- United States

- /

- Pharma

- /

- NYSE:OGN

Can OGN’s First US Biosimilar Approval Redefine Its Long-Term Oncology Strategy?

Reviewed by Sasha Jovanovic

- Shanghai Henlius Biotech and Organon recently announced that the US FDA has approved POHERDY, the first pertuzumab biosimilar in the US, for all indications of the reference product PERJETA in patients with HER2-positive breast cancer.

- This milestone positions Organon as a leader in expanding access to biosimilar oncology therapies and could broaden its reach in the US biologics market.

- We'll examine how the FDA approval of the pertuzumab biosimilar could shape Organon's investment narrative and future growth prospects.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Organon Investment Narrative Recap

To be a shareholder in Organon, you need to believe that the company can leverage new product launches, like the FDA-approved POHERDY biosimilar, to drive meaningful growth, while overcoming its reliance on mature, off-patent drugs and exposure to pricing pressures. While this biosimilar approval broadens Organon's oncology portfolio, its impact may not be enough to offset ongoing generic competition and margin pressures in the short term, which remain the most important catalysts and risks at play.

Of the recent announcements, Organon’s lowered full-year 2025 revenue guidance aligns most directly with these ongoing risks, as it underscores the ongoing impact of generic erosion and portfolio headwinds. Even with the potential from biosimilar successes like POHERDY, near-term revenue stability and profitability continue to face meaningful structural challenges.

Yet, at the same time, investors should remain aware that increased biosimilar competition could also bring...

Read the full narrative on Organon (it's free!)

Organon's narrative projects $6.5 billion in revenue and $990.3 million in earnings by 2028. This requires 1.2% yearly revenue growth and a $290 million earnings increase from $700 million currently.

Uncover how Organon's forecasts yield a $10.33 fair value, a 44% upside to its current price.

Exploring Other Perspectives

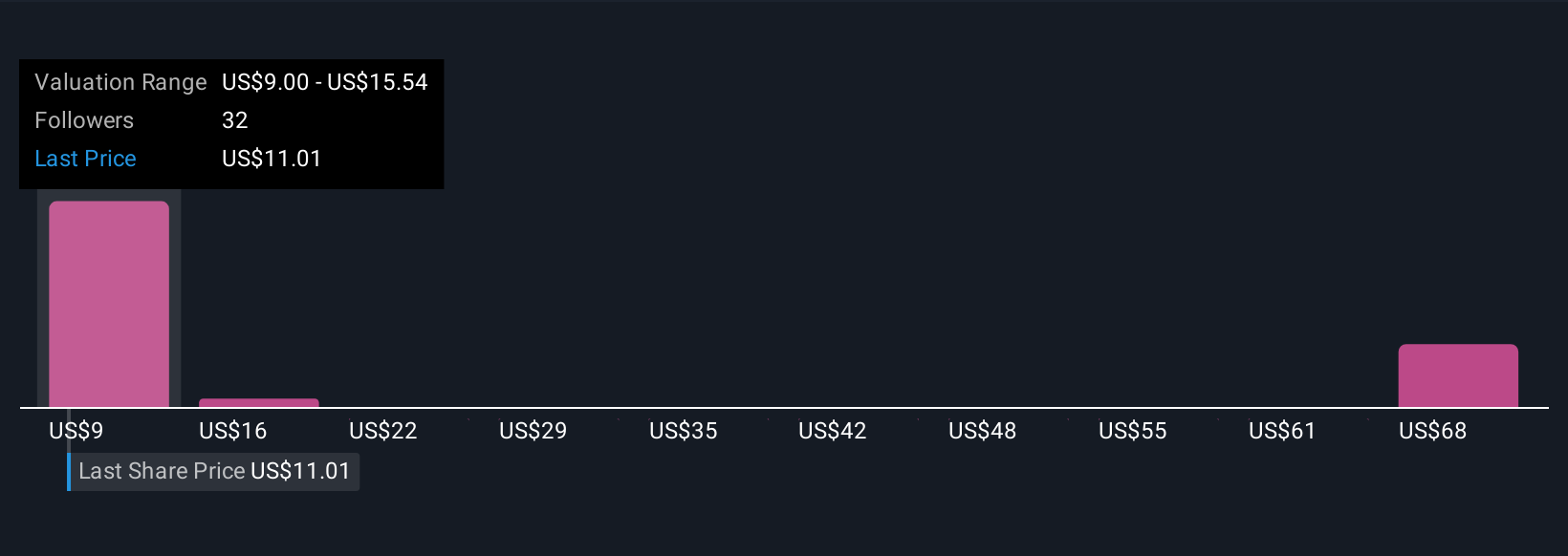

Eight unique fair value estimates from the Simply Wall St Community span an exceptionally wide range from US$9 to US$64.20 per share. At the same time, reliance on external partnerships for pipeline growth raises questions about Organon's ability to sustain momentum if organic R&D remains limited, explore these community viewpoints for a broader outlook.

Explore 8 other fair value estimates on Organon - why the stock might be worth over 8x more than the current price!

Build Your Own Organon Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Organon research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Organon research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Organon's overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OGN

Organon

Develops and delivers health solutions through prescription therapies and medical devices in the United States, Europe, Canada, Japan, rest of the Asia Pacific, Latin America, the Middle East, Russia, Africa, and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives