- United States

- /

- Pharma

- /

- NYSE:PFE

Pfizer (NYSE:PFE) Expands Collaboration With XtalPi To Enhance Drug Discovery Platform

Reviewed by Simply Wall St

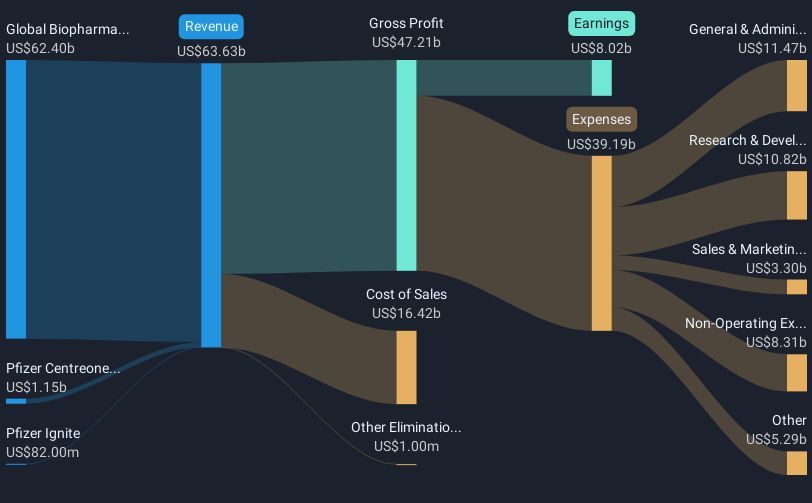

Pfizer (NYSE:PFE) experienced a 2.98% price move over the past month, coinciding with new strategic collaborations. Notably, the company's expanded research partnership with XtalPi aims to advance drug discovery technologies, which could enhance long-term innovation prospects. Additionally, its involvement in the FIBRE Consortium and positive Phase 3 study results for products like HYMPAVZI™ highlight progress in product development. These developments come as major stock indexes, including the S&P 500 and Nasdaq, reached new highs. While Pfizer's performance aligns broadly with the rising market, these events also added depth to the company's narrative during the period.

Pfizer's recent strategic collaborations, including its partnership with XtalPi and involvement in the FIBRE Consortium, could potentially enhance its long-term innovation capabilities and product development pipeline. These developments may influence Pfizer's revenue and earnings forecasts, offering a glimpse of potential future growth stemming from advancements in drug discovery technologies and positive clinical trial outcomes. However, the impact of these initiatives may be tempered by ongoing challenges, such as increased competition and declining utilization of key drugs like Vyndaqel and Paxlovid, which could exert pressure on revenue growth.

Over the five-year period, Pfizer's total shareholder return, which includes share price movements and dividends, was a decline of 6.93%. This performance contrasts with the broader US market's positive return of 13.7% over the past year, illustrating a relative underperformance. Within the pharmaceuticals industry, Pfizer also lagged, with the US Pharmaceuticals industry experiencing a negative return of 11.2% in the same timeframe.

Despite the recent positive news, Pfizer's share price remains below the consensus price target, currently trading at US$24.41 against the consensus target of US$29.24. This implies a discount, reflecting a more conservative market sentiment regarding its near-term growth prospects. The ongoing strategic initiatives and potential revenue drivers from its oncology portfolio could reshape market perceptions, but execution risks and competitive pressures persist as critical factors influencing Pfizer's future valuation and market positioning.

The valuation report we've compiled suggests that Pfizer's current price could be quite moderate.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PFE

Pfizer

Pfizer Inc. discovers, develops, manufactures, markets, distributes, and sells biopharmaceutical products in the United States and internationally.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives