- United States

- /

- Pharma

- /

- NYSE:TEVA

Teva (NYSE:TEVA) Valuation in Focus After FDA Approval and Launch of Generic Saxenda

Reviewed by Simply Wall St

Teva Pharmaceutical Industries (NYSE:TEVA) grabbed headlines with its latest move: announcing FDA approval and the U.S. launch of a generic version of Saxenda, a popular liraglutide injection. Saxenda had annual sales reaching $165 million as of June 2025, making this product launch one that could move the needle for Teva’s U.S. business. For investors on the fence, this kind of event signals more than just another new drug; it raises important questions about how much upside might be left for the stock.

While the Saxenda news is making waves, Teva’s shares have been on something of a rollercoaster this year. After sliding roughly 14% year-to-date and finishing the past year with a modest 3% drop, the past month hints at gathering momentum, with the stock rising 9%. Long-term holders have seen a notable three-year return, though recent profitability remains challenged despite double-digit annual net income growth. The launch of this high-profile generic signals a potential shift, adding fresh fuel to the debate over Teva’s valuation story.

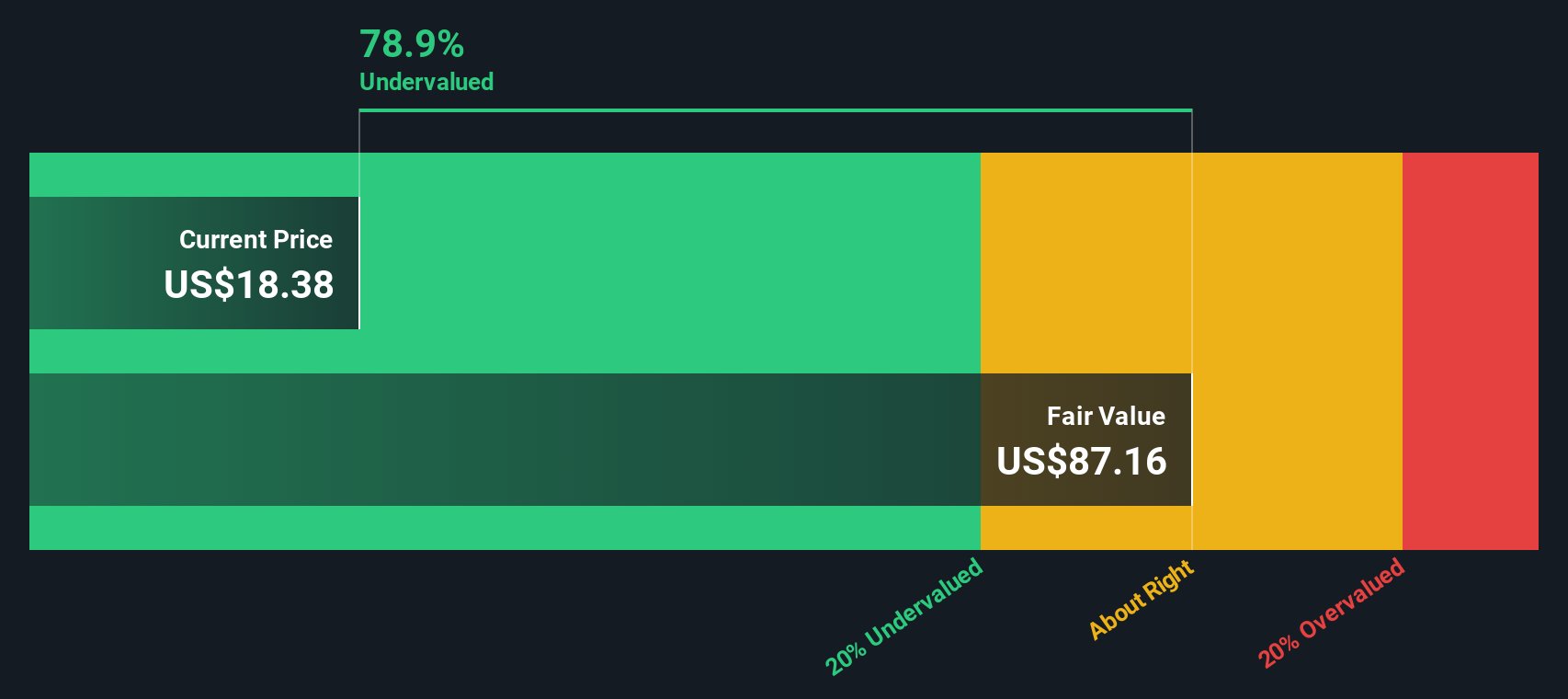

The question for investors now is whether Teva is trading below its true value, setting up for a comeback, or if the market has already priced in its new growth phase.

Most Popular Narrative: 22% Undervalued

According to community narrative, Teva Pharmaceutical Industries is seen as significantly undervalued, with analysts projecting a fair value that is over 20% higher than the current share price.

“The accelerating launch cadence of biosimilars (with 8 launches targeted through 2027 and a goal to double biosimilar revenue), backed by favorable regulatory trends increasing biosimilar adoption in major markets, should unlock incremental, higher-margin revenue streams and offset headwinds from traditional generics, powering long-term EBITDA growth.”

Curious about what is driving this bold undervaluation call? The real intrigue is in projections for future profits, margins, and the aggressive rollout of new products, which hints at ambitions beyond typical pharmaceutical expectations. Want to know which financial factors and new growth formulas support this price target increase? The full narrative connects the dots, detailing how these high-stakes numbers have the potential to change Teva’s story.

Result: Fair Value of $23.56 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, significant debt levels and reliance on a handful of branded drugs could quickly sap momentum if market or regulatory conditions change.

Find out about the key risks to this Teva Pharmaceutical Industries narrative.Another View: Discounted Cash Flow Model

Looking from a different angle, our DCF model also suggests that Teva is trading below what long-term cash flows might justify. Could both perspectives be seeing the same value opportunity, or are hidden risks being overlooked?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Teva Pharmaceutical Industries Narrative

If you think there’s more to the story or want to dig into Teva’s numbers yourself, it takes just a couple of minutes to shape your own investment outlook, so why not Do it your way.

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding Teva Pharmaceutical Industries.

Looking for More Ways to Invest Smarter?

Unlock more opportunities by checking out powerful stock lists built for forward-thinking investors. If you’re eager to spot trends early, maximize returns, or capture strong yields, don’t just settle for the obvious. Give yourself the edge with these top screens:

- Catch the momentum in artificial intelligence by seizing your chance to review AI penny stocks shaking up tomorrow’s digital landscape.

- Boost your passive income with dividend stocks with yields > 3%, where you’ll find companies offering reliable, market-beating yields above 3%.

- Supercharge your portfolio with hidden gems trading below their real value through undervalued stocks based on cash flows, before the crowd catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Teva Pharmaceutical Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:TEVA

Teva Pharmaceutical Industries

Develops, manufactures, markets, and distributes generic and other medicines, and biopharmaceutical products in the United States, Europe, Israel, and internationally.

Very undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives