- United States

- /

- Pharma

- /

- NYSE:ELAN

Elanco Animal Health (ELAN): $606M One-Off Gain Raises Questions on Earnings Quality Versus Growth Hopes

Reviewed by Simply Wall St

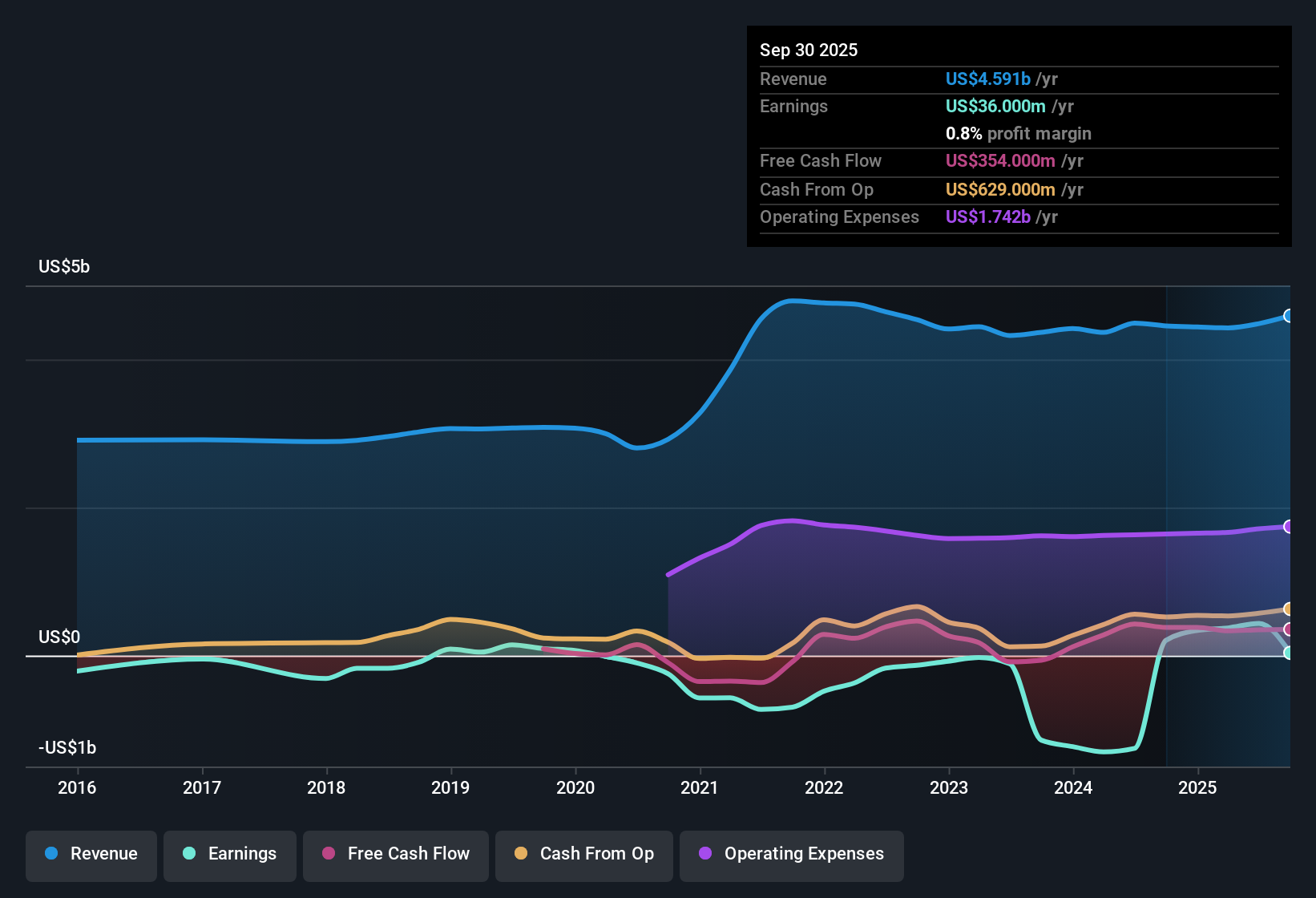

Elanco Animal Health (ELAN) returned to profitability over the last year, with average annual earnings growth of 17.5% over the past five years. There is a dash of optimism as forecast earnings are projected to surge by 40.2% per year moving forward, far above the US market’s 16%. However, revenue growth is expected to lag at 4.4% annually versus the broader market’s 10.5%. The company’s recent $606.0 million one-off gain complicates the story by inflating margins for the period. These headline results point to robust profit momentum, tempered by slower top-line expansion and the reality that this year’s margins may not reflect the company’s core, ongoing performance.

See our full analysis for Elanco Animal Health.The next section takes these numbers and puts them side by side with the prevailing narratives around Elanco at Simply Wall St, highlighting where the results reinforce market expectations and where the story might shift.

See what the community is saying about Elanco Animal Health

Margin Outlook Clouds Profit Growth Story

- Profit margin is forecast to decline sharply from 9.7% today to 3.6% over the next three years, despite average annual earnings growth of 17.5% and much faster growth forecast at 40.2% per year.

- According to the analysts' consensus view, Elanco must maintain margin discipline while supporting investments in product launches and geographic expansion.

- The path to improved margins depends on successful execution of new product launches and ongoing efficiency improvements from 2026 onward.

- Analysts caution that recent margin strength is inflated by a $606 million one-off gain, so operationally, true profitability may be weaker than it appears right now.

- The rapid drop in forecast margins makes headline growth less reflective of core operating improvements. Consensus warns investors not to overstate current margin health.

Consensus views the shrinking profit margin as a real test for Elanco’s next phase, where execution on innovation and expense control will drive the story.

📊 Read the full Elanco Animal Health Consensus Narrative.

Debt Reduction Unlocks Investment Power

- Elanco’s strategy includes divesting non-core businesses like its Aqua division, which has enabled tangible debt reduction and increased investment capacity for core product innovation.

- Consensus narrative highlights:

- Debt reduction lowers net leverage and frees up resources for R&D and strategic market launches, which is crucial for pursuing forecasted constant currency revenue growth of 4% to 6% per year.

- Success of blockbuster product launches directly impacts Elanco’s ability to improve net margins and financial stability, according to analysts tracking the company’s evolving risk profile.

Valuation Gap Versus Peers Narrows

- Elanco trades at a price-to-earnings ratio of 24.7x, noticeably below the peer average of 33.4x, but higher than the US pharmaceuticals industry's average of 17.7x. Its share price sits at $21.60, compared to a DCF fair value estimate of $31.40.

- The consensus narrative underscores that analysts' average price target (rounded as per instructions to $21.55) sits nearly flat relative to the latest share price, signaling that most market watchers see Elanco as fairly valued in the short term.

- The modest 4.6% premium between current price and target reflects confidence in profit growth, but also recognizes persistent execution and margin risks flagged by consensus.

- Analysts highlight divergent valuation lenses. Elanco commands a growth premium to the sector, but only if it delivers on ambitious innovation and efficiency claims detailed in their scenario analysis.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Elanco Animal Health on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Looking at these results from another angle? Share your unique take and shape the discussion in just a few minutes by participating—Do it your way

A great starting point for your Elanco Animal Health research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Despite solid earnings growth, Elanco faces persistent margin pressures and must manage significant debt reduction while executing on ambitious expansion plans.

If you want steadier performance and less financial uncertainty, prioritize companies built for resilience by using our solid balance sheet and fundamentals stocks screener (1979 results) to spot stronger balance sheets and lower risk profiles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Elanco Animal Health might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ELAN

Elanco Animal Health

An animal health company, innovates, develops, manufactures, and markets products for pets and farm animals worldwide.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives