- United States

- /

- Pharma

- /

- NYSE:LLY

Eli Lilly (LLY) Is Up 8.5% After Major Sales Beat and New Global Manufacturing Expansion

Reviewed by Sasha Jovanovic

- In recent days, Eli Lilly reported a surge in quarterly sales and net income, raised its 2025 revenue and earnings guidance, and unveiled new manufacturing expansions in the Netherlands and Puerto Rico to support strong demand for obesity and diabetes treatments. The company announced partnerships to broaden access to its medicine portfolio, including with Walmart for direct-to-consumer obesity drugs, and highlighted advancements in AI-powered drug discovery and pipeline progress with regulatory approvals for new treatments.

- Lilly’s intensified manufacturing buildout positions it to meet rising global demand for its blockbuster therapies, underpinning its ambitious growth targets and expanding its presence as a leader in the cardiometabolic and specialty medicines segment.

- We'll examine how Lilly’s major new manufacturing investments may reinforce its investment narrative and support its expanding diabetes and obesity drug portfolio.

Rare earth metals are the new gold rush. Find out which 38 stocks are leading the charge.

Eli Lilly Investment Narrative Recap

For anyone considering Eli Lilly as an investment, the big picture rests on continued strong demand and expanding access for its diabetes and obesity treatments, backed by expanded manufacturing capacity and new innovations. The recent announcements of large-scale manufacturing projects, including a new US$3 billion facility in the Netherlands, directly support the company’s ability to deliver on this catalyst, though they do not materially reduce the ongoing risk from regulatory pricing pressures in the US and Europe, still the most significant threat to future margins and profits.

Among recent developments, Lilly’s partnership with Walmart to broaden access to Zepbound stands out as especially relevant, since it makes the company’s leading obesity medicine widely available at lower self-pay pricing. This move could further drive the short-term growth catalyst of expanding volume in obesity drugs, while also reinforcing Lilly’s market presence as competitors and payers scrutinize pricing and coverage.

However, if new European or US price controls take effect, investors should be aware that...

Read the full narrative on Eli Lilly (it's free!)

Eli Lilly's narrative projects $89.1 billion in revenue and $34.2 billion in earnings by 2028. This requires 18.7% annual revenue growth and a $20.4 billion increase in earnings from the current $13.8 billion.

Uncover how Eli Lilly's forecasts yield a $919.33 fair value, a 3% upside to its current price.

Exploring Other Perspectives

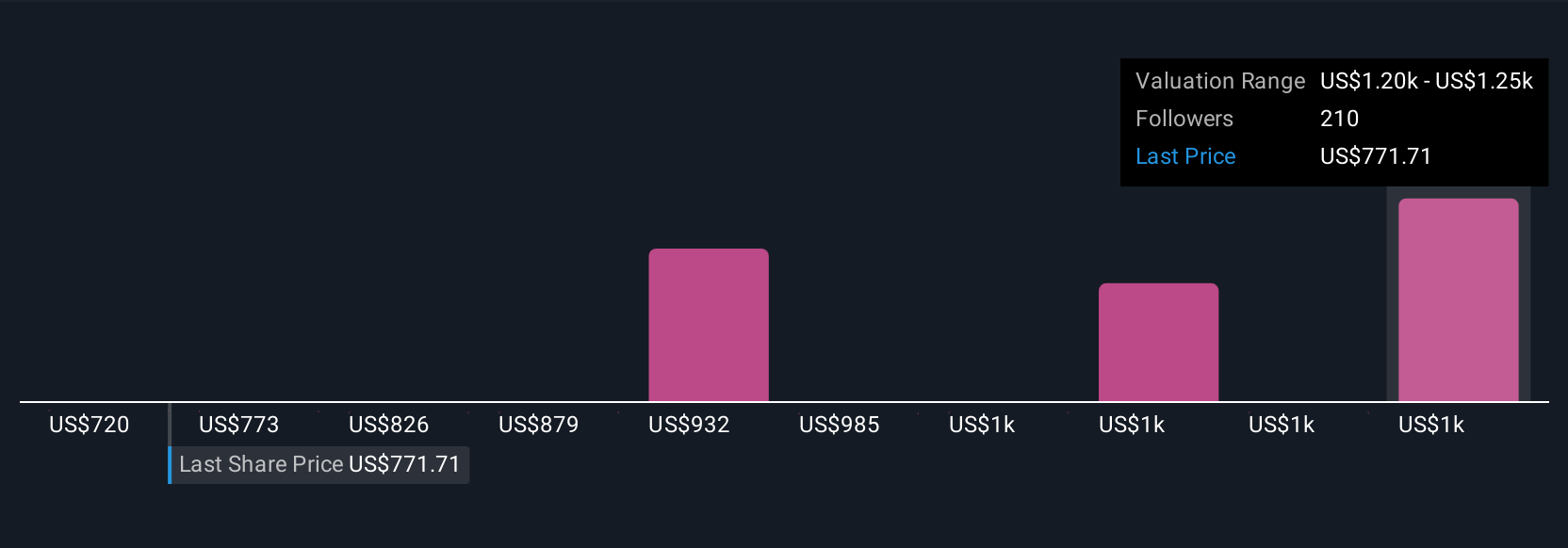

Thirty members of the Simply Wall St Community estimate Eli Lilly’s fair value to be anywhere from US$650 to US$1,226 per share. With regulatory pricing pressure remaining the central risk, market participants are weighing both robust growth potential and the possibility of future margin compression.

Explore 30 other fair value estimates on Eli Lilly - why the stock might be worth 27% less than the current price!

Build Your Own Eli Lilly Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Eli Lilly research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Eli Lilly research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Eli Lilly's overall financial health at a glance.

Ready For A Different Approach?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eli Lilly might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LLY

Eli Lilly

Eli Lilly and Company discovers, develops, and markets human pharmaceuticals in the United States, Europe, China, Japan, and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives