- United States

- /

- Pharma

- /

- NYSE:NUVB

What Nuvation Bio (NUVB)'s Golden Cross and Upbeat Earnings Revisions Mean for Shareholders

Reviewed by Simply Wall St

- In recent weeks, Nuvation Bio experienced a "golden cross" technical event as its 50-day moving average crossed above the 200-day moving average, while positive earnings estimate revisions drew market attention to the stock.

- This combination of technical momentum and improved earnings expectations signals a shift in market sentiment toward the company’s future prospects.

- We'll explore how the golden cross and revised earnings outlook influence Nuvation Bio’s investment narrative in the current landscape.

Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is Nuvation Bio's Investment Narrative?

For investors considering Nuvation Bio, the core belief is in the ability of its lead therapy, IBTROZI, to secure a meaningful foothold within the ROS1-positive NSCLC market, all while navigating financial and operational hurdles that come with commercializing a new oncology drug. The recent FDA approval and NCCN preferred status were viewed as important positives, and the technical "golden cross" event and positive earnings estimate revisions suggest a visible shift in market enthusiasm. However, the size and competitiveness of the ROS1+ NSCLC market remain a limiting factor, and recent price gains indicate that short-term optimism may already reflect these milestones. Risks such as high cash burn, persistent net losses, and reliance on a single product remain material, but the news flow could alter execution and capital-raising risks if market sentiment persists. In sum, while enthusiasm is high, longer-term uncertainties have not disappeared.

But volatility and a rising cash burn still linger beneath the recent rally. Nuvation Bio's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

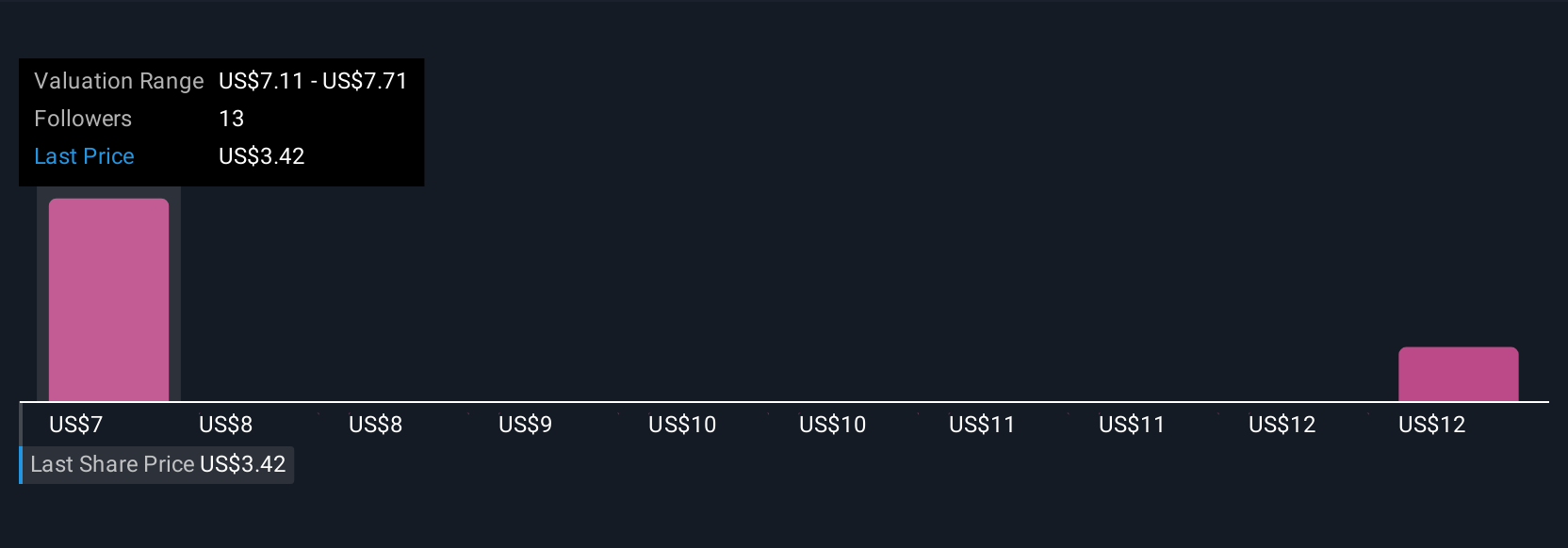

Explore 4 other fair value estimates on Nuvation Bio - why the stock might be worth just $7.11!

Build Your Own Nuvation Bio Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nuvation Bio research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Nuvation Bio research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nuvation Bio's overall financial health at a glance.

Interested In Other Possibilities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are the new gold rush. Find out which 28 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nuvation Bio might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NUVB

Nuvation Bio

A clinical-stage biopharmaceutical company, focuses on developing therapeutic candidates for oncology.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives