- United States

- /

- Life Sciences

- /

- NYSE:WAT

Waters (WAT): Assessing Valuation After a 23% Share Price Surge

Reviewed by Simply Wall St

See our latest analysis for Waters.

After lagging earlier in the year, Waters’ recent 23% one-month share price return stands out and suggests sentiment is swinging back in its favor. While the year-to-date share price return is still slightly negative, momentum is clearly building. Its 10% total shareholder return over the past year hints at solid long-term resilience.

If this renewed strength has you thinking about broader opportunities, now is a great time to broaden your investing horizons and discover fast growing stocks with high insider ownership

But with Waters’ share price now matching or slightly outpacing analyst targets, the question becomes clear: is there real value left for new investors, or is the company’s future growth already baked into the price?

Most Popular Narrative: Fairly Valued

Waters is currently trading just above the narrative's fair value estimate, which puts its latest close and intrinsic worth in near alignment. This setup draws attention to the company’s future prospects, with the consensus pointing to a balanced valuation.

The planned combination with BD's Biosciences and Diagnostic Solutions business is expected to accelerate entry into biologics, precision medicine, and cell/gene therapy markets. These are segments with expanding analytical needs, unlocking new addressable markets and providing a multi-year revenue synergy opportunity. This could directly impact future revenues and EPS growth.

Ever wondered what underlying assumptions could turn a specialty analytics company into a long-term growth machine? The calculation behind this fair value relies on bold profit and revenue expansions, and a future profit multiple that most companies never achieve. Curious about the projections that bridge today’s stock price with tomorrow’s potential? Unlock the full narrative for the details the market is watching.

Result: Fair Value of $355.74 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution risks tied to major acquisitions and persistent weakness in key markets could quickly shift the outlook and challenge these optimistic forecasts.

Find out about the key risks to this Waters narrative.

Another View: Discounted Cash Flow Signals Upside

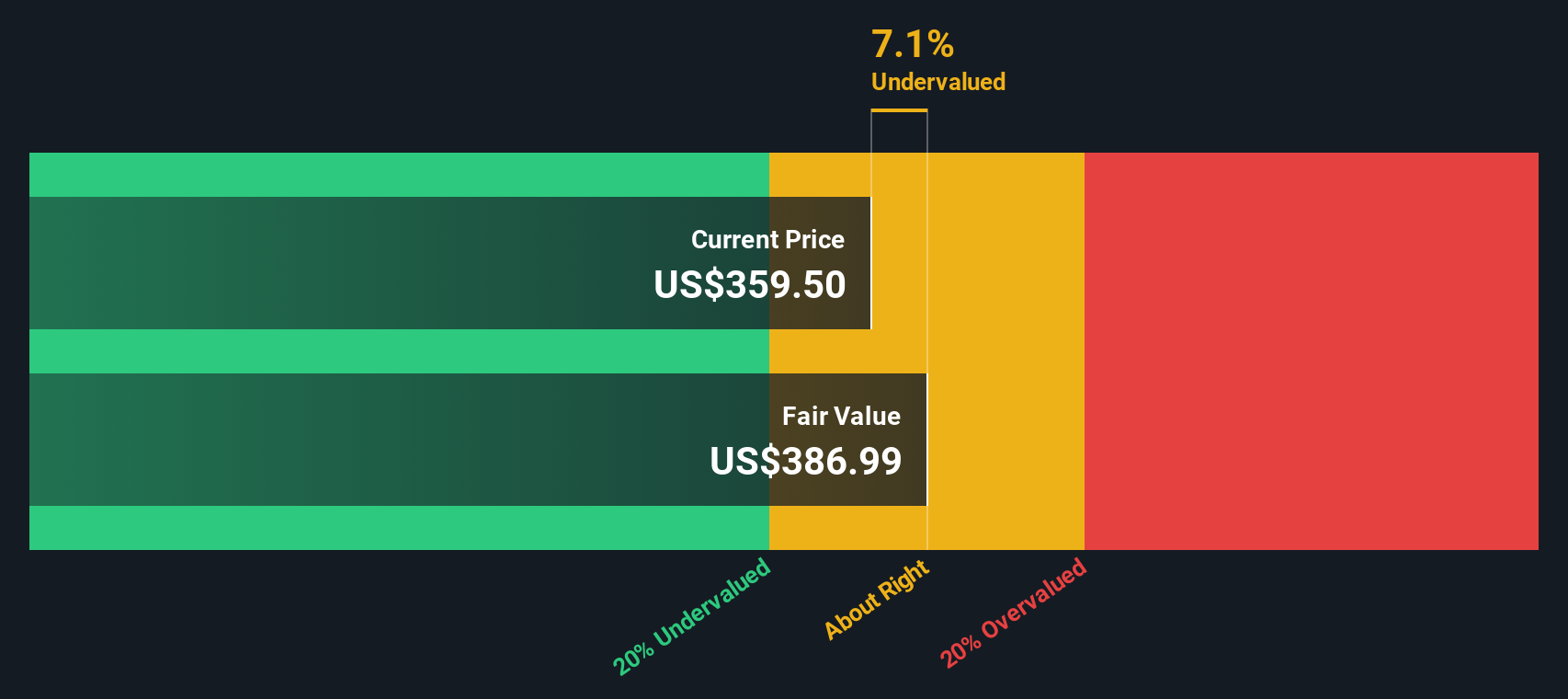

While the consensus view sees Waters trading essentially at fair value, our SWS DCF model presents a different perspective. It suggests the shares are undervalued by 7.1%, with the current price sitting below the model’s fair value estimate of $386.99. Could a focus on future cash flows reveal overlooked potential?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Waters for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Waters Narrative

If you want to dig deeper and reach your own conclusions, you can build a personalized narrative based on your insights in just a few minutes. Do it your way

A great starting point for your Waters research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t leave new opportunities on the table. Expand your watchlist and pinpoint stocks with high potential by tapping into these handpicked market themes:

- Uncover high-yield options by checking out these 17 dividend stocks with yields > 3% and potentially boost your income with reliable, consistent returns.

- Catch the next breakthrough in tech growth. Spot forward-thinking companies through these 27 AI penny stocks making waves in artificial intelligence.

- Benefit from market mispricings and hunt for value gems by reviewing these 872 undervalued stocks based on cash flows based on cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Waters might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WAT

Waters

Provides analytical workflow solutions in Asia, the Americas, and Europe.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives