quarterly earnings, and developments roll in, keeping your analysis fresh. For example, some Zoetis investors see growing pet ownership and margin improvements as reason to set a fair value near $230 per share, while more cautious members highlight global competition and set their fair value as low as $153. Narratives give you the context, flexibility, and confidence to act on what you believe, not just what the numbers say.

Do you think there's more to the story for Zoetis? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zoetis might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ZTS

Zoetis

Engages in the discovery, development, manufacture, and commercialization of animal health medicines, vaccines, diagnostic products and services, biodevices, genetic tests, and precision animal health products in the United States and internationally.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

MicroVision will explode future revenue by 380.37% with a vision towards success

The Indispensable Artery for a New North American Economy

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026