- United States

- /

- Pharma

- /

- NYSE:TEVA

Teva Pharmaceutical Industries (NYSE:TEVA): Evaluating Valuation Following Recent Share Price Surge

Reviewed by Simply Wall St

See our latest analysis for Teva Pharmaceutical Industries.

Teva’s rally over the last month stands out, with a 28.6% one-month share price return boosting confidence after a year marked by a robust 47.8% total shareholder return. That momentum suggests investors may be warming to Teva’s turnaround story, especially with sentiment shifting positively across the pharmaceutical sector.

If pharmaceutical stocks with improving outlooks are on your radar, it’s a great moment to see what’s out there. Discover See the full list for free.

With shares surging and optimism mounting, the key question now is clear: Is Teva undervalued at these levels, or has the recent rally already priced in the company’s next stage of growth?

Most Popular Narrative: 9.5% Undervalued

The most followed valuation narrative puts Teva’s fair value above its last close of $24.84, implying the stock has not yet reached its full potential according to consensus. This positions the spotlight on financial factors that could drive the next leg higher. It also sets the scene for a closer look at the underlying levers behind this outlook.

The accelerating launch cadence of biosimilars (with 8 launches targeted through 2027 and a goal to double biosimilar revenue), backed by favorable regulatory trends increasing biosimilar adoption in major markets, should unlock incremental, higher-margin revenue streams and offset headwinds from traditional generics, powering long-term EBITDA growth.

What really supports this higher fair value? The answer is a bold set of projections for sales, profit growth, and margins, all hinging on the wildcard impact of new blockbuster product launches and long-term operational shifts. Find out which future financial targets are fueling bullish expectations, and why this narrative is sparking debate among market watchers.

Result: Fair Value of $27.45 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, factors like heavy debt loads and reliance on a few key drugs could quickly stall Teva’s momentum if market or regulatory conditions shift suddenly.

Find out about the key risks to this Teva Pharmaceutical Industries narrative.

Another View: Is the Market Getting Ahead of Itself?

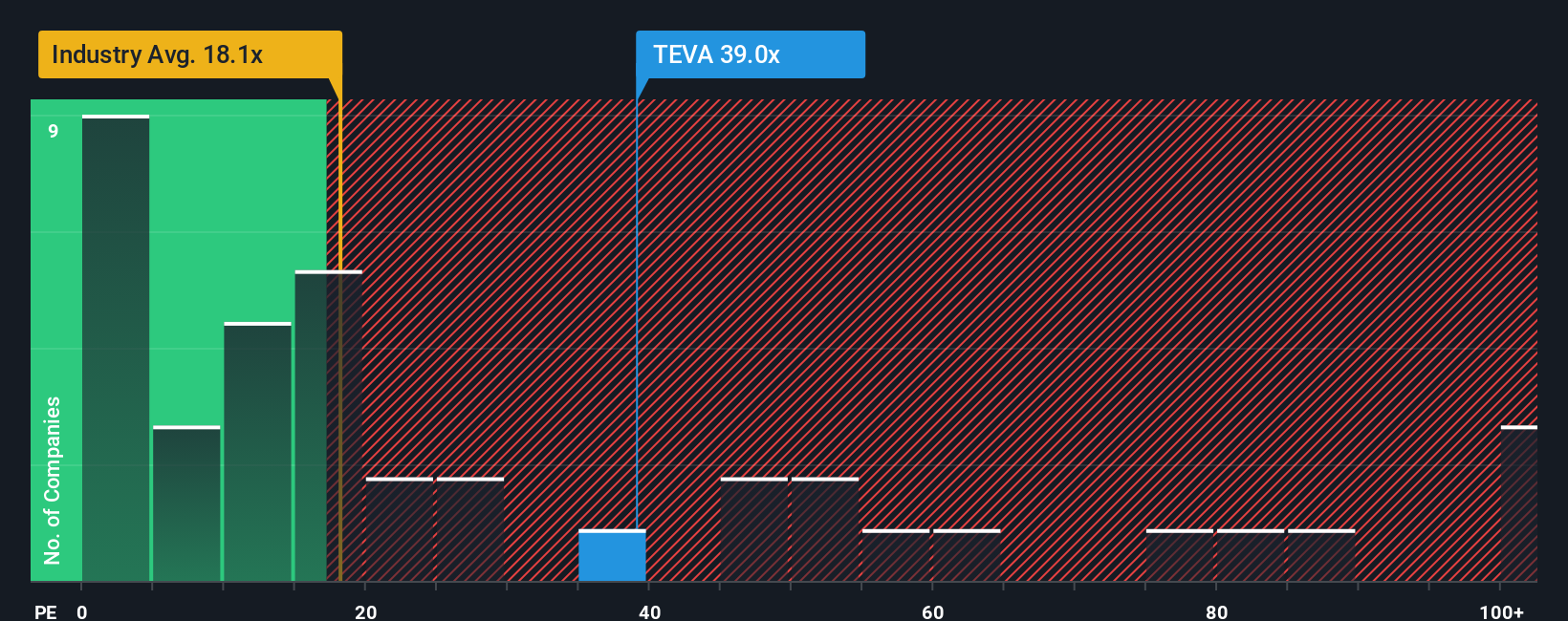

While the fair value estimate points to further upside, a look at the price-to-earnings ratio tells a different story. Teva trades at 40x earnings, far above both its peer average of 33.3x and the industry average of 19.1x. Even compared to its own fair ratio of 29.5x, shares look pricey, suggesting investors may be paying up for optimism. Could this multiple signal a valuation risk if expectations fall short?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Teva Pharmaceutical Industries Narrative

If you want a different perspective or just want to see the numbers for yourself, you can quickly build your own story in just a few minutes. Do it your way.

A great starting point for your Teva Pharmaceutical Industries research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Stay a step ahead by uncovering fresh companies poised for growth. Don’t let great opportunities pass you by when you can widen your watchlist right now.

- Unlock potential returns with these 906 undervalued stocks based on cash flows that are trading below their intrinsic value, offering room for future growth.

- Boost your portfolio’s income by checking out these 18 dividend stocks with yields > 3% featuring generous yields surpassing 3%.

- Catch the next tech wave by tapping into these 26 quantum computing stocks and join innovators advancing quantum computing breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Teva Pharmaceutical Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TEVA

Teva Pharmaceutical Industries

Develops, manufactures, markets, and distributes generic and other medicines, and biopharmaceutical products in the United States, Europe, Israel, and internationally.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026