- United States

- /

- Pharma

- /

- NYSE:JNJ

Johnson & Johnson (JNJ) Is Up 5.9% After New FDA Approvals and Positive Phase 3b Data – Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- In November 2025, Johnson & Johnson announced several significant milestones, including FDA approvals for new indications of DARZALEX FASPRO® and CAPLYTA, as well as positive Phase 3b data for TREMFYA® in psoriatic arthritis. These regulatory advances highlight the continuing expansion of Johnson & Johnson's pharmaceutical portfolio across oncology, immunology, and neuropsychiatry.

- Particularly, the approval of DARZALEX FASPRO® as the first treatment for high-risk smoldering multiple myeloma and sustained TREMFYA® data may position Johnson & Johnson as a leader in bringing first-in-class therapies to market for serious and underserved conditions.

- We'll now examine how these advancements, especially the expansion into both immune and neurological diseases, may influence Johnson & Johnson’s longer-term investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Johnson & Johnson Investment Narrative Recap

To be a long-term shareholder in Johnson & Johnson, you need to believe in the company's ability to offset revenue pressures from loss of exclusivity on major drugs, like STELARA, through its expanding pipeline, especially in oncology and immunology. The recent approvals for DARZALEX FASPRO® and CAPLYTA, and positive TREMFYA® data reflect ongoing innovation; however, these developments are not likely to meaningfully change the short-term catalyst, which is how successfully Johnson & Johnson can replace sales lost to biosimilars.

Among these new milestones, the FDA approval of DARZALEX FASPRO® for high-risk smoldering multiple myeloma stands out. This is the first approved therapy in its indication, and it could help strengthen Johnson & Johnson's position in oncology, providing some counterbalance to the anticipated biosimilar impact in immunology.

On the other hand, investors should be aware of persistent risks still facing the company, in particular the ongoing litigation involving...

Read the full narrative on Johnson & Johnson (it's free!)

Johnson & Johnson's narrative projects $104.1 billion revenue and $22.9 billion earnings by 2028. This requires 4.7% yearly revenue growth and a $0.2 billion earnings increase from $22.7 billion today.

Uncover how Johnson & Johnson's forecasts yield a $199.56 fair value, in line with its current price.

Exploring Other Perspectives

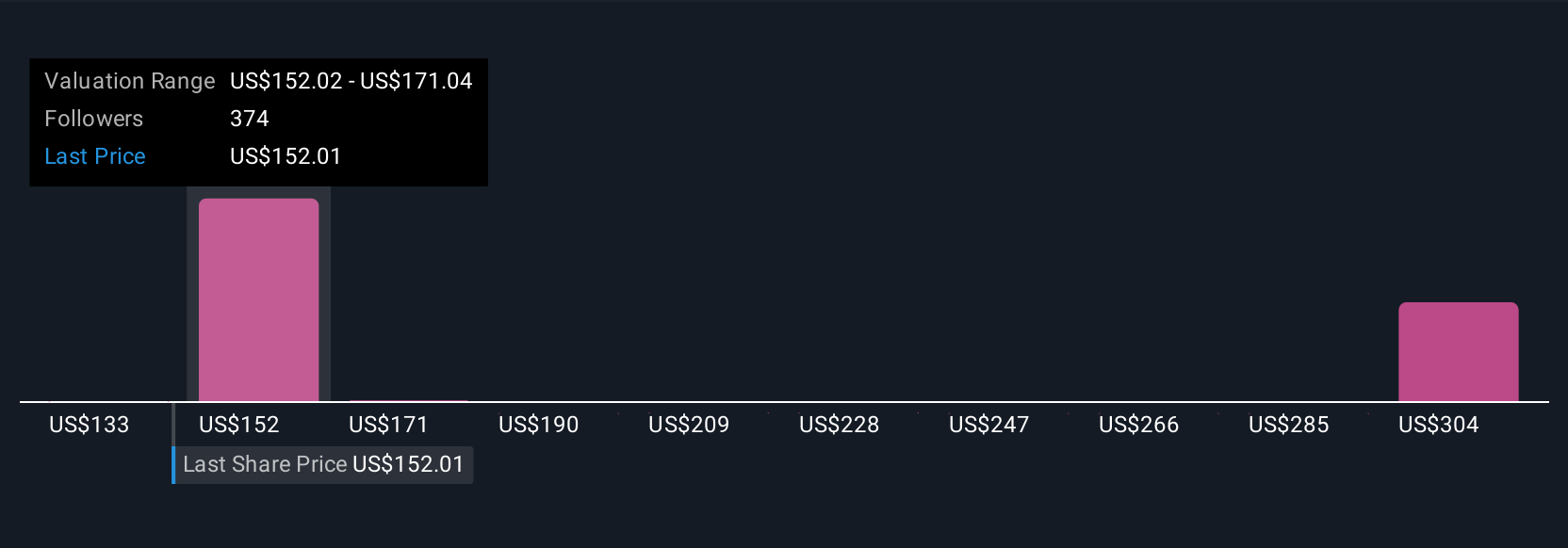

Fair value estimates from 21 members of the Simply Wall St Community range from US$143.62 to US$384.12 per share. While some investors see substantial upside, current analyst consensus points to the near-term challenge of replacing lost STELARA revenue as a focus for future returns.

Explore 21 other fair value estimates on Johnson & Johnson - why the stock might be worth as much as 92% more than the current price!

Build Your Own Johnson & Johnson Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Johnson & Johnson research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Johnson & Johnson research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Johnson & Johnson's overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JNJ

Johnson & Johnson

Engages in the research and development, manufacture, and sale of various products in the healthcare field worldwide.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives