- United States

- /

- Pharma

- /

- NYSE:NUVB

Nuvation Bio (NUVB): Assessing Valuation After Positive Phase 2 Lung Cancer Data Release

Reviewed by Simply Wall St

Nuvation Bio (NUVB) just pulled the curtain back on new data from its pivotal Phase 2 TRUST-I and TRUST-II studies for taletrectinib, making a splash at the annual World Conference on Lung Cancer in Barcelona. The company’s update showed compelling response rates for adults with ROS1-positive non-small cell lung cancer, especially those with brain metastases, a notoriously tough-to-treat group. For investors weighing what to do next, this kind of clinical news grabs attention because it can redefine drug pipeline confidence and future revenue possibilities.

Leading up to this announcement, Nuvation Bio’s stock saw a sharp swing, surging around 20% in the past month and up more than 80% across the last three months. Momentum has clearly gathered pace relative to the past year’s more muted gains. While recent years have brought both wins and setbacks for the company, this latest clinical milestone could signal a shift in risk perception among investors, especially as updates from the company’s next-stage studies are on deck.

With the market reacting quickly to these promising results, it is fair to ask whether the shares still offer value at this point, or if everyone has already priced in the potential for growth ahead.

Price-to-Book of 2.9x: Is it justified?

Nuvation Bio currently trades at a price-to-book (P/B) ratio of 2.9x, which is lower than the peer average but higher than the broader US pharmaceuticals industry. This suggests the valuation is attractive when compared to similar companies, but appears somewhat expensive relative to the industry as a whole.

The price-to-book ratio measures a company’s market price versus its net asset value. This gives investors a sense of how much they are paying for the company’s underlying assets. In the biotech space, P/B is often used to assess early-stage firms that may not yet be profitable but have significant pipeline value or cash reserves.

Based on current numbers, the market seems to be pricing in optimism about Nuvation Bio’s growth potential, despite its ongoing losses. Whether this premium is warranted may depend on the success of its clinical trials and the realization of future revenue growth.

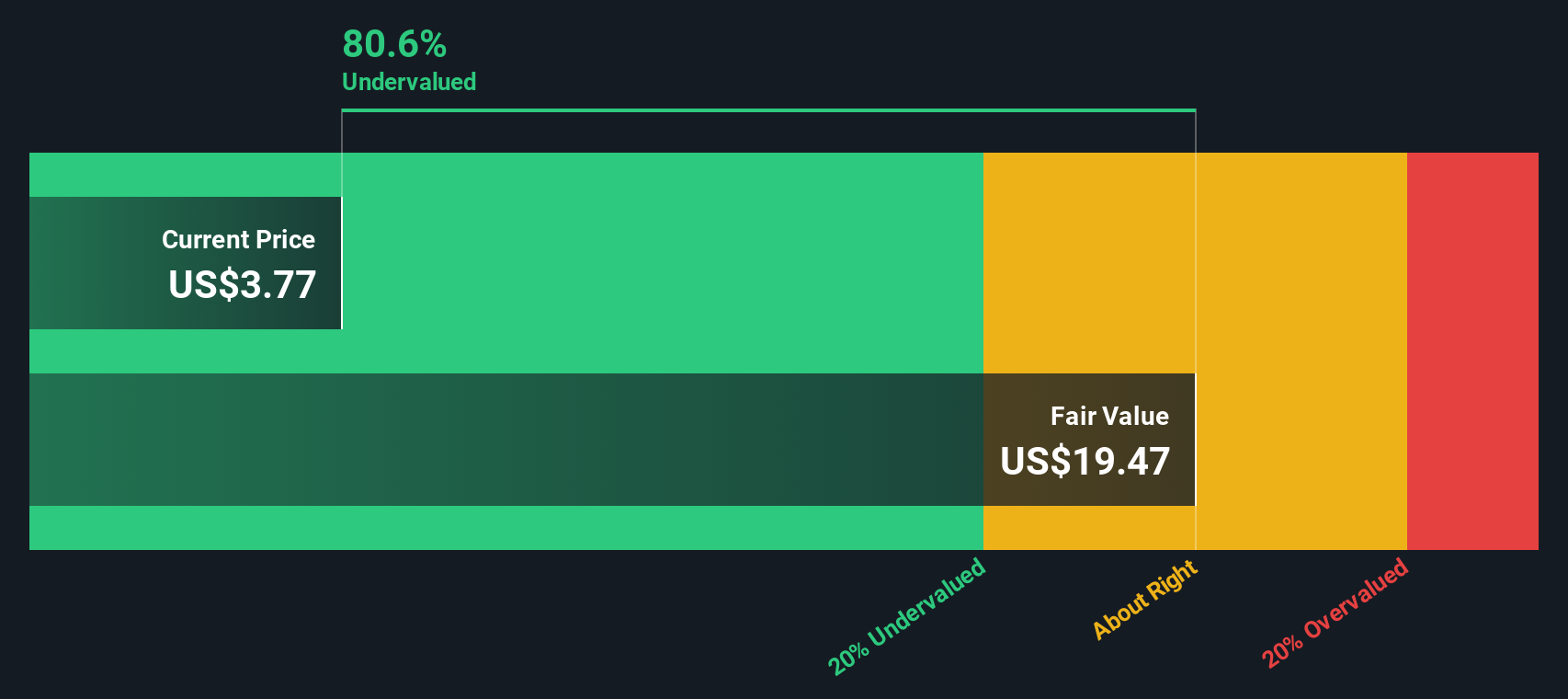

Result: Fair Value of $19.47 (UNDERVALUED)

See our latest analysis for Nuvation Bio.However, setbacks in ongoing trials or slower than expected revenue growth could quickly reverse the recent optimism around Nuvation Bio’s stock outlook.

Find out about the key risks to this Nuvation Bio narrative.Another View: Our DCF Model Perspective

Taking a different lens, the SWS DCF model also points toward the stock being undervalued based on future cash flow potential. Can both methods be correct, or is the market missing something?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Nuvation Bio Narrative

If you want to dig deeper or have a different perspective, you can review the numbers and shape your own narrative in just a few minutes. Do it your way.

A great starting point for your Nuvation Bio research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t limit your growth to just one opportunity. Gain an edge in your research by tapping into proven strategies that uncover hidden winners and redefine your approach to the market.

- Spot real value by sizing up stocks that are trading below their intrinsic worth using our insights into undervalued stocks based on cash flows.

- Boost your portfolio with regular income by tapping into opportunities with dividend stocks with yields > 3%.

- Seize the explosive potential behind artificial intelligence trends and see which companies are leading in AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nuvation Bio might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NUVB

Nuvation Bio

A clinical-stage biopharmaceutical company, focuses on developing therapeutic candidates for oncology.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives