- United States

- /

- Pharma

- /

- NYSE:PFE

The Bull Case for Pfizer (PFE) Could Change Following Major Patent Litigation Developments

Reviewed by Simply Wall St

- Earlier this month, Pfizer Inc. was involved in two significant legal developments: the certification of settlement classes over alleged price-fixing in the generic drug market, and a key claim construction ruling in a high-profile patent infringement lawsuit relating to its COVID-19 mRNA vaccine technology.

- These legal proceedings may influence Pfizer’s future liabilities and highlight the complexity of intellectual property rights and regulatory compliance for large pharmaceutical companies.

- We will now examine how these patent litigation developments could affect Pfizer's long-term investment narrative and future business prospects.

Find companies with promising cash flow potential yet trading below their fair value.

Pfizer Investment Narrative Recap

To own Pfizer shares, I think you have to believe in the potential of its late-stage drug pipeline and the company's ability to offset looming revenue declines from patent expirations with new launches and emerging market growth. While the latest legal developments, including a class-action antitrust settlement and an ongoing mRNA patent case, add complexity and could potentially shape short-term sentiment, they do not appear to materially change Pfizer’s current biggest risk: the loss of exclusivity on key drugs by 2027.

Among recent announcements, Pfizer’s positive results from a Phase 3 trial for its adapted COMIRNATY COVID-19 vaccine stand out. This is closely tied to near-term catalysts for the business, as successful vaccine launches not only support headline revenues, they demonstrate Pfizer’s ongoing innovation in the face of competitive and regulatory challenges.

In contrast, investors should not overlook the longer-term impact of expanding price control measures on Pfizer’s US revenue and profit margins...

Read the full narrative on Pfizer (it's free!)

Pfizer's outlook anticipates $59.6 billion in revenue and $12.8 billion in earnings by 2028. This reflects a projected annual revenue decline of 2.2% and a $2.1 billion increase in earnings from the current $10.7 billion level.

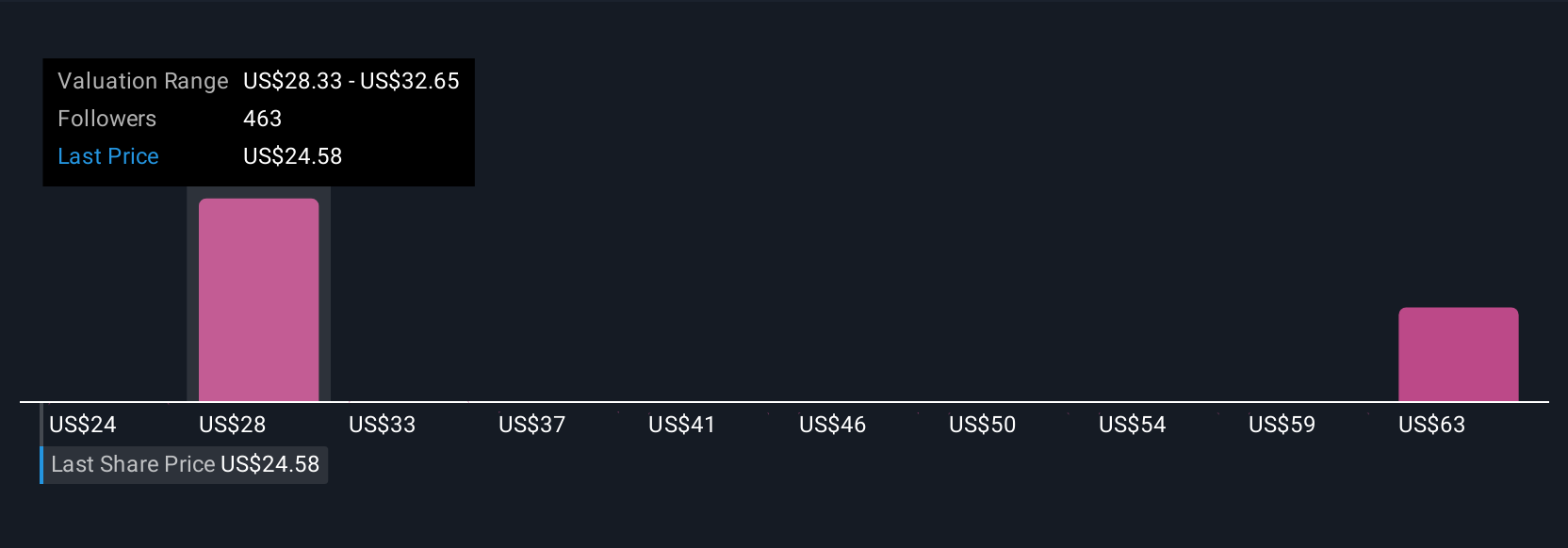

Uncover how Pfizer's forecasts yield a $28.86 fair value, a 21% upside to its current price.

Exploring Other Perspectives

Optimistic analysts were forecasting Pfizer’s earnings to reach US$15.1 billion by 2028 and saw operating margin expansion outpacing consensus. Compared to the baseline, these forecasts assume that faster regulatory progress and aggressive launches in growth markets could transform future growth. Analyst opinions can differ widely, and it is important to consider how new legal or regulatory events like this may change those expectations.

Explore 31 other fair value estimates on Pfizer - why the stock might be worth just $24.00!

Build Your Own Pfizer Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Pfizer research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Pfizer research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Pfizer's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Rare earth metals are the new gold rush. Find out which 29 stocks are leading the charge.

- Explore 25 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PFE

Pfizer

Pfizer Inc. discovers, develops, manufactures, markets, distributes, and sells biopharmaceutical products in the United States and internationally.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives