- United States

- /

- Pharma

- /

- NYSE:JNJ

Is Johnson & Johnson’s Recent 35% Surge Justified by Its 2025 Valuation?

Reviewed by Bailey Pemberton

- Wondering if Johnson & Johnson’s stock is worth your investment dollars? Let’s break down the numbers and see if the price matches the company’s potential.

- After climbing 4.5% in the last week and a steady 35.0% year-to-date, J&J’s share price is catching the attention of growth-focused and value-minded investors alike.

- Recent headlines about Johnson & Johnson’s strategic product launches and big-ticket acquisitions have spurred renewed optimism, fueling these share price moves. The buzz around its expanding pharmaceutical pipeline and presence in the consumer health market is giving many investors reason to stay tuned.

- On our valuation checks, Johnson & Johnson clocks in at a 4 out of 6. However, as we’ll see, there is more to finding value than a simple score. We’ll dig into various valuation methods next and take a deeper look at what this stock may really be worth.

Approach 1: Johnson & Johnson Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a common valuation tool that estimates a company’s worth by forecasting its future cash flows and discounting them back to the present. This gives investors an estimate of what the business is intrinsically worth today, based on its ability to generate cash over time.

For Johnson & Johnson, the current Free Cash Flow stands at $19.5 Billion. Analysts have projected incremental growth in these figures over the next few years, with Free Cash Flow expected to reach approximately $35.5 Billion by the end of 2029. It’s important to note that while analyst estimates cover up to five years, projections beyond that, such as the ten-year outlook here, are extrapolations by Simply Wall St, based on available trends and estimates.

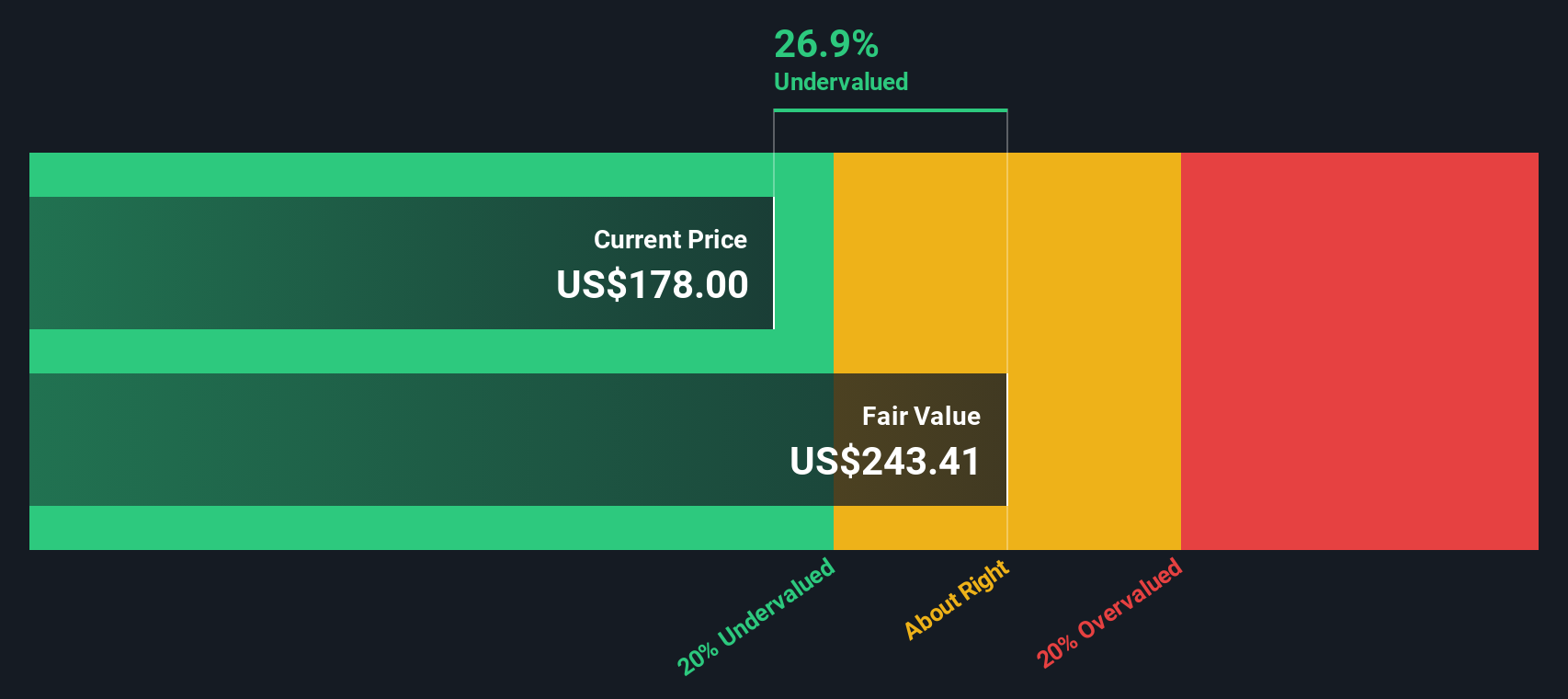

The DCF analysis calculates an intrinsic value of $428.83 per share for Johnson & Johnson. Compared to the company’s current share price, this figure implies the stock is trading at a 54.7% discount. This suggests it could be significantly undervalued if these cash flow expectations prove accurate.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Johnson & Johnson is undervalued by 54.7%. Track this in your watchlist or portfolio, or discover 885 more undervalued stocks based on cash flows.

Approach 2: Johnson & Johnson Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used valuation metric for profitable companies like Johnson & Johnson. It helps investors gauge how much they are paying for one dollar of the company’s earnings, making it a straightforward tool for comparing the value of established businesses with consistent profits.

It is important to remember that what counts as a “normal” or “fair” PE ratio varies depending on several factors. Companies with higher expected earnings growth or perceived stability usually trade at higher multiples, while greater risk or slow growth tends to mean a lower ratio is justified.

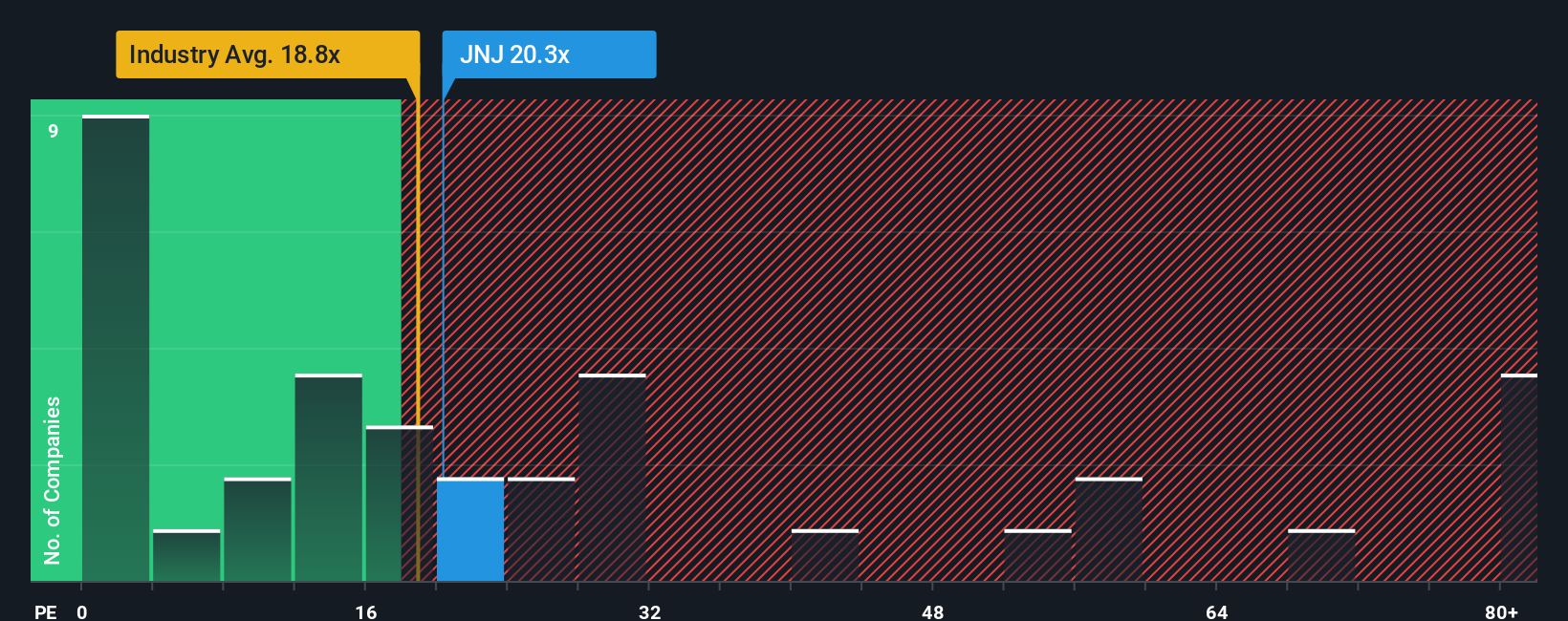

Currently, Johnson & Johnson’s PE ratio stands at 18.64x. This is close to the Pharmaceuticals industry average of 18.14x and below the average of key peers, which sits at 23.24x. However, picking the right benchmark can be tricky, as not all companies in the industry share the same growth prospects, risk profile, or profitability.

This is where Simply Wall St’s “Fair Ratio” comes in. This proprietary metric boils down factors such as a company’s own earnings growth trends, profit margins, market cap, industry, and risk to estimate what its PE ratio should be today. Unlike simple industry or peer comparisons, this approach gives a valuation more tailored to the company’s actual scenario.

For Johnson & Johnson, the Fair Ratio is 26.23x. Since the company’s current PE ratio is substantially lower than this “fair” level, it suggests the stock may be undervalued by this metric and that the market could be underestimating the company’s earning power and prospects.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1403 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Johnson & Johnson Narrative

Earlier, we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personal story about a company, reflecting how you interpret Johnson & Johnson's future by linking your assumptions about its revenue, earnings, and margins to a specific fair value.

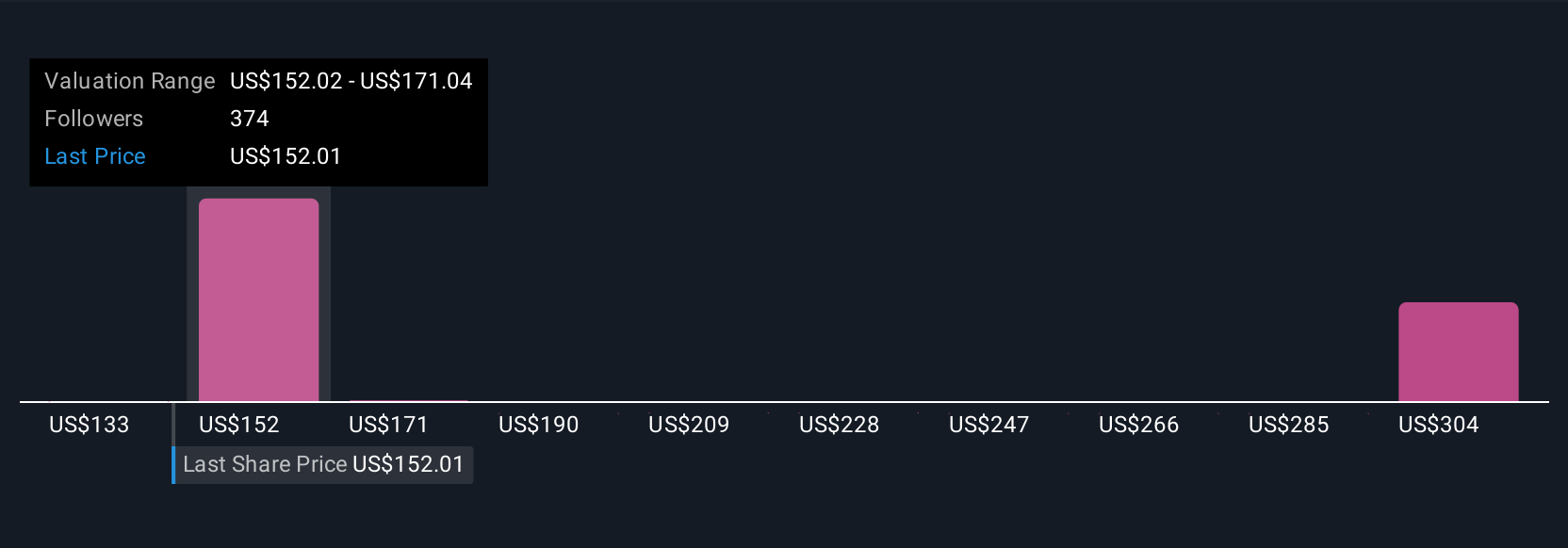

Narratives make the investing process more intuitive by connecting what you know or believe about a company's prospects to financial forecasts and actual market value. Rather than just following scores or ratios, Narratives allow you to map out your perspective, see how it stacks up against others, and make buy or sell decisions by comparing your fair value to the current price.

Simply Wall St puts the power of Narratives in your hands through the Community page, where millions of investors can easily create, share, and update their views as new news or earnings emerge. This ensures your strategy keeps up with real-time developments.

For example, some investors might see Johnson & Johnson’s portfolio expansion and new therapies as signals for robust long-term growth (targeting a fair value above $200). Others, concerned about litigation and drug exclusivity risks, may take a more cautious view (valuing shares closer to $155). Narratives help you clarify your viewpoint and invest with confidence, using more than just numbers to guide your decisions.

Do you think there's more to the story for Johnson & Johnson? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JNJ

Johnson & Johnson

Engages in the research and development, manufacture, and sale of various products in the healthcare field worldwide.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives