- United States

- /

- Life Sciences

- /

- NYSE:MTD

What Mettler-Toledo International (MTD)'s Raised Guidance and Q2 Beat Means For Shareholders

Reviewed by Simply Wall St

- On July 31, Mettler-Toledo International reported second-quarter results that exceeded Wall Street expectations, with both adjusted EPS and revenue coming in above forecasts and the company projecting full-year adjusted EPS between US$42.10 and US$42.60.

- Analyst consensus has recently shifted to a more positive stance, reflecting growing confidence in the company’s performance after its upbeat results and improved outlook.

- We'll explore how Mettler-Toledo’s raised full-year outlook and strong quarterly beat may impact its long-term growth narrative.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Mettler-Toledo International Investment Narrative Recap

To believe in Mettler-Toledo International as a shareholder, you need confidence in its ability to leverage ongoing tailwinds in automation, regulatory demand, and life sciences, even as short-term volatility remains a reality. The recent earnings beat and raised full-year EPS guidance reinforce the positive momentum but do not fundamentally alter the most important short-term catalyst, pickup in end-market demand, or the major risk of margin pressure from tariffs and global trade uncertainty, which remain highly material risks.

Among recent announcements, the acceleration of share repurchases stands out; between April and June alone, Mettler-Toledo bought back nearly 200,000 shares, signaling a focus on shareholder returns. While this supports the investment narrative tied to capital allocation, meaningful exposure to macro risks and tariffs remains, influencing both sentiment and the company's ability to achieve its outlook.

However, investors should also be aware that even upbeat earnings do not fully insulate against ongoing tariff and trade-policy headwinds which...

Read the full narrative on Mettler-Toledo International (it's free!)

Mettler-Toledo International's outlook anticipates $4.4 billion in revenue and $1.0 billion in earnings by 2028. This is based on a projected annual revenue growth rate of 4.5% and an earnings increase of about $170 million from current earnings of $829.8 million.

Uncover how Mettler-Toledo International's forecasts yield a $1295 fair value, in line with its current price.

Exploring Other Perspectives

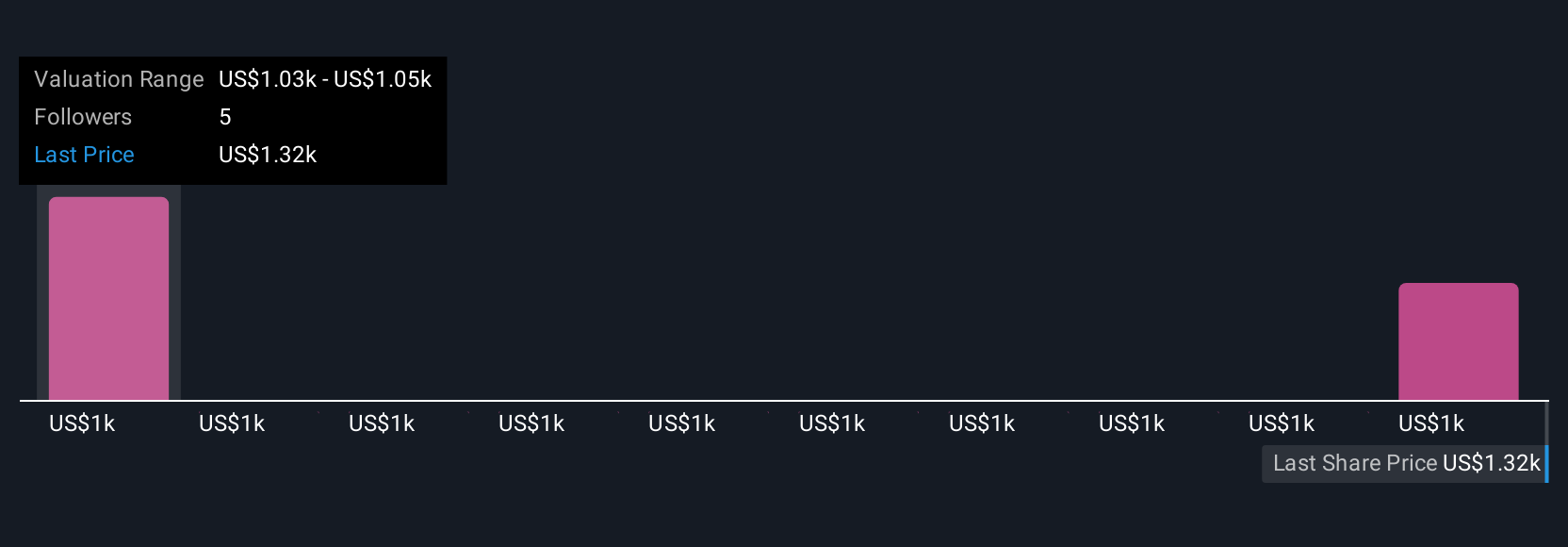

Simply Wall St Community members estimate Mettler-Toledo’s fair value between US$1,025 and US$1,295 based on two independent analyses. While the enthusiasm around automation and regulatory-driven demand is evident, you’ll find a variety of views across the Community on whether these factors truly offset global risks to profitability.

Explore 2 other fair value estimates on Mettler-Toledo International - why the stock might be worth 21% less than the current price!

Build Your Own Mettler-Toledo International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mettler-Toledo International research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Mettler-Toledo International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mettler-Toledo International's overall financial health at a glance.

Searching For A Fresh Perspective?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MTD

Mettler-Toledo International

Manufactures and supplies precision instruments and services in the Americas, Europe, Asia, and internationally.

Acceptable track record with limited growth.

Similar Companies

Market Insights

Community Narratives