- United States

- /

- Pharma

- /

- NYSE:PFE

Pfizer (PFE) Is Down 5.2% After Study Links Depo-Provera to Higher Meningioma Risk

Reviewed by Simply Wall St

- In late July 2025, a study published in Expert Opinion on Drug Safety linked Pfizer's Depo-Provera contraceptive to a much higher risk of developing intracranial meningioma with extended use, fueling ongoing lawsuits and scrutiny over the company's safety warnings across different countries.

- This development highlights growing legal and reputational risks for Pfizer, as well as concerns about inconsistencies in global risk communication for its well-known products.

- We'll examine how heightened litigation and safety concerns around Depo-Provera may influence Pfizer's investment narrative going forward.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Pfizer Investment Narrative Recap

If you’re considering Pfizer as a long-term holding, you’ll need confidence in its ability to offset losses from major patent expirations and regulatory pressure by achieving blockbuster success from its late-stage pipeline and driving operational efficiencies. The recent Depo-Provera litigation adds a layer of legal and reputational risk, but at this stage it does not appear to materially shift the primary short-term catalyst, which remains Pfizer’s upcoming earnings and pipeline readouts, or the biggest risk, which is continued revenue and margin pressure from patent cliffs and increased competition.

The announcement of EMA’s recommendation for Pfizer’s Omicron LP.8.1-adapted COVID-19 vaccine stands out as particularly relevant, reflecting the company’s ongoing push to diversify revenue streams as older products face exclusivity losses. While this vaccine development is a catalyst for maintaining near-term revenue, investor focus is likely to remain on how Pfizer’s pipeline can deliver sustained growth amid headline risks.

Yet, behind the headlines, investors should also be aware of how global inconsistencies in risk communication could expose Pfizer to challenges that extend far beyond immediate litigation...

Read the full narrative on Pfizer (it's free!)

Pfizer's outlook anticipates $60.3 billion in revenue and $13.4 billion in earnings by 2028. This scenario assumes a 1.2% annual decline in revenue and an increase of $5.5 billion in earnings from the current $7.9 billion.

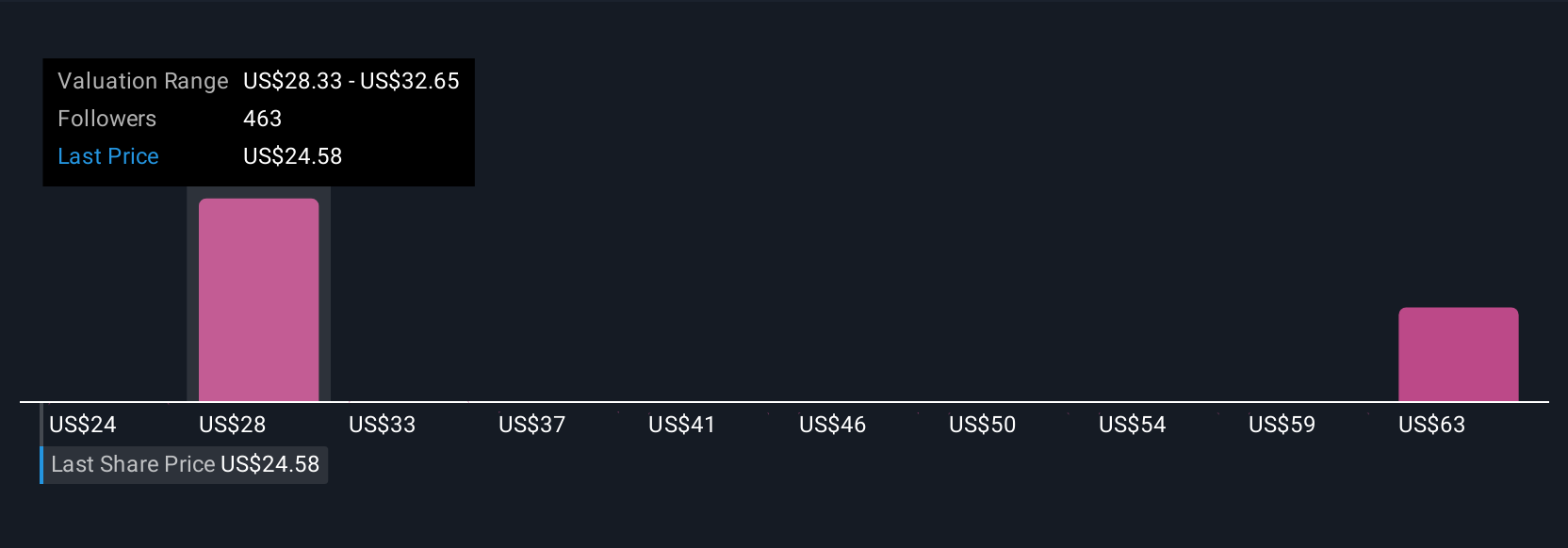

Uncover how Pfizer's forecasts yield a $28.67 fair value, a 22% upside to its current price.

Exploring Other Perspectives

Whereas the consensus view highlights legal and operational headwinds, some of the highest analyst forecasts expect Pfizer’s revenue to reach US$64.3 billion by 2028, primarily driven by a wave of potential new blockbusters and increased pipeline productivity. Both narratives were set before the latest Depo-Provera news, so it will be important to watch if bullish estimates shift as risks for regulatory scrutiny and product liability claims become clearer. Your perspective on these forecasts might be very different, and there are a variety of viewpoints to consider as the story develops.

Explore 26 other fair value estimates on Pfizer - why the stock might be worth just $24.57!

Build Your Own Pfizer Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Pfizer research is our analysis highlighting 5 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Pfizer research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Pfizer's overall financial health at a glance.

Want Some Alternatives?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 25 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PFE

Pfizer

Pfizer Inc. discovers, develops, manufactures, markets, distributes, and sells biopharmaceutical products in the United States and internationally.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives