- United States

- /

- Pharma

- /

- NYSE:LLY

Does Eli Lilly’s Rally After Obesity Drug Breakthrough Leave More Room for Growth in 2025?

Reviewed by Bailey Pemberton

- Wondering if Eli Lilly is fairly priced after its remarkable run? Let's break down what you need to know if you're weighing up your next move.

- Shares leapt 13.8% in the past week and are up 20.2% over the last year, building on an impressive 576.4% gain in five years. This highlights just how much momentum this stock can carry.

- Much of the recent excitement has centered around breakthrough drug approvals and blockbuster demand forecasts, which have sent bullish signals through the market. Headlines highlighting Eli Lilly’s dominance in obesity and diabetes treatments are adding to the discussion, putting the company in the spotlight for long-term growth debates.

- Eli Lilly scores a 2 out of 6 on our valuation framework, meaning it might not appear to be a “bargain” by most traditional checks. There are always nuances to valuation that numbers alone can't tell. Next, we’ll look at different valuation approaches, and there is a smarter way to assess value that you’ll want to stick around for at the end.

Eli Lilly scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Eli Lilly Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by forecasting future cash flows and discounting them back to today’s dollars. This method helps investors gauge what a stock could be worth based on its ability to generate free cash flow over time.

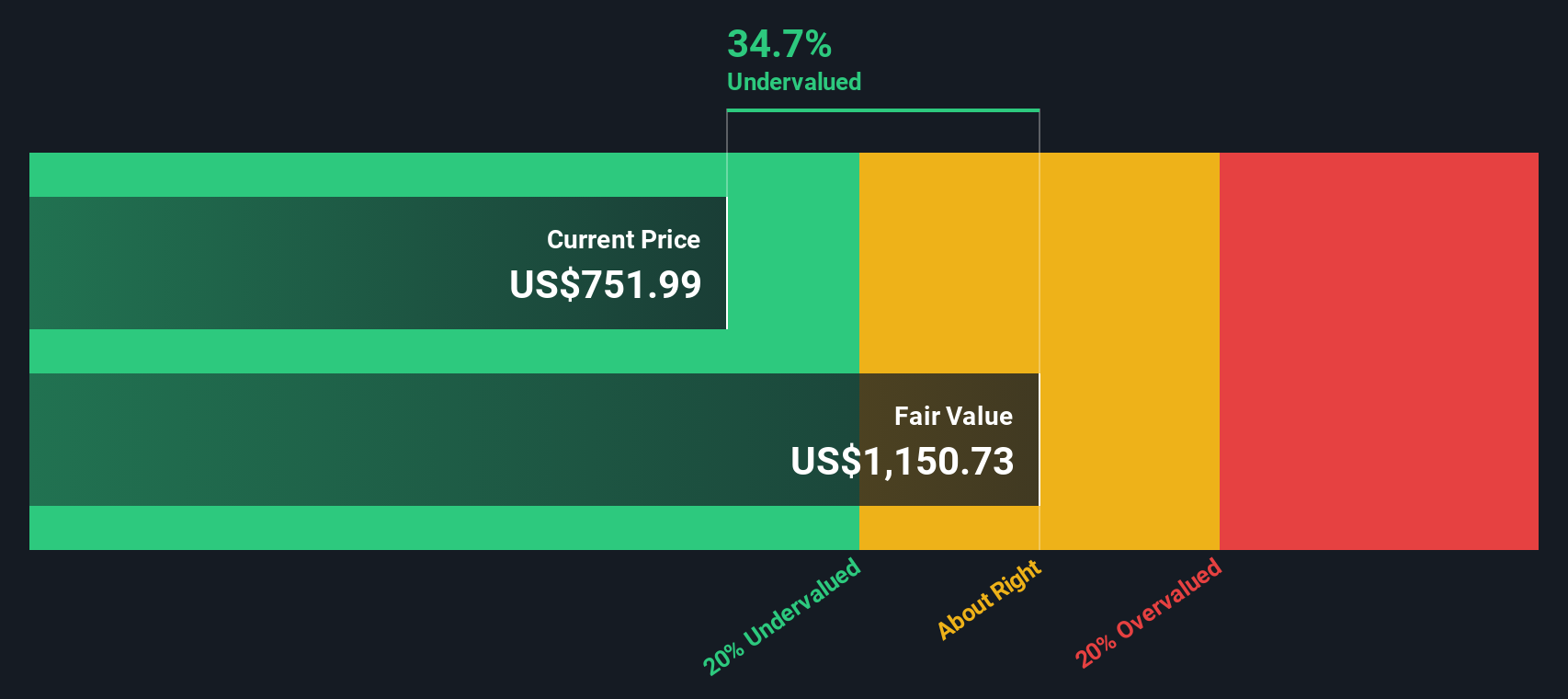

For Eli Lilly, the most recent free cash flow was $6.2 billion. Analysts expect these cash flows to grow rapidly, with projections rising to $36.0 billion by 2029. After the first five years, which are based on direct analyst estimates, the longer-term outlook is extrapolated. This reflects Simply Wall St’s assumptions about the business’ growth trajectory in the following years.

Based on this DCF approach, Eli Lilly’s estimated intrinsic value is $1,226 per share. Given the stock’s current price, this implies the shares are trading at a 24.5% discount to their intrinsic value. In other words, the market may be undervaluing Eli Lilly’s long-term cash-generating potential right now.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Eli Lilly is undervalued by 24.5%. Track this in your watchlist or portfolio, or discover 842 more undervalued stocks based on cash flows.

Approach 2: Eli Lilly Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is a popular way to value profitable companies because it shows how much investors are paying for each dollar of earnings. For stocks that are consistently generating profits, the PE ratio helps measure whether the current share price makes sense relative to those earnings.

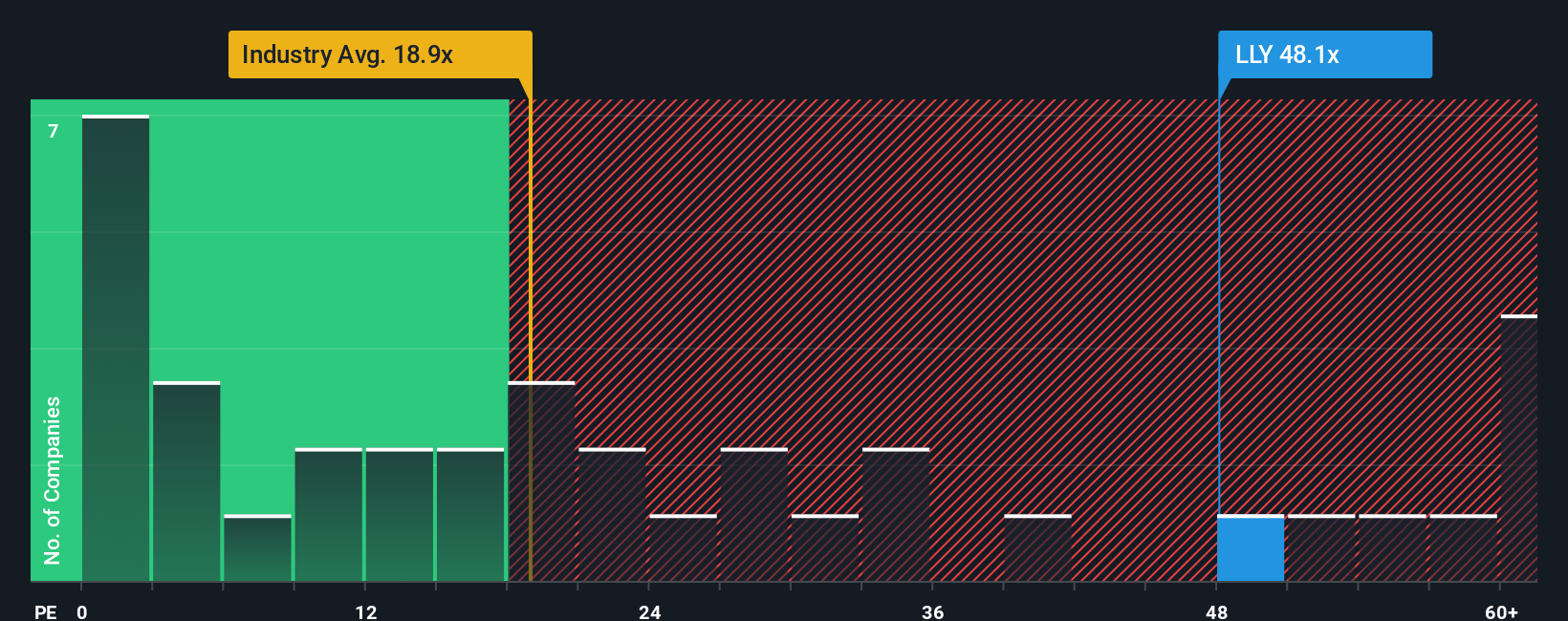

Growth expectations and risk play a key role in what’s considered a reasonable PE ratio. Companies with bigger growth prospects usually command higher PE ratios, while higher risks or uncertainty tend to keep the ratio lower. That means context matters when interpreting these multiples.

Right now, Eli Lilly trades at a PE ratio of 45x, which is well above both the pharmaceutical industry average of 17.8x and the peer average of 14.7x. At a glance, this premium might seem steep. However, using the Simply Wall St Fair Ratio, which adjusts for Eli Lilly’s specific growth outlook, industry, profit margins, size and risk profile, we get a fair value multiple of 42.5x.

The Fair Ratio goes a step further than generic industry or peer comparisons because it blends in those crucial, forward-looking factors. Instead of comparing apples to oranges, you get a benchmark tailored to what’s really shaping Eli Lilly’s value.

Here, Eli Lilly’s actual PE ratio is only a little above its Fair Ratio, suggesting the current price fairly reflects the company’s potential and underlying risks.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1405 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Eli Lilly Narrative

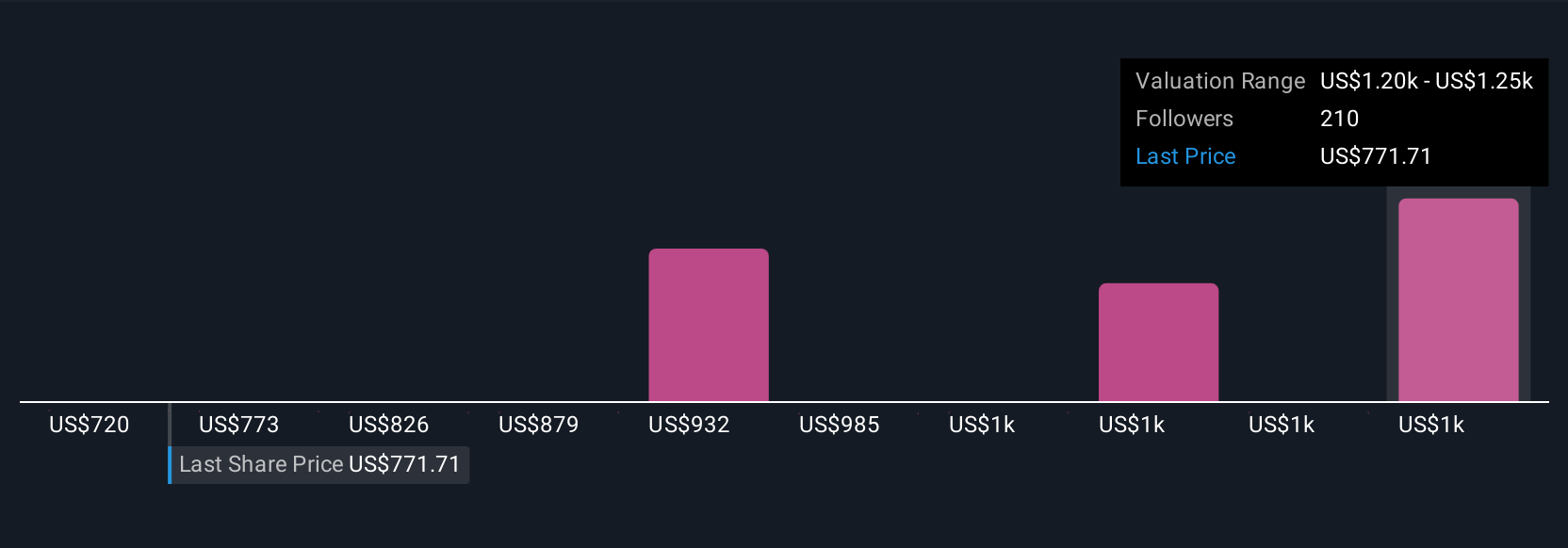

Earlier we mentioned that there is an even better way to understand valuation. Let’s introduce you to Narratives. A Narrative is a story you build about a company by combining your perspective on its outlook, financial assumptions, and forecasts to shape what you believe its fair value should be.

This approach connects the company’s business story, such as blockbuster drug launches or regulatory changes, to a tangible financial forecast and a resulting estimate of fair value. Narratives are easy to create, compare, and update using the Simply Wall St platform’s Community page, where millions of investors share and discuss their own views on companies like Eli Lilly.

With Narratives, you can easily see how fair value estimates change as you adjust growth or margin assumptions, and you can quickly compare your outlook to the current market price to decide if it is the right time to buy or sell. Narratives automatically update when news or new earnings data are released, keeping your analysis current and actionable.

For example, some investors view Eli Lilly’s long patent runway and rapid sales growth as supporting a fair value near $1,200 per share. Others cite pricing pressures and competition to justify estimates closer to $650 per share.

For Eli Lilly, however, we'll make it really easy for you with previews of two leading Eli Lilly Narratives:

- 🐂 Eli Lilly Bull Case

Fair Value: $1,189.18

Currently: 22.2% undervalued

Revenue Growth Rate: 20%

- Growth is driven by blockbuster tirzepatide drugs (Mounjaro and Zepbound), with strong sales momentum and years of patent protection. These are expected to surpass key competitors by 2026.

- Strength in the U.S. market, improving insurance coverage, and only 4% penetration in the GLP-1 addressable market provide a significant runway for further expansion.

- Risks include high drug prices, new competitors in development, potential production bottlenecks, and market pressure if side effects emerge or generics arrive earlier than expected.

- 🐻 Eli Lilly Bear Case

Fair Value: $919.33

Currently: 0.7% overvalued

Revenue Growth Rate: 16.3%

- Rapid growth in obesity and diabetes franchises, major manufacturing expansion, and innovation in new drug categories and digital platforms support a robust outlook. The current share price, however, already incorporates much of this future growth.

- Risks include high reliance on a small number of blockbuster drugs, exposure to policy and pricing pressures, potential for future generic competition, and uncertain reimbursement expansion for obesity treatments.

- The consensus analyst fair value is close to the current market price. Sustaining the upside would require Eli Lilly to grow revenue and margins aggressively while navigating a more competitive and tightly regulated landscape.

Do you think there's more to the story for Eli Lilly? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eli Lilly might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LLY

Eli Lilly

Eli Lilly and Company discovers, develops, and markets human pharmaceuticals in the United States, Europe, China, Japan, and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives