- United States

- /

- Pharma

- /

- NYSE:LLY

Should Positive Jaypirca Trial Results and AI Launch Prompt Action From Eli Lilly (LLY) Investors?

Reviewed by Simply Wall St

- In early September 2025, Eli Lilly announced positive Phase 3 results for Jaypirca (pirtobrutinib) in chronic lymphocytic leukemia and launched Lilly TuneLab, an advanced AI/ML platform for drug discovery, with additional strategic collaborations unveiled by partners such as insitro and Circle Pharma.

- The combination of new clinical data and the introduction of AI-driven drug development models underscores Lilly's expanding innovation capabilities and commitment to accelerating R&D productivity within the pharmaceutical sector.

- We'll now examine how Lilly TuneLab's launch and clinical progress with Jaypirca could influence the company’s investment narrative and growth prospects.

Find companies with promising cash flow potential yet trading below their fair value.

Eli Lilly Investment Narrative Recap

Being a shareholder in Eli Lilly requires confidence in its ability to drive growth through innovation in therapies for obesity, diabetes, and oncology while navigating regulatory pressures and payer constraints. The launch of Lilly TuneLab and positive Jaypirca trial results reinforce Lilly's innovative momentum; however, these developments do not materially reduce near-term risks tied to pricing power erosion and market access for its lead products, which remain top concerns for future revenue stability.

Among recent announcements, the FDA Breakthrough Therapy designation for olomorasib in combination with Keytruda is especially relevant. As competition intensifies and regulatory scrutiny persists, the ability to gain such designations and expand Lilly’s portfolio in oncology serves as an important catalyst for sustaining long-term earnings growth.

Yet, in contrast with innovation-driven optimism, investors should be aware that ongoing regulatory actions and heightened pressure on US drug pricing could...

Read the full narrative on Eli Lilly (it's free!)

Eli Lilly's narrative projects $89.1 billion revenue and $34.2 billion earnings by 2028. This requires 18.7% yearly revenue growth and a $20.4 billion increase in earnings from the current $13.8 billion.

Uncover how Eli Lilly's forecasts yield a $891.62 fair value, a 18% upside to its current price.

Exploring Other Perspectives

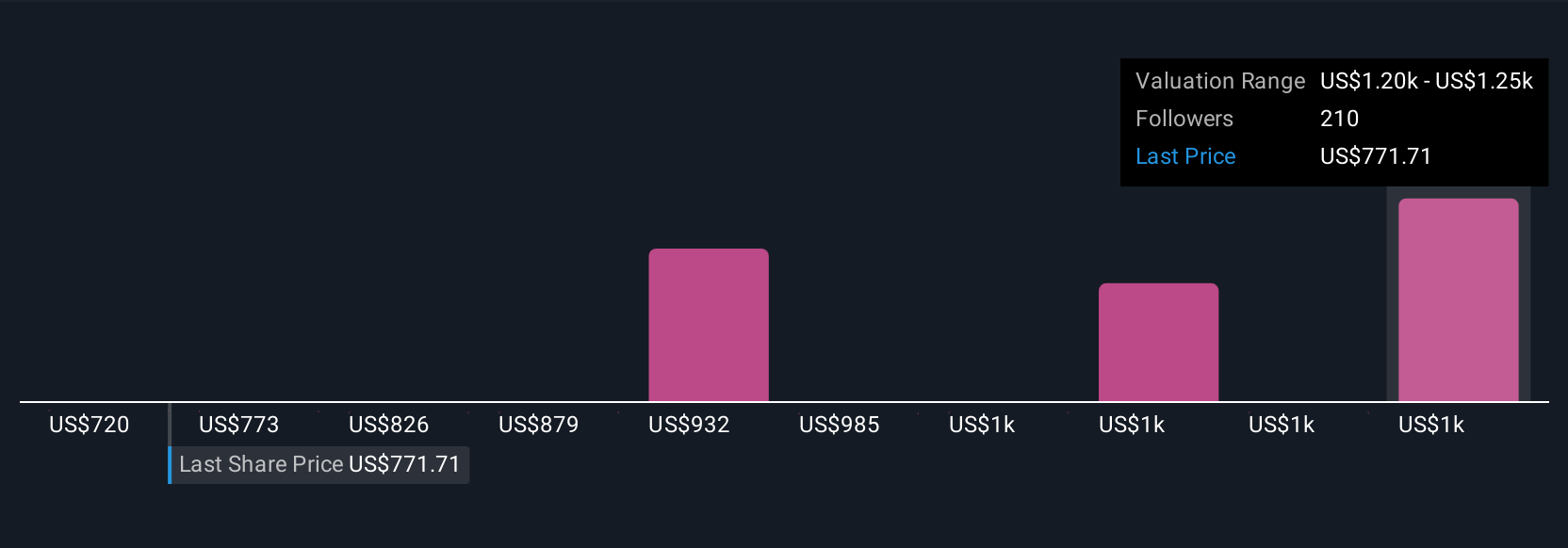

Fair value estimates from 28 Simply Wall St Community members range from US$650 to US$1,186 per share. This breadth reflects varied approaches, while current concerns over regulatory-driven pricing pressure invite a closer look at how investor opinions can diverge, so consider exploring several viewpoints before making your own call.

Explore 28 other fair value estimates on Eli Lilly - why the stock might be worth 14% less than the current price!

Build Your Own Eli Lilly Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Eli Lilly research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Eli Lilly research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Eli Lilly's overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 28 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eli Lilly might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LLY

Eli Lilly

Eli Lilly and Company discovers, develops, and markets human pharmaceuticals in the United States, Europe, China, Japan, and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives