- United States

- /

- Life Sciences

- /

- NYSE:STVN

Could Stevanato Group’s (STVN) German Expansion Reveal a New Supply Chain Edge?

Reviewed by Sasha Jovanovic

- Earlier this week, Stevanato Group S.p.A. announced the expansion of its drug delivery system manufacturing capacity at its Bad Oeynhausen facility in northern Germany, adding over 2,500 square meters of advanced production space including an ISO 8 cleanroom for injection molding and automated assembly.

- This multi-million euro investment is expected to further solidify Stevanato’s role in supporting global pharma partners with resilient European supply-chain integration, particularly in autoinjector and pen injector platforms.

- We’ll now examine how Stevanato’s expanded German manufacturing footprint could influence its long-term investment narrative and industry positioning.

This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

Stevanato Group Investment Narrative Recap

Stevanato Group’s investment story centers on the accelerating global demand for advanced drug delivery systems, especially as pharmaceutical innovation continues to move toward biologics and self-administered treatments. The recent expansion in Germany underscores the company’s commitment to scaling capacity, but this does not materially change the main short-term catalysts, namely, the scaling of its Fishers facility in the US or ongoing margin improvement, nor does it resolve the biggest current risk: the pressure on net margins from heavy upfront capital investments and operational ramp-up costs at multiple sites.

Of Stevanato’s recent announcements, the July securing of €200 million in debt financing stands out for its direct tie-in to growth catalysts and supply chain investments. This funding supports parallel capacity expansion efforts in both Europe and North America, facilitating the company’s ability to meet surging demand for injectable drug formats and supply reliability requirements from major pharma customers, reinforcing the focus on operational scale and efficient production ramp.

However, it is important to recognize that if new facilities take longer than planned to scale or encounter operational setbacks, Stevanato’s margin improvement goals could be at risk, especially if...

Read the full narrative on Stevanato Group (it's free!)

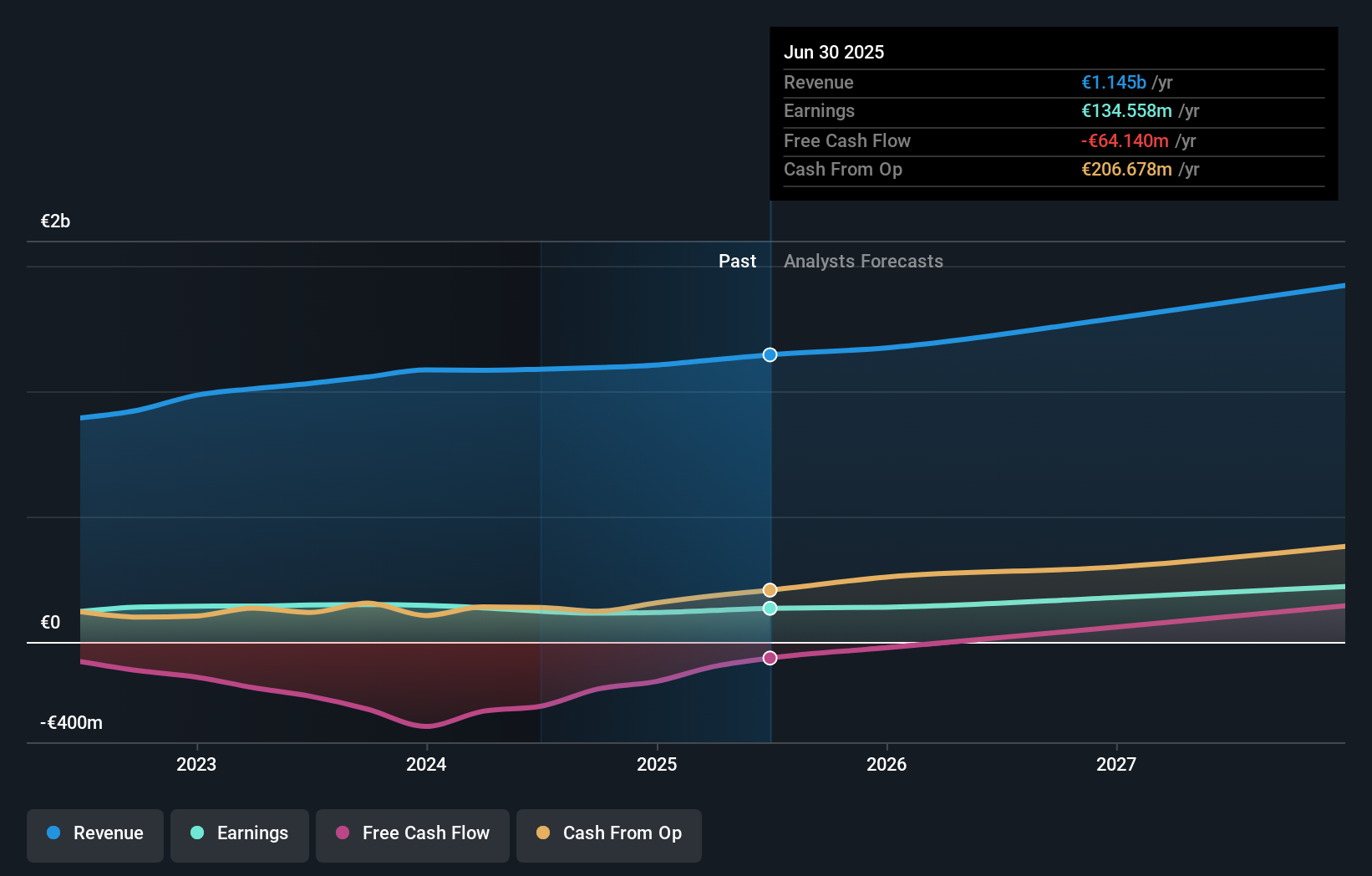

Stevanato Group's outlook anticipates €1.5 billion in revenue and €242.0 million in earnings by 2028. This requires annual revenue growth of 9.2% and an earnings increase of €107.4 million from current earnings of €134.6 million.

Uncover how Stevanato Group's forecasts yield a $28.62 fair value, a 10% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided one fair value estimate at €28.62 per share, signaling limited diversity in perspectives so far. Alongside consensus focus on execution risks tied to heavy facility investments, this is a clear reminder of how sharply views on Stevanato’s trajectory can differ, explore more insights to understand the full picture.

Explore another fair value estimate on Stevanato Group - why the stock might be worth just $28.62!

Build Your Own Stevanato Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Stevanato Group research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Stevanato Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Stevanato Group's overall financial health at a glance.

Looking For Alternative Opportunities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:STVN

Stevanato Group

Engages in the design, production, and distribution of products and processes to provide solutions for biopharma and healthcare industries in Europe, the Middle East, Africa, North America, South America, and the Asia Pacific.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives