- United States

- /

- Life Sciences

- /

- NYSE:QGEN

Qiagen (NYSE:QGEN): Assessing Valuation After Recent Share Price Rebound

Reviewed by Simply Wall St

See our latest analysis for Qiagen.

Qiagen’s share price has seen a solid lift recently, climbing 9.4% over the past month. This reverses some of the earlier declines this quarter. While momentum is picking up in the short term, the real highlight is its 19.3% one-year total shareholder return, showing above-average performance for investors willing to stay the course.

If you’re interested in discovering what else is gaining traction in healthcare, now could be a smart time to explore See the full list for free.

With strong recent gains and a solid track record, investors are left to consider whether Qiagen remains undervalued at current levels or if the stock’s recent run means the market has already priced in future growth potential.

Most Popular Narrative: 4.5% Undervalued

Qiagen’s most closely watched narrative now sees its fair value at $51.64, a slight premium to the recent closing price of $49.32. This suggests room for modest upside and puts the focus on how future business drivers may lift valuation.

The accelerated adoption of automation and digital workflows in both clinical and research settings, as seen with the development and imminent launch of three new high-throughput, digitally connected automated sample prep systems, positions Qiagen to address increasing throughput and efficiency needs. This supports both top-line growth and operating margin improvement in coming years.

Want to uncover what underpins this near-term upside? The real story is powered by head-turning forecasts for margin expansion and recurring sales growth. Which strategic moves and long-range projections push the fair value higher? The full narrative reveals the ingredients behind the number, but only if you’re ready to see what’s driving the bullish case.

Result: Fair Value of $51.64 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in research funding and competition in diagnostics could put pressure on Qiagen’s earnings growth and challenge the bullish case.

Find out about the key risks to this Qiagen narrative.

Another View: What the Numbers Say

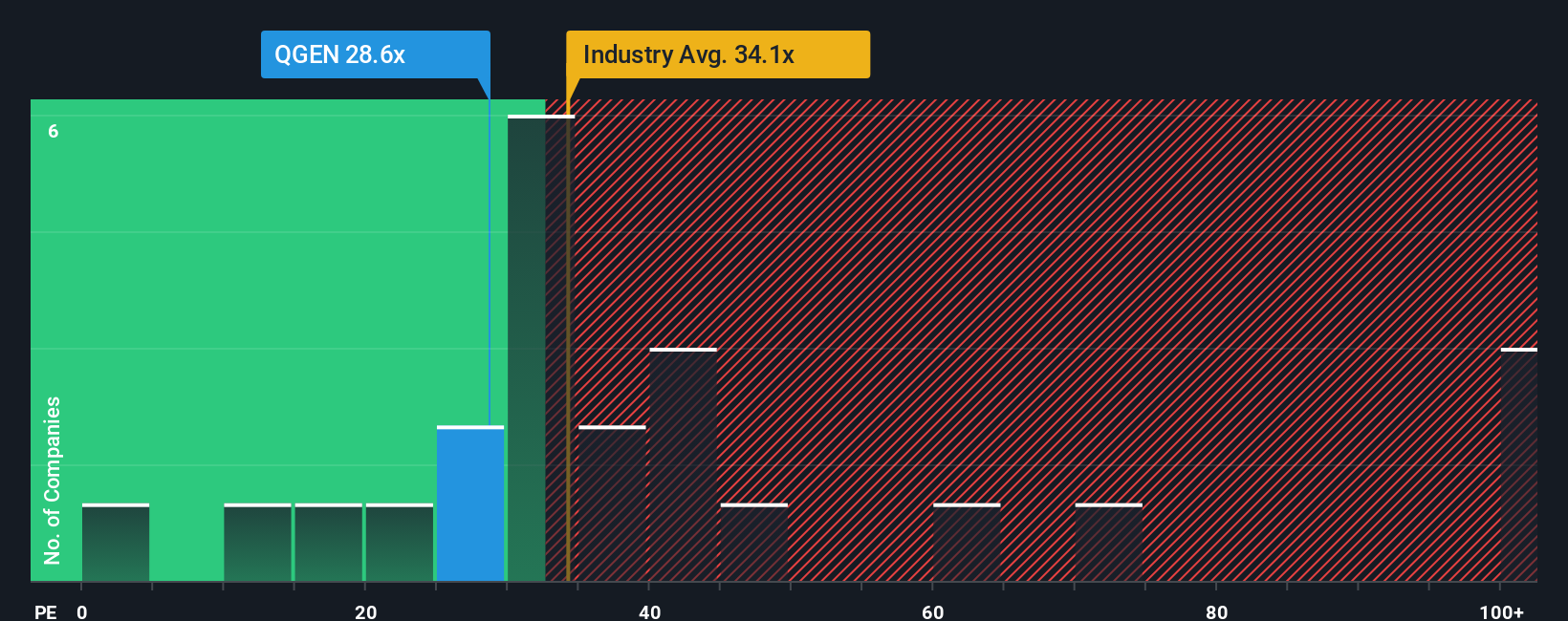

Looking from the angle of earnings compared to the market and peers, Qiagen is trading at a price-to-earnings ratio of 28.6x. This is lower than the US Life Sciences industry average of 33.4x and much lower than the peer average of 56.3x, but still well above its fair ratio of 18.1x. This gap offers both opportunity and risk. Could sentiment shift enough to close it in the coming year?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Qiagen Narrative

If you want a deeper dive or see things differently, take a few minutes to explore the numbers yourself and develop your own perspective. Do it your way.

A great starting point for your Qiagen research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Why limit your strategy to just one opportunity? Take charge of your portfolio by uncovering stocks that match your style, goals, and appetite for growth.

- Get ahead of market trends by targeting innovation with these 27 AI penny stocks, where promising companies are pushing new frontiers in artificial intelligence.

- Maximize your yield potential by seeking steady returns via these 17 dividend stocks with yields > 3%, featuring proven businesses that offer attractive income streams.

- Uncover tomorrow’s potential success stories by spotting hidden gems using these 877 undervalued stocks based on cash flows that could be flying under the radar right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Qiagen might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:QGEN

Qiagen

Provides sample to insight solutions that transform biological samples into molecular insights in the Netherlands and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives