- United States

- /

- Pharma

- /

- NYSE:NUVB

How Nuvation Bio's (NUVB) Revenue Surge and Shelf Registration Plan Could Shape Investor Outlook

Reviewed by Sasha Jovanovic

- Nuvation Bio reported third quarter 2025 earnings, highlighting sales of US$5.4 million and a net loss of US$55.79 million, and announced a US$105.89 million shelf registration filing for potential future issuance of Class A Common Stock.

- While sales and revenue grew substantially compared to the prior year, the company’s net loss from continuing operations also widened in the quarter.

- We’ll assess how the combination of strong revenue growth and a major shelf registration filing shapes Nuvation Bio’s investment narrative.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Nuvation Bio's Investment Narrative?

If you're looking at Nuvation Bio today, you need to believe in the company's ability to turn its impressive revenue momentum into long-term success, despite widening losses. The newly reported US$5.4 million in quarterly sales marks a strong step forward, but an even larger net loss and another shelf registration filing raise important questions. This jump in potential new stock issuance could weigh on shares by diluting existing holders and shifting attention to the company's need for additional capital. On the other hand, the recent IBTROZI approvals and strong trial data remain central short-term catalysts, and the leadership shakeup just ahead of these announcements could influence execution. As a result, the risk equation may be changing: the financial boost from Japan and the US is encouraging, but heavy losses and ongoing capital raises now stand out as key uncertainties for those watching the next chapters of Nuvation's story.

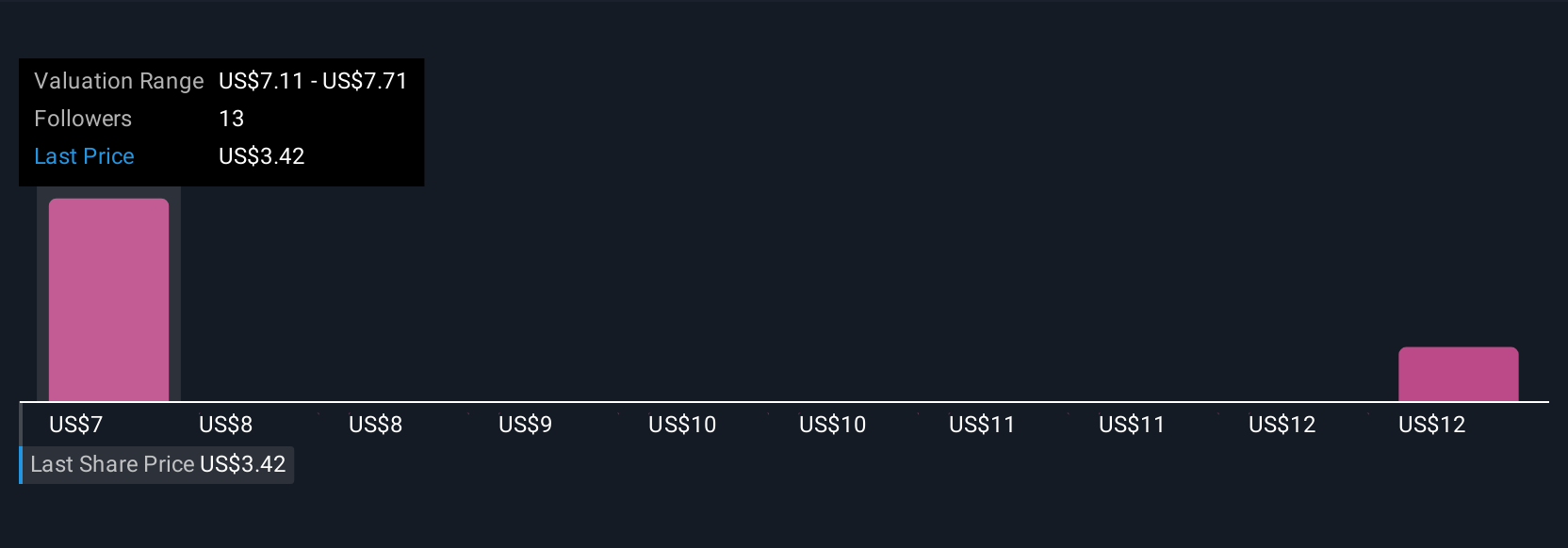

But while commercial growth is encouraging, dilution risk is something investors should keep in mind. Nuvation Bio's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 5 other fair value estimates on Nuvation Bio - why the stock might be worth less than half the current price!

Build Your Own Nuvation Bio Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nuvation Bio research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Nuvation Bio research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nuvation Bio's overall financial health at a glance.

Ready For A Different Approach?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nuvation Bio might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NUVB

Nuvation Bio

A clinical-stage biopharmaceutical company, focuses on developing therapeutic candidates for oncology.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives