- United States

- /

- Pharma

- /

- NYSE:PFE

Pfizer (PFE) Margin Expansion Surpasses Expectations, Challenging Bearish Narratives on Profit Outlook

Reviewed by Simply Wall St

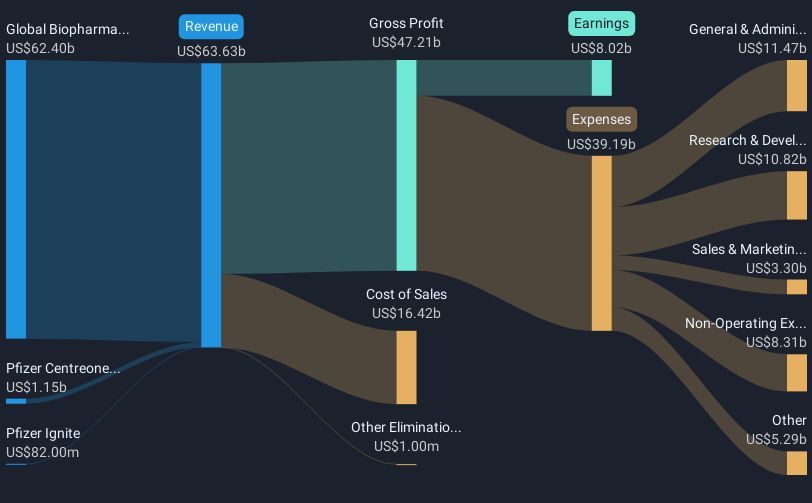

Pfizer (PFE) delivered headline earnings growth over the past twelve months, with net profit margins climbing to 15.6% from 7% a year earlier, and earnings soaring by 133.3%. This sharp turnaround follows a difficult five-year stretch during which average earnings declined by 13.2% per year. However, the company reported a significant one-off loss of $7.0 billion in the trailing twelve months, and forward guidance points to revenue declining at 3.2% annually with expected earnings growth of just 0.8% per year, well below the broader US market's 15.8% pace. With margins improving but growth prospects muted, Pfizer’s results present a complex picture for investors evaluating its future trajectory.

See our full analysis for Pfizer.The next section puts these results side by side with the dominant community narratives, highlighting which stories the latest numbers support and which ones might get shaken up.

See what the community is saying about Pfizer

Margin Expansion Outpaces Industry Expectations

- Pfizer’s net profit margin jumped to 15.6%, more than double last year’s 7%. This contrasts with the five-year trend of average annual earnings decline of -13.2%.

- Bulls emphasize that rapid productivity gains, commercial focus, and pipeline expansion can keep margins rising, even as overall revenue faces headwinds.

- The bullish narrative argues that efficiency efforts and new high-margin therapies, accelerated by AI and successful global launches, could push margins as high as 23.1% in three years. This may help offset expected sales declines.

- This margin strength supports the bullish claim that profit growth and strategic execution are outpacing what is priced into the stock today.

Bulls watching Pfizer’s margin momentum believe high-value drug launches and cost savings could drive bigger profit beats. See the full case in the 🐂 Pfizer Bull Case

Revenue Headwinds Challenge Long-Term Growth

- Guidance points to annual revenue shrinking by 3.2% for the next three years, confirming that the growth engine is stalling despite recent profit gains.

- Bears argue pricing reforms, patent expirations, and generic competition are material headwinds that may limit Pfizer’s earnings recovery.

- Bearish analysts note projected revenue declines of up to 4.2% per year. These trends reinforce concerns that even margin improvement may not be enough to maintain long-term growth if blockbuster drug exclusivity is lost by 2027.

- They also highlight that, with heightened regulatory pressure on drug pricing and looming loss of major patents, the risk of a meaningful revenue cliff is significant in the coming years.

Bears warn Pfizer’s upcoming patent cliffs and shrinking sales could drag on profits. Read why the cautious camp is sounding the alarm in the 🐻 Pfizer Bear Case

Valuation Remains Attractive Versus Peers

- Pfizer trades at a price-to-earnings ratio of 14.4x, below peer (16.2x) and industry (17.8x) averages. Its $24.85 share price is well below the DCF fair value estimate of $61.04.

- Analysts’ consensus view notes that, while profit growth will likely slow, the current valuation offers a cushion for patient investors.

- With an analyst target price of $28.70, Pfizer’s stock sits at a discount to consensus fair value. This suggests the market has already priced in much of the looming risk.

- The favorable relative valuation, coupled with consistently positive margin trends, is consistent with the consensus narrative that Pfizer could rebound if it can deliver on new launches and sustain cost efficiencies.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Pfizer on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Got an alternative take on Pfizer’s results? It only takes a few minutes to turn your insights into a narrative and share your view. Do it your way

A great starting point for your Pfizer research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Pfizer’s slumping revenue outlook and risk of sharper declines from patent expirations raise concerns over consistency and long-term growth potential.

If you want steadier performance, check out stable growth stocks screener (2083 results) to focus on companies that deliver reliable revenue and earnings across market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PFE

Pfizer

Pfizer Inc. discovers, develops, manufactures, markets, distributes, and sells biopharmaceutical products in the United States and internationally.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives