- United States

- /

- Pharma

- /

- NYSE:JNJ

Is Johnson & Johnson’s Recent 5.9% Rise Backed by Its Intrinsic Value in 2025?

Reviewed by Bailey Pemberton

Deciding what to do with Johnson & Johnson stock these days is a lot like weighing your options at a crossroads. From long-time holders to investors peering in for a first look, there’s plenty to consider. Over the past month alone, J&J shares have pushed up 5.9%, making up lost ground after a mild 1.8% slip last week. Longer-term, the growth story shines even brighter, with the stock up a solid 32.1% year-to-date and delivering a 58.2% return over the past five years.

Several factors are fueling these moves. Recent headlines about J&J’s steady progress in separating its consumer health business have helped reshape how investors view the company’s potential, particularly the focus on core pharmaceutical and medical device growth. There has been renewed optimism around the company’s pipeline of new treatments, and sentiment has improved as J&J continues to navigate global health trends with fewer surprises for shareholders. It is these kinds of updates, along with the company’s reputation for resilience, that have market watchers regularly revisiting their valuation of J&J.

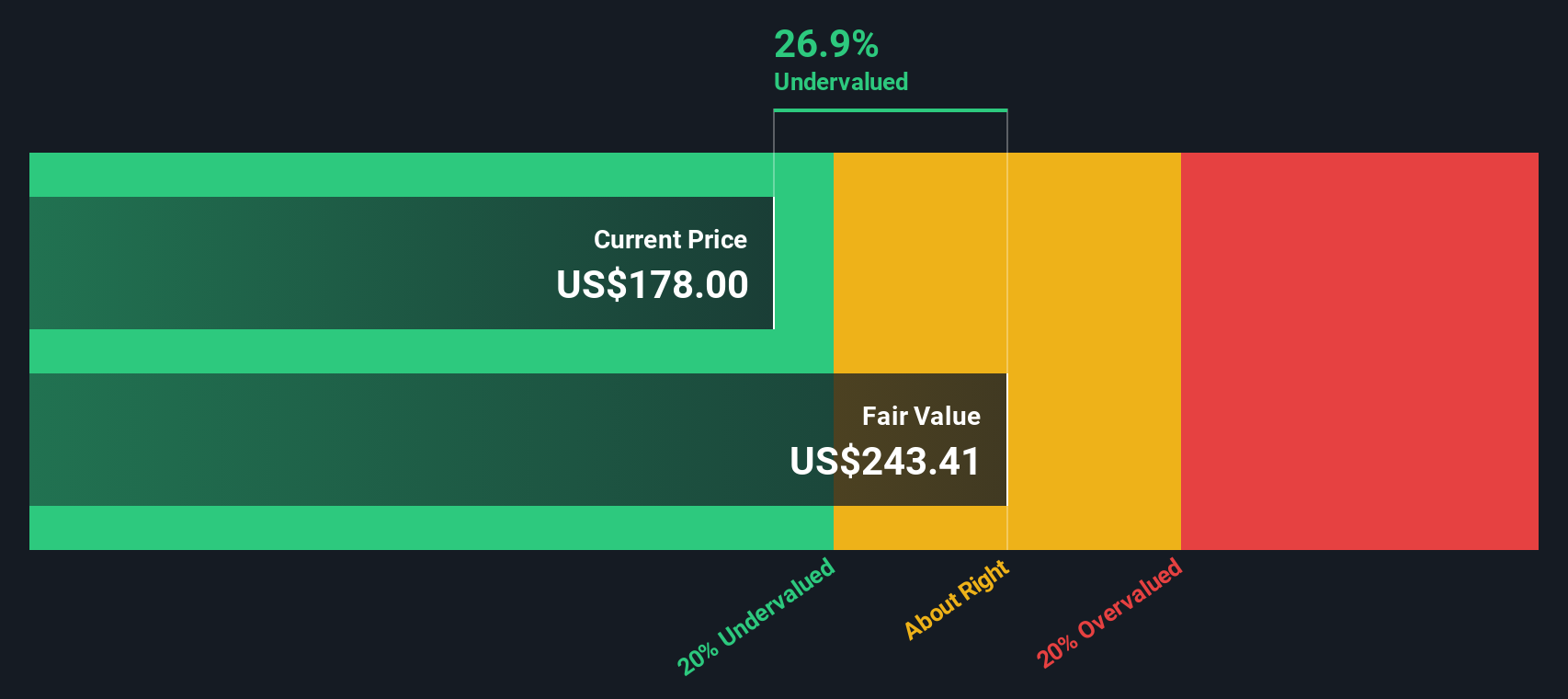

When we step back and look at the numbers, J&J currently scores a 4 out of 6 on major undervaluation checks. That is a strong indicator for investors looking for value in a blue-chip name. But while most folks stop at the surface-level metrics, we’re going deeper. Next up, we'll run through the main valuation methods in detail and then reveal a fresh perspective on how you can really tell if a stock like Johnson & Johnson is worth your attention.

Approach 1: Johnson & Johnson Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to today using a reasonable rate. This approach captures both the company’s current performance and analysts’ views of its long-term prospects.

For Johnson & Johnson, the current Free Cash Flow stands at $19.47 billion. Analyst consensus forecasts, combined with further extrapolation, project FCF reaching $53.98 billion by 2035. Over the next five years, analysts expect FCF growth with projections such as $22.75 billion in 2026, $23.66 billion in 2028, and $35.5 billion in 2029, all amounts in US dollars. Beyond 2029, these estimates are extended to model steady annual increases based on industry assumptions and past company performance.

This DCF projection leads to an estimated intrinsic value of $433.29 per share. According to the latest calculations, Johnson & Johnson stock is trading at a 56.1% discount to this valuation, indicating that the market price is considerably below its estimated worth.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Johnson & Johnson is undervalued by 56.1%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Johnson & Johnson Price vs Earnings

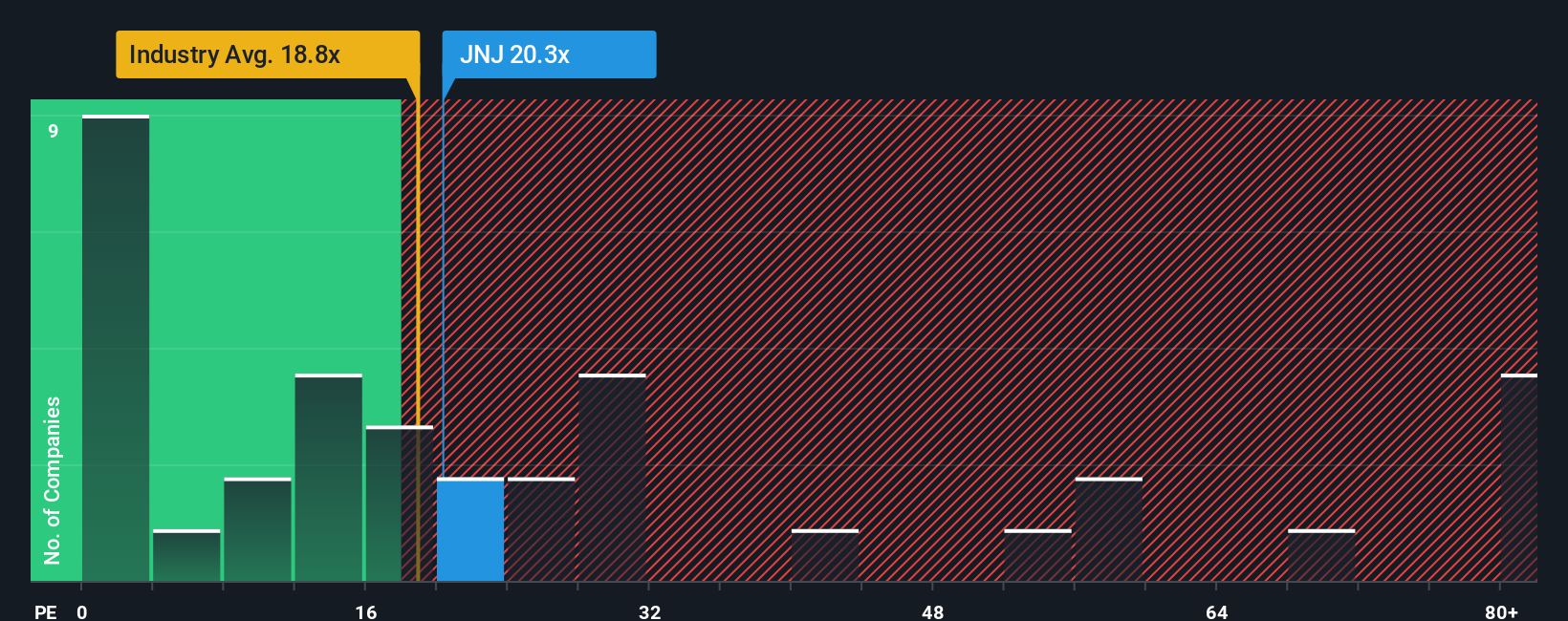

For established, consistently profitable companies like Johnson & Johnson, the Price-to-Earnings (PE) ratio is a reliable metric to gauge whether a stock is sensibly priced. The PE ratio reflects how much investors are willing to pay for each dollar of earnings, and is influenced by expectations for growth and the perceived risk of those future earnings. In general, companies with faster expected earnings growth or lower risks merit a higher PE, while those with lower growth or higher risk tend to trade at lower multiples.

Currently, Johnson & Johnson trades at an 18.2x PE ratio. Compared to its pharmaceutical industry peers, which average 24.4x, and the wider sector's average of roughly 17.5x, J&J sits below its peer group but in line with the broader industry.

Simply Wall St's proprietary "Fair Ratio" digs deeper than peer and industry comparisons. This metric weighs factors like Johnson & Johnson's growth prospects, profit margins, industry trends, market capitalization and risk. With a Fair Ratio of 24.1x, it suggests investors could reasonably pay up for the stock thanks to J&J's strengths and outlook. Because this Fair Ratio accounts for company-specific factors, it is typically a more tailored and accurate benchmark than a broad industry or peer average.

With the actual PE ratio at 18.2x and the Fair Ratio at 24.1x, Johnson & Johnson currently trades well below its fair multiple, implying the stock may be undervalued based on earnings power.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Johnson & Johnson Narrative

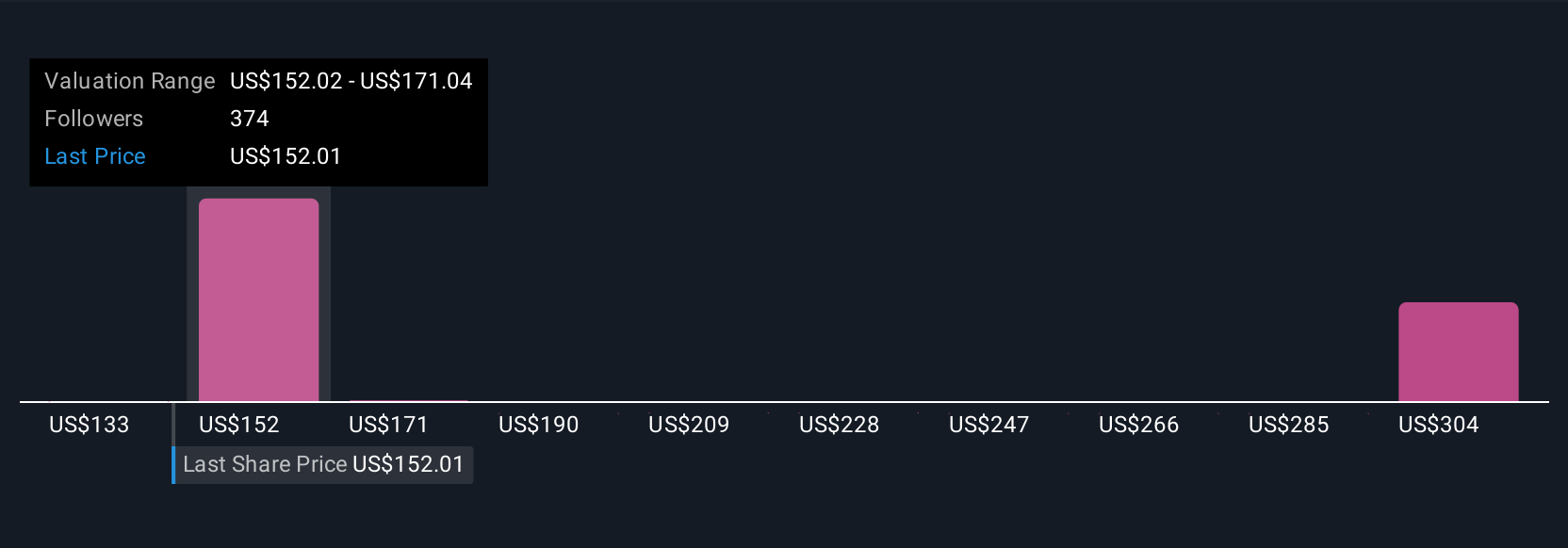

Earlier, we hinted at an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personal story about a company, including the beliefs, context, and assumptions you bring to the numbers. Rather than relying only on preset models, Narratives empower you to connect your outlook for Johnson & Johnson’s business (such as revenue growth, profit margins, or risks) with a financial forecast and see exactly how that story translates into a calculated fair value.

On Simply Wall St’s Community page, millions of investors can easily create and share Narratives for any company, making it an accessible tool for everyone, not just finance pros. Narratives help you decide when to buy or sell by comparing your Fair Value (based on your chosen story and assumptions) to the current market price, and they update dynamically whenever new developments such as earnings, news, or deal announcements come in.

For example, one investor’s optimistic Narrative for Johnson & Johnson might forecast robust drug pipeline growth, high margins, and a fair value above $230 per share. Another might focus on litigation risk and forecast earnings only justifying fair value near $155. Narratives allow you to express your unique view, updating as new facts arrive, so you always have your own evidence-backed answer to “Is this stock worth it right now?”

For Johnson & Johnson, we’ll make it really easy for you with previews of two leading Johnson & Johnson Narratives:

Fair Value: $198.03

Currently undervalued by 4.0%

Forecasted revenue growth: 5.1%

- Analysts expect steady growth in immunology and oncology, driven by next-generation therapies and U.S. investments. This is expected to offset challenges from key patent expirations.

- Strategic moves such as MedTech expansion and high-profile acquisitions are aimed at boosting operational efficiency, future earnings, and long-term margins.

- Key risks include ongoing litigation, tariffs impacting costs, and pipeline execution. However, the consensus is that the stock is close to fair value and fundamentally strong.

Fair Value: $173.55

Currently overvalued by 9.6%

Forecasted revenue growth: 6.3%

- JNJ’s well-diversified drug pipeline and focus on Medical Devices and Pharmaceuticals segments following the Kenvue spin-off position it for higher, though riskier, growth.

- Dividend increases and buybacks appear sustainable given earnings power, but profitability is pressured by litigation and patent expirations.

- Bears highlight the risk that recent legal headwinds and competition could restrain earnings, and current valuation may be ahead of long-term profit delivery.

Do you think there's more to the story for Johnson & Johnson? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JNJ

Johnson & Johnson

Engages in the research and development, manufacture, and sale of various products in the healthcare field worldwide.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives