- United States

- /

- Life Sciences

- /

- NYSE:WST

West Pharmaceutical Services (WST) Margin Compression Reinforces Valuation Concerns Despite High-Quality Earnings

Reviewed by Simply Wall St

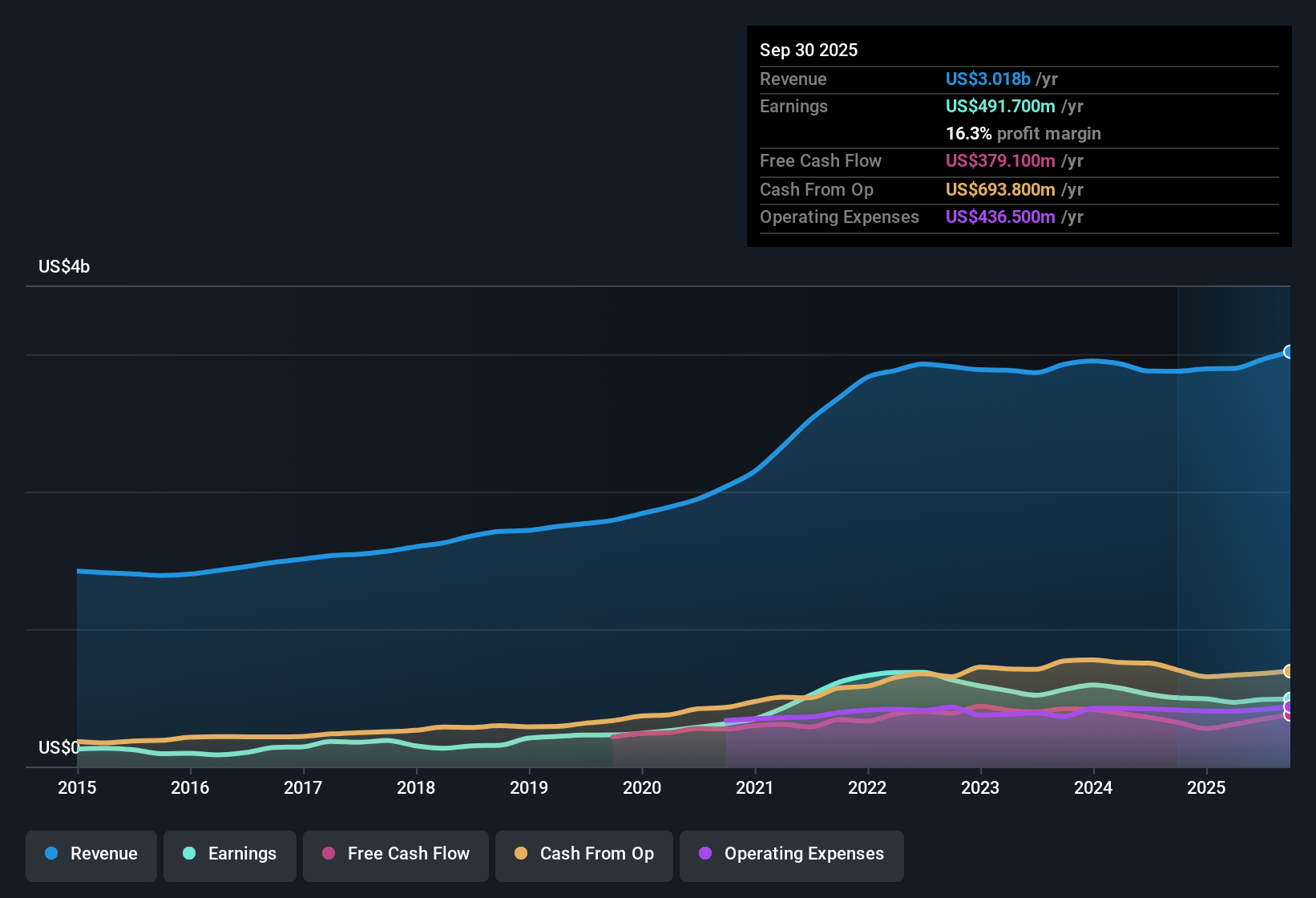

West Pharmaceutical Services (WST) reported a net profit margin of 16.3%, a pullback from last year’s 17.4%, alongside negative earnings growth over the past year. While annual revenue growth is forecast at 6.4%, which lags behind the broader US market’s 10% pace, earnings are expected to rise 11.8% per year, a slower rate than the 15.5% projected for the market. Despite these slower growth rates and profit margin compression, investors are weighing the company’s recognized high-quality earnings and expected profit growth against its premium valuation and recent dip in margins.

See our full analysis for West Pharmaceutical Services.The next section digs deeper, comparing these headline results to the market’s most widely followed narratives, and exploring where the numbers reinforce or push back against investor expectations.

See what the community is saying about West Pharmaceutical Services

GLP-1s and HVP Devices Drive Mix Shift

- GLP-1s contributed about 7% of first-quarter revenues, while approximately 340 Annex 1 projects and planned automated HVP delivery lines are expected to improve the product mix and lift margins over the next two years.

- According to analysts' consensus view, growth in these segments could significantly accelerate revenue and margin expansion.

- Automated HVP device production targeted for late 2025 to early 2026 supports anticipated uptick in operational efficiency and margin improvement.

- The projected high single-digit growth rate for Biologics HVP in late 2025 offers a potential boost, despite recent inventory destocking weighing on near-term trends.

- Consensus narrative claims the ongoing shift to higher-value, higher-margin products is a key driver for the company's expected profit growth, especially as scale and automation enhance profitability.

See how analysts weigh these next-gen segment catalysts in their full view on performance, including margin and mix shift impacts, in the consensus narrative below. 📊 Read the full West Pharmaceutical Services Consensus Narrative.

Share Count Declines as Margin Efforts Ramp Up

- Analysts expect the number of shares outstanding to decrease by approximately 0.71% per year over the coming three years, while profit margins are projected to grow from 16.5% to 18.9% by 2027.

- Consensus narrative notes that operational investments, including cost control and efficiency initiatives, underpin the margin improvement story.

- Expansion into automated, higher-margin delivery systems and contract drug handling is cited as a critical enablement for more durable margins and offsetting input cost headwinds.

- Restructuring and C-suite changes remain a watch area for investors, since execution missteps could impact margin progress and earnings predictability, tempering the expected upside.

Valuation Stretched Against DCF and Peers

- The current share price of $297.47 represents a 61% premium to DCF fair value of $184.93 and a price-to-earnings multiple of 43.5x, well above the peer average of 25.7x and sector average of 33.4x.

- Consensus narrative highlights that for the company to justify analysts’ 2028 price target of $346.91, it would need to achieve $3.6 billion in annual revenue and a future PE of 40.4x, a valuation still above industry norms.

- Despite high-quality earnings and profit-growth projections, the steep valuation places pressure on the company to deliver margin gains and significant top-line expansion as expected.

- The 20% upside to the target offers opportunity, but only if execution remains robust against industry pressures and margin risks.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for West Pharmaceutical Services on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Looking at the data from a different angle? Take just a few minutes to build and share your point of view. Do it your way

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding West Pharmaceutical Services.

See What Else Is Out There

While West Pharmaceutical Services boasts strong quality earnings, its stretched valuation and declining profit margins mean investors face significant pressure for flawless execution ahead.

If you want to focus on companies trading at more attractive prices with greater upside, check out these 877 undervalued stocks based on cash flows that may offer better value opportunities right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if West Pharmaceutical Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WST

West Pharmaceutical Services

Designs, manufactures, and sells containment and delivery systems for injectable drugs and healthcare products in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Flawless balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives