- United States

- /

- Pharma

- /

- NYSE:MRK

Does Merck’s Recent Drug Partnership Signal a Rare Value Opportunity for 2025?

Reviewed by Bailey Pemberton

- Wondering if Merck is a bargain or an overpriced pick in today’s market? You’re in the right place for a clear-eyed look at its value.

- While Merck’s share price dipped 1.2% over the last week, it has surged 10.2% in the past month, even though it remains down 14.4% over one year.

- One catalyst behind these recent moves has been the announcement of new collaborative drug development partnerships, alongside regulatory headlines that put Merck’s innovation in the spotlight. This mix of strategic news and market reaction is shaping how investors think about future prospects.

- Adding it all up, Merck scores 5 out of 6 on our valuation checklist, which means it’s undervalued in nearly every key area. Let’s break down how traditional valuation methods stack up and preview a smarter approach that can help you find hidden value. Stay tuned for that reveal at the end.

Find out why Merck's -14.4% return over the last year is lagging behind its peers.

Approach 1: Merck Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates what a business is worth today by projecting its future cash flows and discounting them back to the present. For Merck, this model uses both analyst estimates and extrapolations to forecast the company’s Free Cash Flow (FCF) over the next decade.

Currently, Merck generates annual Free Cash Flow of approximately $14.5 Billion. According to analysts, FCF is expected to increase steadily, reaching roughly $23.2 Billion by the end of 2029. Beyond the analyst forecast period, projections are extended using carefully modeled growth assumptions from Simply Wall St. This leads to an estimated FCF of $24.5 Billion in 2035.

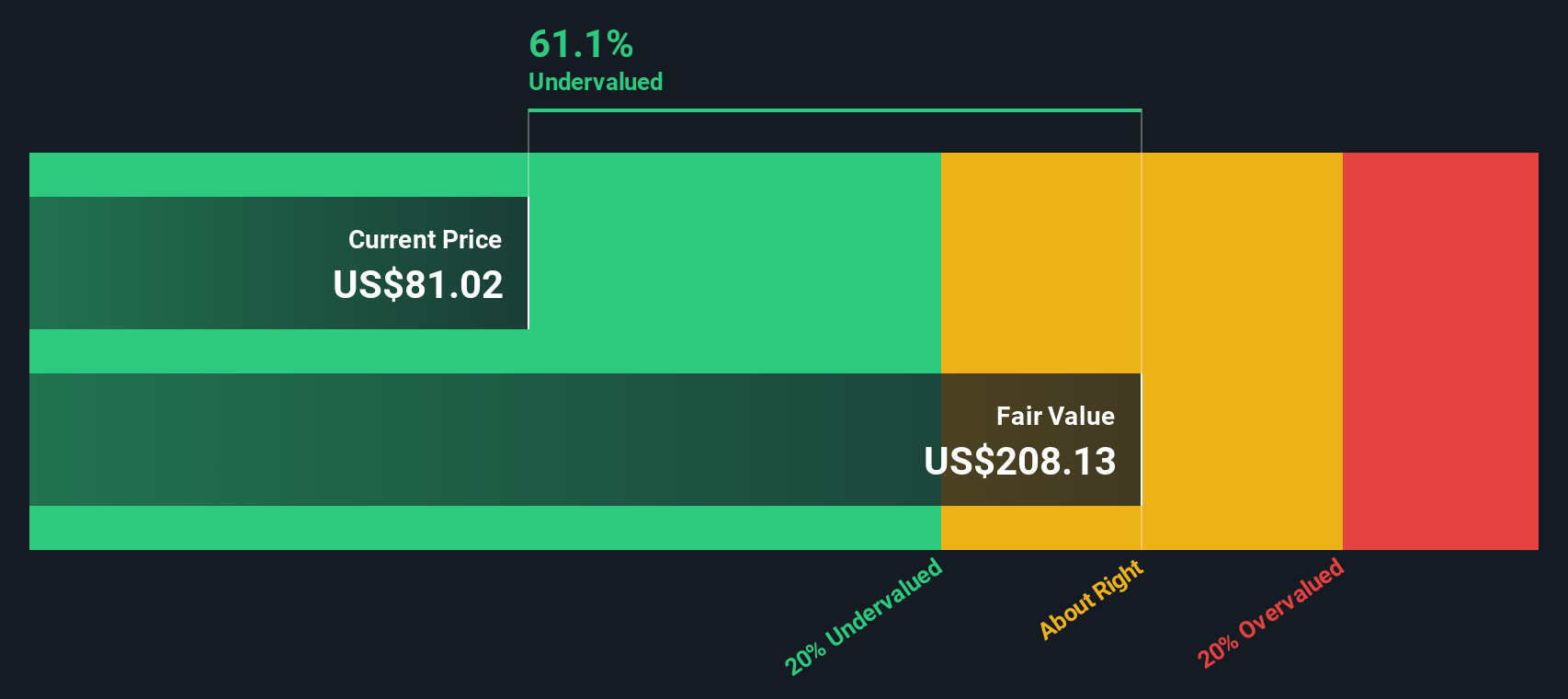

Using these projections and discounting all future cash flows to their present value, the DCF model calculates Merck’s intrinsic value at $207.62 per share. With the stock trading at a price that implies it is 58.3% below this fair value estimate, Merck appears to be significantly undervalued based on cash flow fundamentals.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Merck is undervalued by 58.3%. Track this in your watchlist or portfolio, or discover 854 more undervalued stocks based on cash flows.

Approach 2: Merck Price vs Earnings

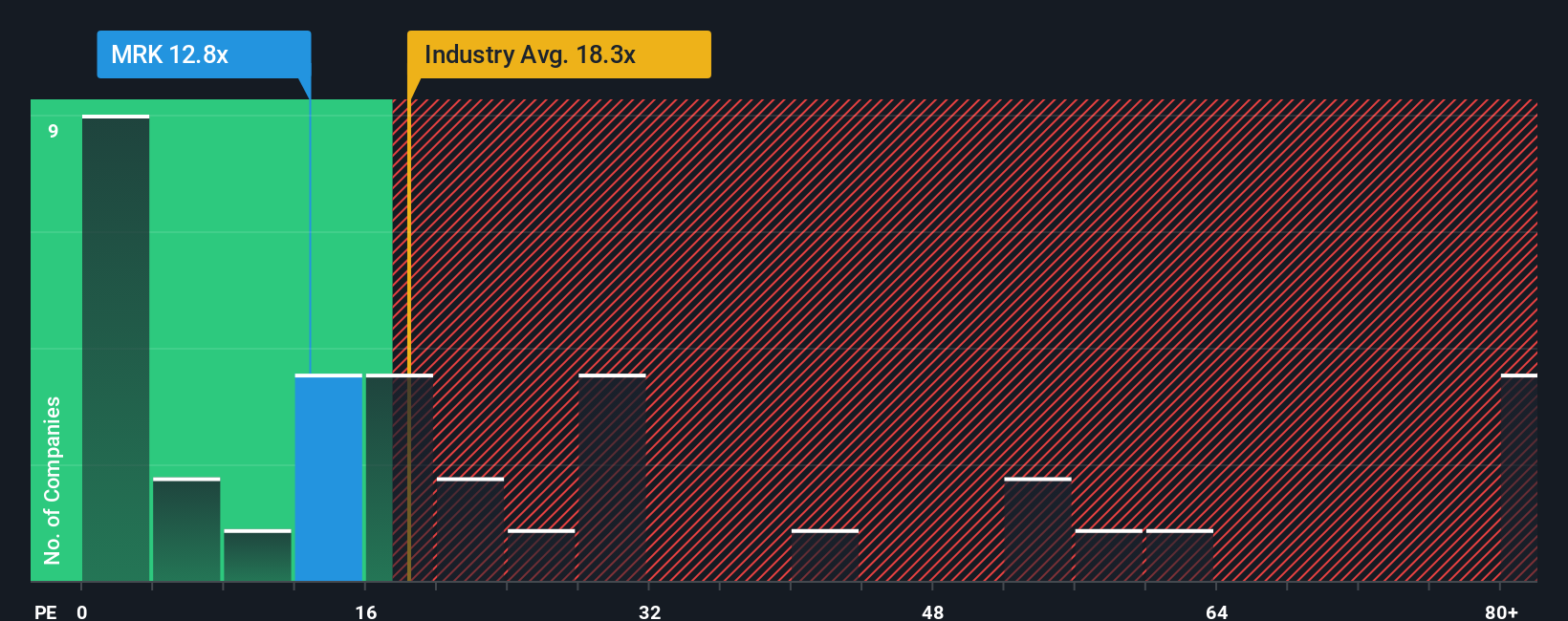

The Price-to-Earnings (PE) ratio is a tried-and-true valuation metric, especially useful for established, profitable companies like Merck. It helps investors gauge how much they are paying for each dollar of the company’s earnings. The PE ratio can reflect both the market’s growth expectations and perceived risks. Higher ratios usually mean investors expect stronger future growth or lower risks, while lower ratios may suggest the opposite.

Merck currently trades at a PE ratio of 13.2x. For comparison, the Pharmaceuticals industry average sits higher at 17.9x, and peers are averaging around 18.1x. This places Merck comfortably below these main benchmarks, suggesting that the market might be more cautious about its prospects, or potentially overlooking its value.

But Simply Wall St’s proprietary “Fair Ratio” provides a more tailored benchmark, filtering out much of the noise. This Fair Ratio, set at 25.6x for Merck, takes into account its specific earnings growth outlook, profit margins, industry trends, market cap, and risk profile. Unlike broad industry or peer averages, the Fair Ratio helps pinpoint what the multiple should be for Merck’s unique circumstances, rather than what is merely typical for sector peers.

Comparing Merck’s actual PE of 13.2x to its Fair Ratio of 25.6x, it is clear the stock is trading well below the valuation its fundamentals might justify, strongly indicating undervaluation by this metric as well.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1395 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Merck Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a simple, powerful framework that lets you connect your view of Merck’s business story, including its strategy, opportunities, and risks, to a full financial forecast and an estimated fair value, all in one place.

Rather than just looking at numbers in isolation, Narratives allow you to bring your assumptions about revenue growth, profit margins, and future market conditions to life. You can quickly test what Merck is truly worth based on your own expectations, not just those of analysts or broad industry averages.

Narratives are designed to be accessible and easy for any investor to use, and you can find them on Simply Wall St’s Community page, where millions collaborate and compare perspectives. The platform helps you make more confident decisions by clearly showing how the Fair Value from your (or any) Narrative lines up against today’s market Price, giving you a “buy” or “sell” signal grounded in your unique outlook.

Plus, Narratives are dynamic; they automatically update when important news or earnings data arrives, keeping your valuations relevant and forward-looking.

For example, some Merck Narratives see blockbuster product launches and margin expansion driving a fair value as high as $141, while more cautious views, worried about patent losses or pricing pressure, land at $82, showing how different investors’ stories create very different price targets.

Do you think there's more to the story for Merck? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MRK

Outstanding track record, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives