- United States

- /

- Pharma

- /

- NYSE:MRK

Merck (NYSE:MRK) Begins Phase 3 Trial Of Innovative Prostate Cancer Treatment

Reviewed by Simply Wall St

Merck (NYSE:MRK) recently initiated the IDeate-Prostate01 phase 3 trial, dosing the first patient for its investigational drug ifinatamab deruxtecan, aimed at treating metastatic castration-resistant prostate cancer. Alongside this major development, the company saw FDA approval of KEYTRUDA for head and neck cancer, and embarked on a collaborative Phase 3 dengue vaccine trial, possibly contributing to its 2.92% stock price increase over the last month. In a market characterized by geopolitical tensions and economic anticipations, these announcements may have buoyed Merck as it matches broader market trends.

We've spotted 1 weakness for Merck you should be aware of.

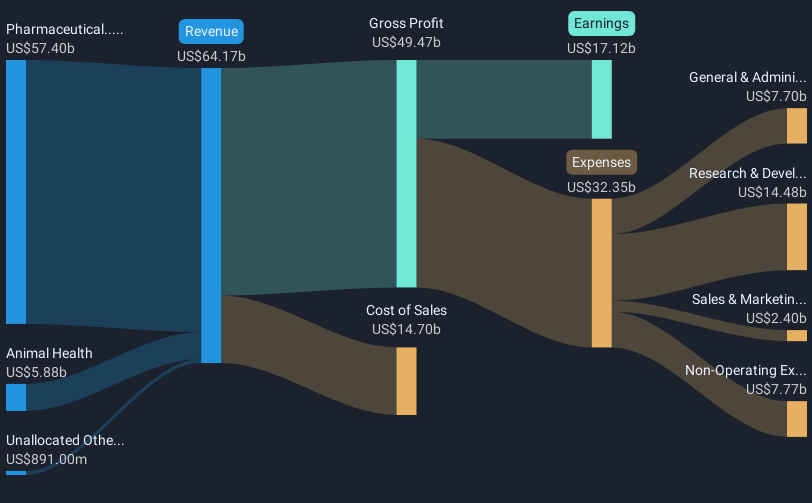

Merck's latest endeavors, including the IDeate-Prostate01 phase 3 trial and the FDA approval of KEYTRUDA for head and neck cancer, are expected to bolster its long-term growth narrative. These developments could enhance Merck’s leadership in oncology and potentially strengthen revenue streams, aligning with its broader strategy of introducing over 20 growth drivers with blockbuster potential. Merck's share price saw a 2.92% increase last month, closely reflecting these ongoing advancements. However, it's important to juxtapose this with the analysts' consensus price target of US$105.02, indicating a substantial upside potential of approximately 24.7% from the current share price of US$79.04.

Over the last five years, Merck’s total shareholder return, including dividends, was 24.36%, showcasing a steady appreciation. In comparison to the broader US market, Merck slightly underperformed over the past year, as it returned 9.8% while the US Pharmaceuticals industry experienced a 9% decline. The recent news could influence revenue forecasts positively if product launches succeed and if the pipeline supports new growth avenues. Additionally, with earnings anticipated to rise from US$17.43 billion today to US$24.6 billion by May 2028, the developments could accelerate earnings growth, assuming no significant market or regulatory disruptions.

Evaluate Merck's prospects by accessing our earnings growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MRK

Outstanding track record, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success