- United States

- /

- Life Sciences

- /

- NYSE:MTD

Why Mettler-Toledo (MTD) Is Up 5.8% After Strong Earnings and Reaffirmed Outlook

Reviewed by Sasha Jovanovic

- Mettler-Toledo International recently reported quarterly earnings that exceeded analyst expectations, with strong growth in its Industrial and Laboratory segments driven by new product launches and higher bioprocessing demand in the Americas.

- The company's reaffirmation of its full-year outlook and continued expansion of services have highlighted its leadership position despite ongoing tariff pressures and shifting global market conditions.

- Let's examine how Mettler-Toledo's robust segment performance and reaffirmed outlook may influence the company's investment thesis.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Mettler-Toledo International Investment Narrative Recap

To be a shareholder in Mettler-Toledo International, you need to believe that demand for advanced precision instruments will keep benefiting from structural trends in bioprocessing, automation, and life sciences, despite potential headwinds from global trade policy. The company’s recent earnings beat and solid performance in Industrial and Laboratory segments underscore the importance of product innovation as a catalyst, but these results do not materially reduce ongoing risks tied to tariff-driven margin pressure, which remains the most significant operational concern in the near term.

Among recent announcements, the uptick in share buyback authorizations stands out as most relevant. With the board expanding the buyback program to over US$13 billion, this move supports shareholder returns and may add confidence amid uncertain operating conditions, though it should be viewed alongside ongoing margin challenges and broader revenue visibility issues.

However, investors need to be mindful that rising and unpredictable tariff costs, like those recently imposed on Swiss imports, could still...

Read the full narrative on Mettler-Toledo International (it's free!)

Mettler-Toledo International's outlook anticipates $4.4 billion in revenue and $1.0 billion in earnings by 2028. This projection rests on an annual revenue growth rate of 4.5% and a $170 million increase in earnings from the current $829.8 million.

Uncover how Mettler-Toledo International's forecasts yield a $1493 fair value, in line with its current price.

Exploring Other Perspectives

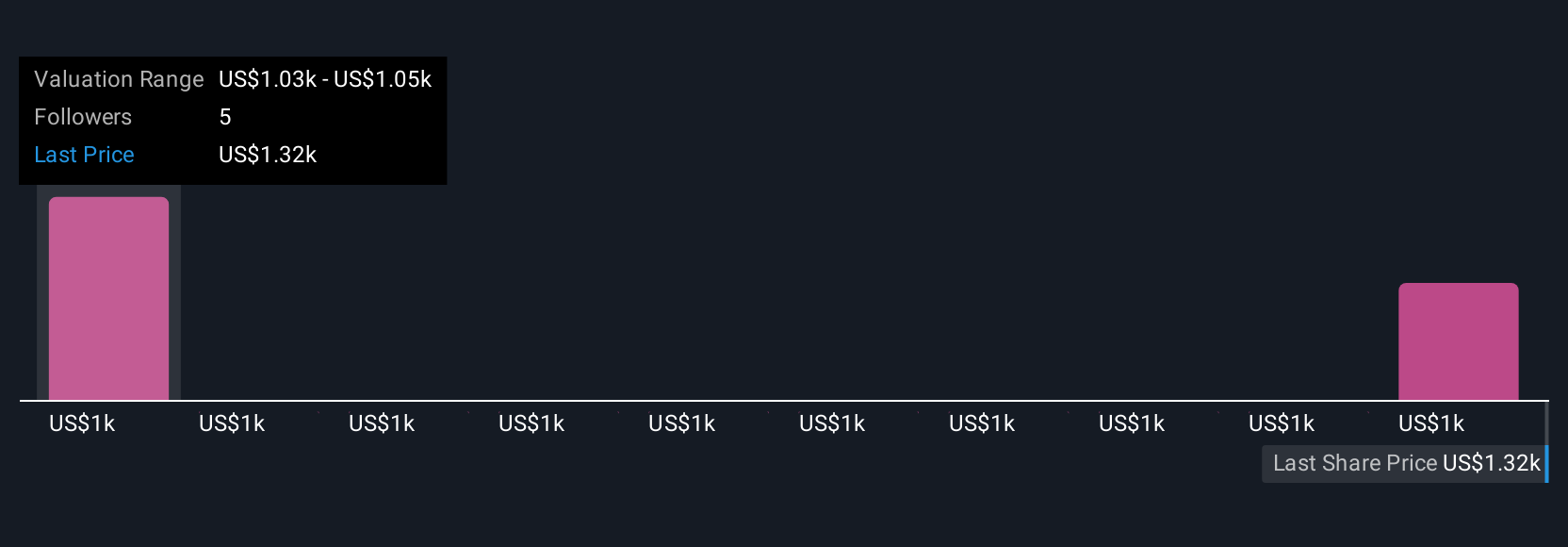

Two unique fair value views from the Simply Wall St Community placed Mettler-Toledo’s worth between US$929 and US$1,493. While these personal forecasts are wide apart, keep in mind that persistent tariff risks highlighted in recent news could shape future outlooks in ways the community has yet to reflect. Explore more viewpoints to see how other investors are weighing these risks for themselves.

Explore 2 other fair value estimates on Mettler-Toledo International - why the stock might be worth 38% less than the current price!

Build Your Own Mettler-Toledo International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mettler-Toledo International research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Mettler-Toledo International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mettler-Toledo International's overall financial health at a glance.

Contemplating Other Strategies?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MTD

Mettler-Toledo International

Manufactures and supplies precision instruments and services in the Americas, Europe, Asia, and internationally.

Solid track record with limited growth.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success