- United States

- /

- Pharma

- /

- NYSE:LLY

Eli Lilly (LLY) Is Up 7.8% After Surpassing $1 Trillion Valuation on Obesity Drug Demand – Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- Eli Lilly became the first healthcare company to reach a US$1 trillion market capitalization, propelled by unprecedented demand for its diabetes and weight loss drugs, Zepbound and Mounjaro, along with robust growth in new drug launches and manufacturing expansion.

- This milestone not only highlights surging global interest in metabolic health solutions but also signals growing expectations for Eli Lilly’s innovation pipeline across neuroscience and oncology.

- We'll examine how Eli Lilly’s unprecedented sales and market leadership in obesity and diabetes care are influencing its investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Eli Lilly Investment Narrative Recap

For shareholders, the core belief underpinning Eli Lilly’s investment case is that it can sustain industry-leading growth in diabetes, obesity, and emerging therapeutic areas, powered by demand for Mounjaro and Zepbound and a deep pipeline. The newly advanced civil RICO lawsuit tied to Actos highlights legal and regulatory risks, but does not materially change the short-term catalyst: rising global sales of Lilly’s next-generation incretin drugs. The most significant business risk remains the company’s exposure to high-impact legal or regulatory actions.

Among recent announcements, the nationwide expansion of Lilly Gateway Labs in Philadelphia stands out. This move enhances Lilly’s capacity for drug discovery partnerships and ecosystem growth, aligning with the company’s focus on R&D-driven pipeline expansion, a key catalyst as demand for metabolic and specialty therapies continues to surge.

However, investors should be aware that unexpected legal challenges could ...

Read the full narrative on Eli Lilly (it's free!)

Eli Lilly's outlook anticipates $89.1 billion in revenue and $34.2 billion in earnings by 2028. This scenario reflects 18.7% annual revenue growth and an increase in earnings of $20.4 billion from the current $13.8 billion.

Uncover how Eli Lilly's forecasts yield a $1003 fair value, a 10% downside to its current price.

Exploring Other Perspectives

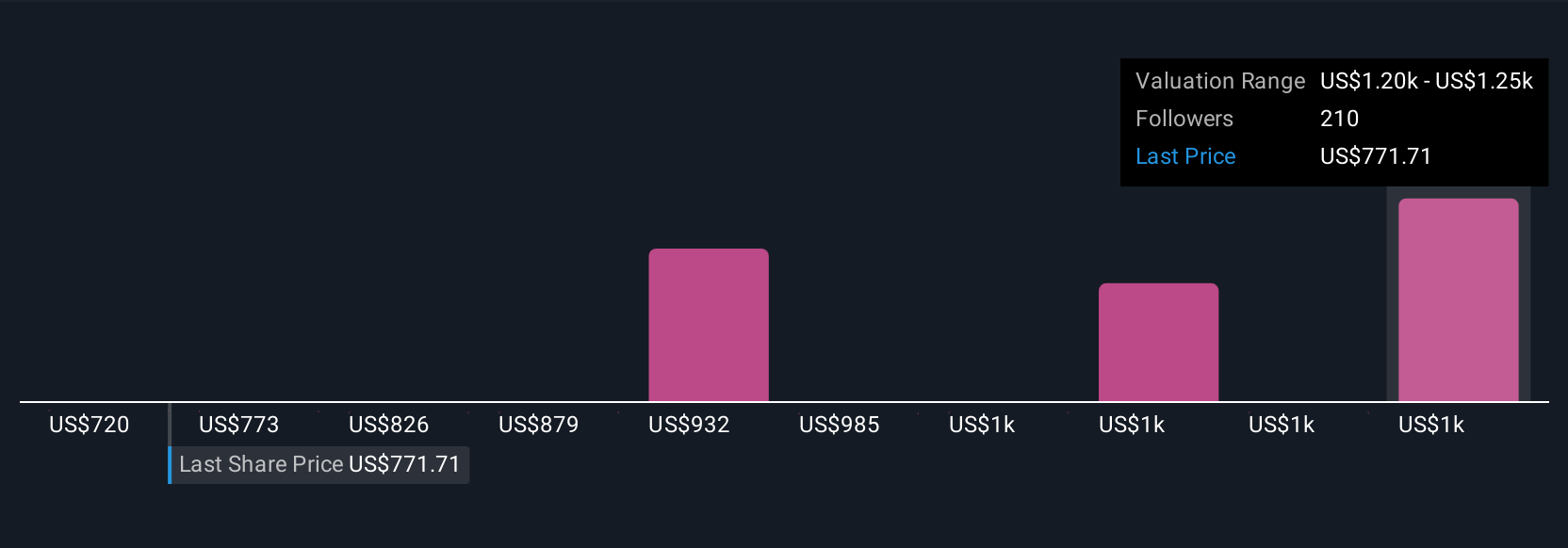

Fair value estimates from 32 Simply Wall St Community members range from US$650 to US$1,270 per share, capturing a spectrum of optimism and caution. With ongoing regulatory and legal scrutiny, broader market expectations can shift as new risks or catalysts emerge, explore these viewpoints before making your next move.

Explore 32 other fair value estimates on Eli Lilly - why the stock might be worth as much as 14% more than the current price!

Build Your Own Eli Lilly Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Eli Lilly research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Eli Lilly research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Eli Lilly's overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eli Lilly might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LLY

Eli Lilly

Eli Lilly and Company discovers, develops, and markets human pharmaceuticals in the United States, Europe, China, Japan, and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success