- United States

- /

- Life Sciences

- /

- NYSE:TMO

Is Thermo Fisher Scientific’s Stock Rally Justified After Strategic Growth Initiatives in 2025?

Reviewed by Bailey Pemberton

If you're sizing up what to do with Thermo Fisher Scientific stock right now, you're not alone. Plenty of investors are wondering whether it's time to jump in, hold tight, or take some profits. After all, the stock has not just rebounded; it has rallied, posting an impressive 21.4% gain over the last month alone. For context, that's a move you don't see every day in a large-cap name like this one. Year to date, shares are up 7.9%. Factoring in the last week, too, with a 3.7% climb, there’s no question that momentum has picked up, and the market seems to be shifting its risk-reward view on Thermo Fisher.

One big reason for this renewed optimism? The company has upgraded its growth strategy, announcing initiatives in advanced clinical research supplies and ramping up capabilities in gene therapy solutions. Investors are watching these moves, eyeing the potential long-term revenue streams from cutting-edge fields such as personalized medicine and bioprocessing. These headlines might not always set off price fireworks in the short term, but they certainly influence how the market values a company built for durable growth.

Now, let's talk numbers for a second. According to our valuation scorecard, Thermo Fisher clocks in with a 3 out of 6, meaning it looks undervalued on half of the major valuation checks. That's enough to catch the savvy investor's attention, but not quite a slam dunk yet. So, how does the stock stack up on different valuation approaches? And is there an even sharper way to cut through the noise? Let’s dig in.

Approach 1: Thermo Fisher Scientific Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today’s value. This model is widely used because it focuses on the business’s ability to generate free cash over time, rather than just its earnings multiples or book value.

For Thermo Fisher Scientific, the current Free Cash Flow sits at $6.13 billion. Analyst consensus projects this figure to climb steadily, reaching around $8.58 billion by 2026 and surpassing $11.27 billion by 2029. Longer term, Simply Wall St extrapolates continued growth, with free cash flow estimates extending out to nearly $15.16 billion by 2035. All values are measured in USD.

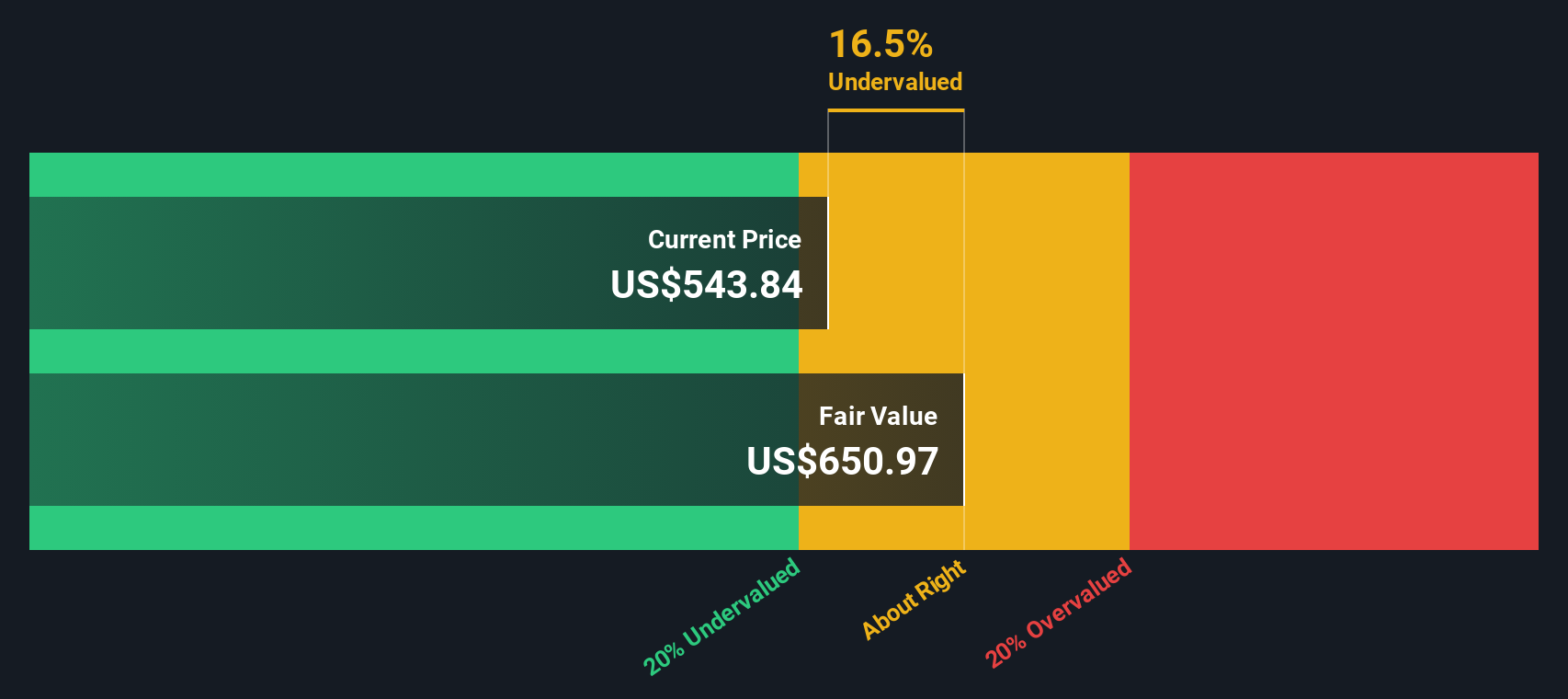

Factoring in these projected future cash flows and discounting them, the DCF calculation places Thermo Fisher’s fair value at $649.09 per share. Comparing this intrinsic value to the current stock price, the model suggests the stock is trading at a 13.1% discount. In other words, shares appear undervalued when judged by long-term cash flow potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Thermo Fisher Scientific is undervalued by 13.1%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Thermo Fisher Scientific Price vs Earnings

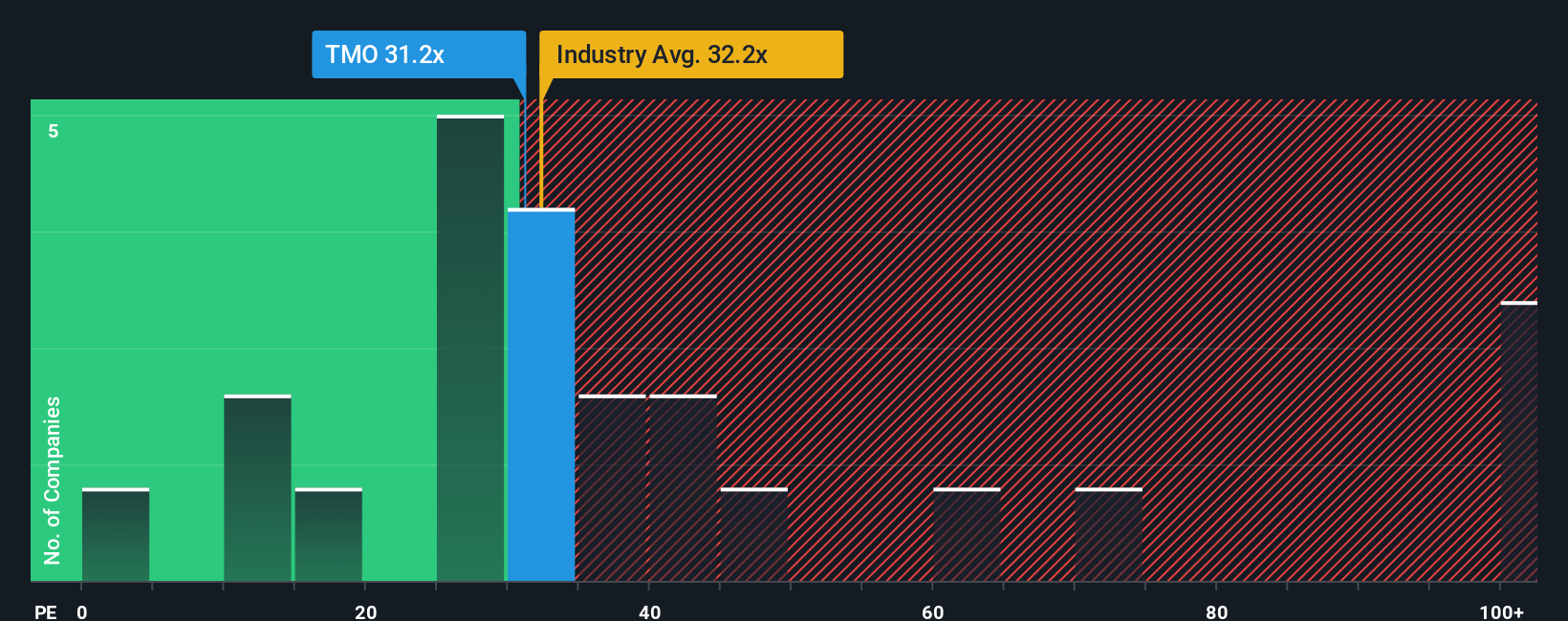

For established, profitable companies like Thermo Fisher Scientific, the Price-to-Earnings (PE) ratio is a popular and useful valuation metric. Since it directly compares the stock price with the company's earnings, the PE ratio gives a quick read on how much investors are paying for each dollar of profit today. It is especially meaningful for profitable businesses, as it reflects market sentiment about their growth prospects and risk profile.

What constitutes a “fair” PE ratio varies. Faster-growing or lower-risk companies usually command higher multiples, while slower-growing or riskier businesses tend to trade at lower ones. Thermo Fisher currently trades at a PE ratio of 32.4x. By comparison, the average for its Life Sciences industry peers is 34.1x, and the peer group average is 35.9x. This suggests the stock is trading below both its direct competitors and the broader sector in terms of how much investors are willing to pay for current profits.

However, just comparing Thermo Fisher to peer or industry averages does not tell the full story. Simply Wall St’s proprietary “Fair Ratio” aims to address this gap by factoring in additional variables such as the company’s earnings growth, profit margins, market capitalization, and risk profile. This approach arrives at a more tailored benchmark. The Fair Ratio for Thermo Fisher is 27.6x. Comparing this to the current market PE, the stock is trading a bit above its Fair Ratio, indicating that despite solid fundamentals, the shares may be slightly ahead of themselves based on these comprehensive inputs.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Thermo Fisher Scientific Narrative

Earlier we mentioned there's an even better way to understand valuation, so let's introduce you to Narratives. This is a simple but powerful approach that combines your view of Thermo Fisher Scientific’s story with actual numbers about its future, such as projected revenue, earnings, and profit margins, to reach your own fair value estimate.

With a Narrative, you link your perspective on what drives the business, for example, growing demand for personalized medicine, new technologies, or industry risks, to a transparent financial forecast and see exactly how those assumptions shape your estimate of what the stock is worth.

This makes Narratives an approachable tool for any investor and is available right now on Simply Wall St’s Community page, empowering millions of users to move beyond generic ratios and summaries.

You can use Narratives to decide when to buy or sell by directly comparing your Fair Value estimate to the current share price. Since Narratives update automatically whenever new news or results are released, your story always stays in line with reality.

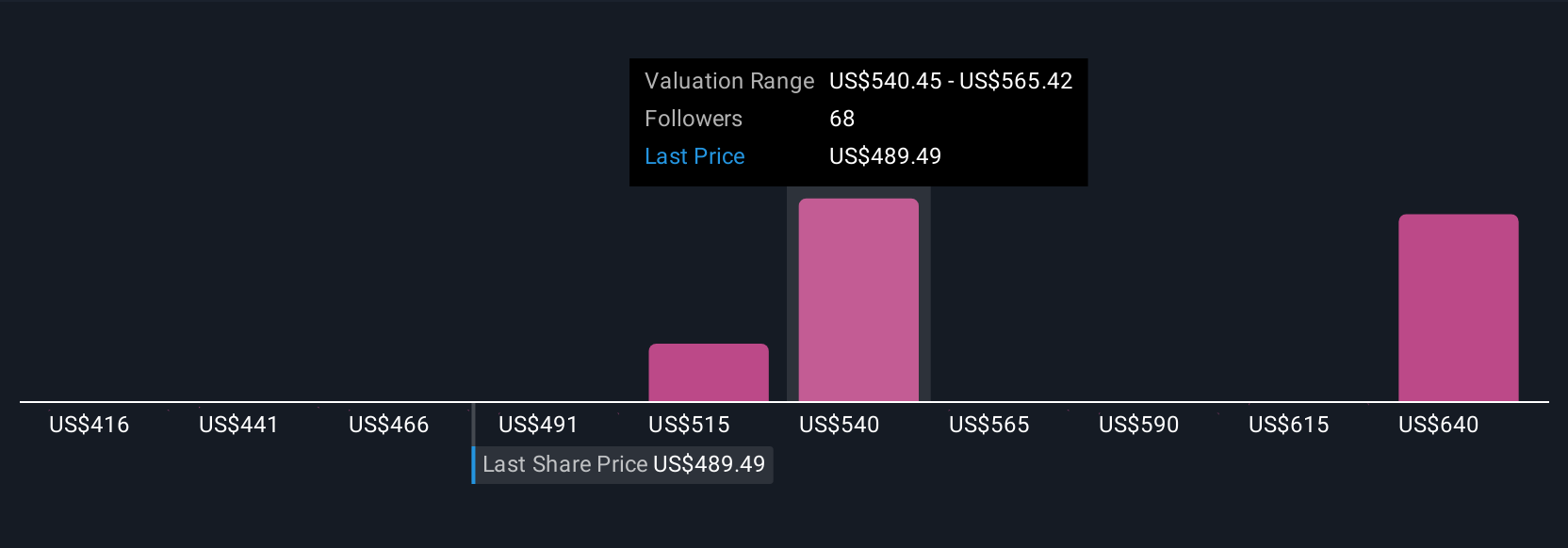

For example, one investor might see Thermo Fisher as a long-term winner due to breakthroughs in personalized medicine and estimate a Fair Value of $604 per share. Another might weigh industry headwinds more heavily and arrive at a more conservative $490. Your own Narrative reflects exactly what you believe.

For Thermo Fisher Scientific, we make it easy for you with previews of two leading Thermo Fisher Scientific Narratives:

🐂 Thermo Fisher Scientific Bull Case

Fair Value: $603.78

Shares are trading at a 6.6% premium to this narrative's fair value.

Expected Revenue Growth: 5.2%

- Growth is driven by expansion in pharmaceutical manufacturing, AI-powered operational efficiencies, strategic mergers and acquisitions, and close integration with key customers that contribute to recurring revenue and improved margins.

- Analysts note that international uncertainty and leadership transition may present challenges, but these are balanced by stronger financial discipline and exposure to resilient end markets.

- This narrative’s fair value estimate is $603.78, suggesting some further upside compared to recent prices if analyst expectations for growth and margin improvement are met.

🐻 Thermo Fisher Scientific Bear Case

Fair Value: $540.27

Shares are trading at a 4.3% premium to this narrative's fair value.

Expected Revenue Growth: 7%

- Thermo Fisher demonstrates strong resilience due to diversified life sciences demand, cost efficiencies from recent acquisitions, and stable recurring revenue streams from consumables and services.

- Industry trends such as increased global R&D spending and an aging population provide support, but risks remain from post-pandemic revenue normalization, possible regulatory shifts, and potential challenges in merger integration.

- While the stock appears fairly valued with the possibility for further gains if growth objectives are achieved, slower spending or integration difficulties could pose downside risks, placing the fair value at $540.27 in this case.

Do you think there's more to the story for Thermo Fisher Scientific? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Thermo Fisher Scientific might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TMO

Thermo Fisher Scientific

Provides life sciences solutions, analytical instruments, specialty diagnostics, and laboratory products and biopharma services in the North America, Europe, Asia-Pacific, and internationally.

Proven track record and fair value.

Similar Companies

Market Insights

Community Narratives