- United States

- /

- Life Sciences

- /

- NYSE:RVTY

Revvity (RVTY): Evaluating Value After the Recent Share Price Rebound

Reviewed by Simply Wall St

See our latest analysis for Revvity.

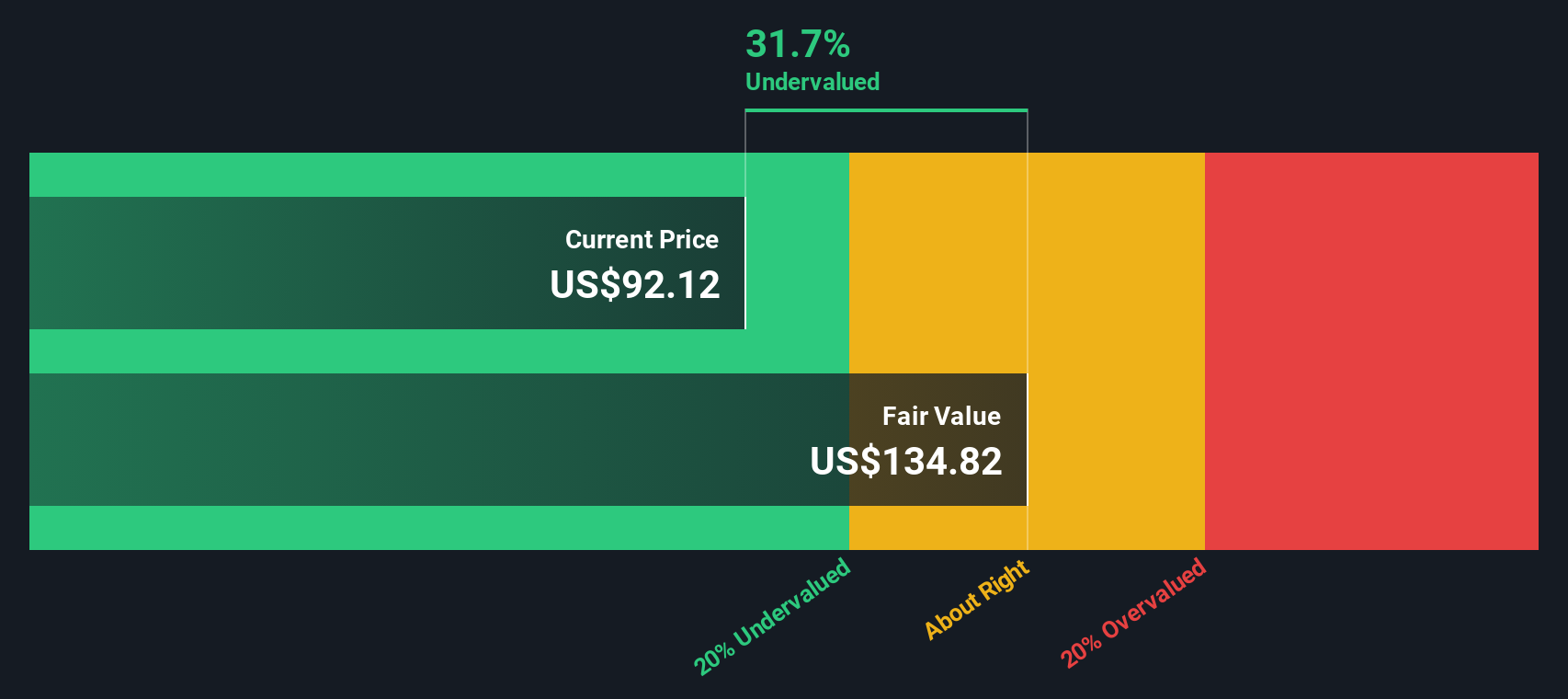

After a choppy start to the year, Revvity’s momentum has picked up noticeably. The share price has gained nearly 19% over the past quarter, even as the total shareholder return sits at -8% for the past 12 months. This suggests investors are warming back up to its growth prospects following some mixed signals in earlier periods.

If you’re curious about where else momentum or insider confidence is building, now is a smart time to broaden your perspective and discover fast growing stocks with high insider ownership

With Revvity’s shares rebounding and a modest discount to analyst targets still present, the big question remains: is there real value left on the table, or has the market already factored in the company’s rebound and future growth?

Most Popular Narrative: 7% Undervalued

Revvity closed at $105.57, which sits a little below the most popular narrative’s fair value estimate of $113.67. This sets the stage for a lively debate about whether the market is overlooking the potential from recent operational shifts and buyback activity.

Ongoing shift in product mix toward higher-margin, software-enabled and consumables-driven offerings (e.g., SaaS Signals, reagents, new IDS i20 platform), along with structural cost actions, are expected to materially expand operating and net margins. In 2026, operating margin is projected to start at a higher 28% baseline.

What’s really fueling this bullish narrative? Analysts are betting on a future profit margin jump and a dramatic step up in earnings. The secret sauce behind the numbers? Dive deeper to discover the aggressive assumptions underpinning this valuation.

Result: Fair Value of $113.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent uncertainty in key international markets like China and tougher reimbursement trends could quickly undermine Revvity’s accelerating recovery story.

Find out about the key risks to this Revvity narrative.

Another View: Looking Through a Different Lens

Shifting focus to the SWS DCF model offers a fresh perspective. Our DCF model values Revvity at $128.19 per share, which is well above both its current share price and typical analyst estimates. This result presents Revvity as even more undervalued by this method. Could this suggest the market is missing something significant, or are the DCF model’s assumptions too optimistic?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Revvity Narrative

If you see things differently or want to dig into the numbers yourself, you can shape your own story in just a few minutes using our easy tools. So why not Do it your way?

A great starting point for your Revvity research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Sharpen your investing edge and keep up with strategies that top investors use. The right screener can help you spot tomorrow’s winners before the crowd catches on.

- Supercharge your search for innovation and get ahead of the curve with these 26 AI penny stocks powering advancements in artificial intelligence across industries.

- Start building reliable income streams by tapping into these 14 dividend stocks with yields > 3% offering healthy yields above 3% for steady cash flow and long-term security.

- Uncover the next big growth stories rooted in breakthrough science by checking out these 30 healthcare AI stocks set to transform medical technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RVTY

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success