- United States

- /

- Life Sciences

- /

- NYSE:TMO

Thermo Fisher Scientific (TMO) Reports Earnings Increase and Announces CFO Transition

Reviewed by Simply Wall St

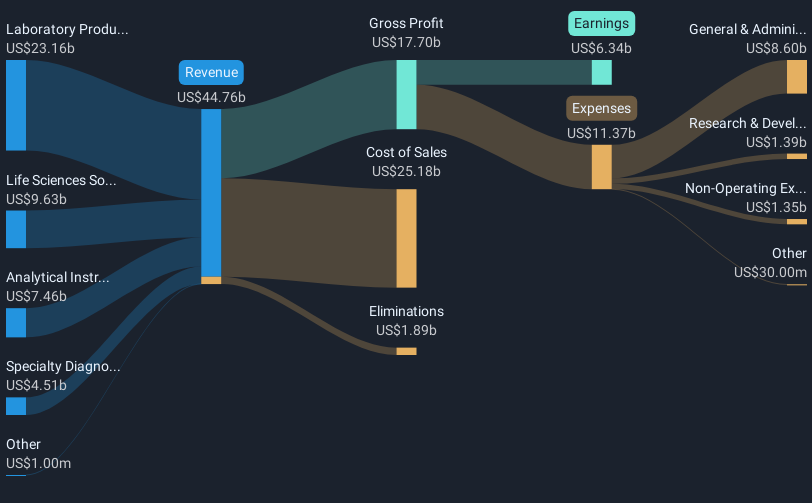

Thermo Fisher Scientific (TMO) has recently reported strong financial performance with half-year sales rising to USD 21,219 million and net income of USD 3,124 million. Alongside robust earnings, the company's announcement of leadership changes, particularly with CFO Stephen Williamson's retirement, aligns with its steady direction. Amid this backdrop, TMO's stock rose by 7% over the last month, mirroring broader market gains driven by positive sentiment around corporate earnings and economic conditions. While TMO's impressive results added stability to its price movement, the market's upward trend likely buoyed this growth further, alongside strategic alliances and product advancements shared during this period.

Be aware that Thermo Fisher Scientific is showing 1 possible red flag in our investment analysis.

Find companies with promising cash flow potential yet trading below their fair value.

Thermo Fisher Scientific's recent developments, including robust half-year sales of US$21.22 billion and net income of US$3.12 billion, coupled with leadership changes, align with its narrative of strategic growth and operational resilience. The acquisition of Vulcan Lab and Solventum is anticipated to bolster its bioproduction capabilities, potentially driving future revenue further by enhancing market position. The market's positive sentiment likely buoyed Thermo Fisher's stock, which rose by 7% over the past month, reflecting broader market dynamics.

Over the longer term, Thermo Fisher's total shareholder return, inclusive of share price and dividends, was 6.29% over the past five years. Comparatively, the company matched the US Life Sciences industry's return of 22.2% over the last year but underperformed the broader US market's 14.6% return the same year.

The acquisitions and strategic innovations may positively affect revenue and earnings forecasts, with analysts predicting earnings to grow annually by 9.67% over the next few years. Analysts' consensus price target of US$559.12 represents a 30.2% potential increase from the current share price of US$427.62. The price target's alignment with future revenue growth assumptions underscores the company's potential for value appreciation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Thermo Fisher Scientific might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TMO

Thermo Fisher Scientific

Provides life sciences solutions, analytical instruments, specialty diagnostics, and laboratory products and biopharma services in the North America, Europe, Asia-Pacific, and internationally.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives