- United States

- /

- Life Sciences

- /

- NYSE:STVN

Stevanato Group (NYSE:STVN): Assessing Valuation as Shares Fall 10% Over the Past Month

Reviewed by Kshitija Bhandaru

Stevanato Group (NYSE:STVN) shares have slipped over the past month, continuing a trend that has seen the stock lose around 10% during that period. Investors may be watching for signs that its performance will stabilize soon.

See our latest analysis for Stevanato Group.

While Stevanato Group’s share price has slipped nearly 10% over the past month, it’s worth noting that momentum faded after an earlier strong run. Over the past year, the stock delivered an impressive 30.8% total shareholder return, substantially outpacing its price gains alone.

If you’re weighing your next move, this could be a great opportunity to discover fast growing stocks with high insider ownership

With shares now trading nearly 20% below analyst price targets and fundamentals still showing steady growth, investors are left to debate whether Stevanato Group is undervalued at these levels or if the market has already priced in the company’s future gains.

Most Popular Narrative: 16.7% Undervalued

Stevanato Group ended the latest session at $23.85, notably below the narrative fair value estimate of $28.62. This signals a sizable valuation gap and is fueling debate over whether the current price offers a rare buying window.

The growing prevalence of biologics and novel drug classes (including GLP-1s, mAbs, and biosimilars) is driving robust, increasing demand for Stevanato's high-value containment and delivery solutions. This is evidenced by high growth rates in these product lines and strong order pipelines from major pharma clients, which supports ongoing revenue expansion.

Want to peek behind the curtain on this bullish valuation? The secret sauce lies in some bold long-term growth projections and a future profit multiple that most companies don’t dare to claim. Curious which numbers justify such optimism? Explore the full narrative to uncover the surprising assumptions that drive this target price.

Result: Fair Value of $28.62 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing high capital spending and heavy reliance on a few major customers could put pressure on margins and threaten steady long-term growth if conditions shift.

Find out about the key risks to this Stevanato Group narrative.

Another View: What Do Market Multiples Suggest?

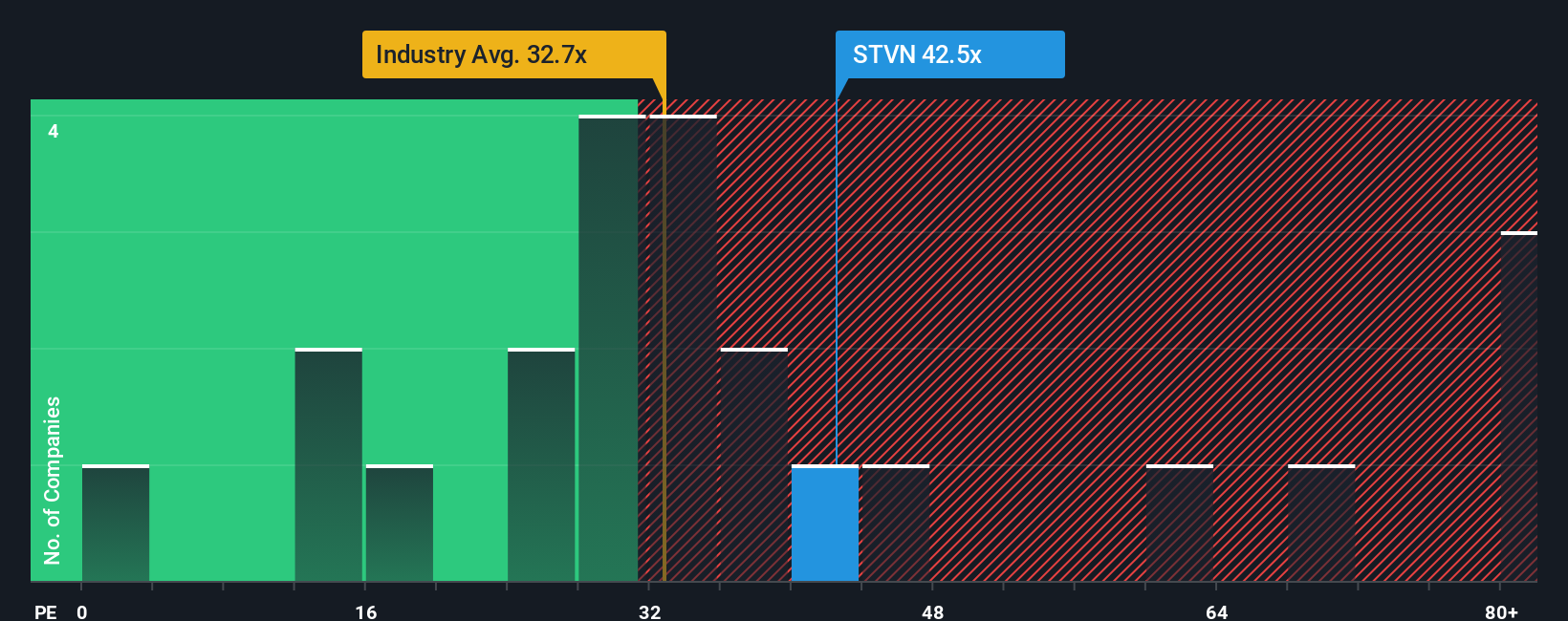

Switching perspective, Stevanato Group currently trades at a price-to-earnings ratio of 41.7x, which is higher than the US Life Sciences industry average of 31.7x and well above its fair ratio of 23x. This premium price raises questions about whether optimism is already reflected, increasing downside risk if growth falls short. Could these multiples be signaling caution rather than opportunity?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Stevanato Group Narrative

Not convinced by the consensus or eager to follow your own analysis? Dive into the data yourself and see how quickly a personal narrative takes shape, you can Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Stevanato Group.

Looking for More Smart Investment Ideas?

Great opportunities do not wait around. Get ahead of the crowd by checking out these unique stock selections tailored for different market trends and growth stories.

- Capture outsized growth potential early by targeting these 3580 penny stocks with strong financials with strong financials before they hit mainstream radars.

- Tap into unstoppable industry transformation with these 24 AI penny stocks. These focus on businesses pioneering the artificial intelligence revolution from the ground up.

- Supercharge your income strategy by securing these 19 dividend stocks with yields > 3% that consistently outperform by offering yields above the 3% mark.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:STVN

Stevanato Group

Engages in the design, production, and distribution of products and processes to provide solutions for biopharma and healthcare industries in Europe, the Middle East, Africa, North America, South America, and the Asia Pacific.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives