- United States

- /

- Pharma

- /

- NYSE:ELAN

Could FDA Nod for Credelio CAT Nudge Elanco Animal Health’s (ELAN) Competitive Edge in Feline Care?

Reviewed by Sasha Jovanovic

- Elanco Animal Health recently received Emergency Use Authorization from the U.S. FDA for Credelio CAT to treat New World screwworm infestations in cats, marking the first approval of its kind for felines in the country.

- This regulatory milestone highlights an emerging focus on innovative solutions in companion animal care, where cats traditionally have had fewer approved treatment options than dogs.

- We'll examine how Elanco's progress in feline health innovation may influence its growth prospects and ongoing investment thesis.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

Elanco Animal Health Investment Narrative Recap

To be a shareholder in Elanco Animal Health, you need to believe in the company’s ability to drive growth through constant product innovation in companion animal health, while executing operationally amid headwinds. The recent FDA Emergency Use Authorization for Credelio CAT expands Elanco’s feline solutions portfolio, but it does not materially change near-term catalysts, which remain the adoption pace of its broader innovation pipeline, nor does it shift the most pressing risk, managing increased sales and marketing costs as new products launch.

Among recent announcements, the FDA approval of Credelio Quattro for new tick-borne disease indications stands out in context, as both developments reinforce Elanco’s focus on innovation-led expansion in companion animal health. These moves support the company’s key growth catalyst: building a robust innovation pipeline that can deliver sustained revenue gains, while the challenge will be efficiently scaling adoption and supporting profitability through disciplined execution.

By contrast, investors should be aware of the immediate margin pressure from elevated operating expenses as Elanco pushes to...

Read the full narrative on Elanco Animal Health (it's free!)

Elanco Animal Health's narrative projects $5.1 billion in revenue and $186.7 million in earnings by 2028. This requires 4.5% annual revenue growth and a $247.3 million decrease in earnings from the current $434.0 million.

Uncover how Elanco Animal Health's forecasts yield a $24.08 fair value, a 3% upside to its current price.

Exploring Other Perspectives

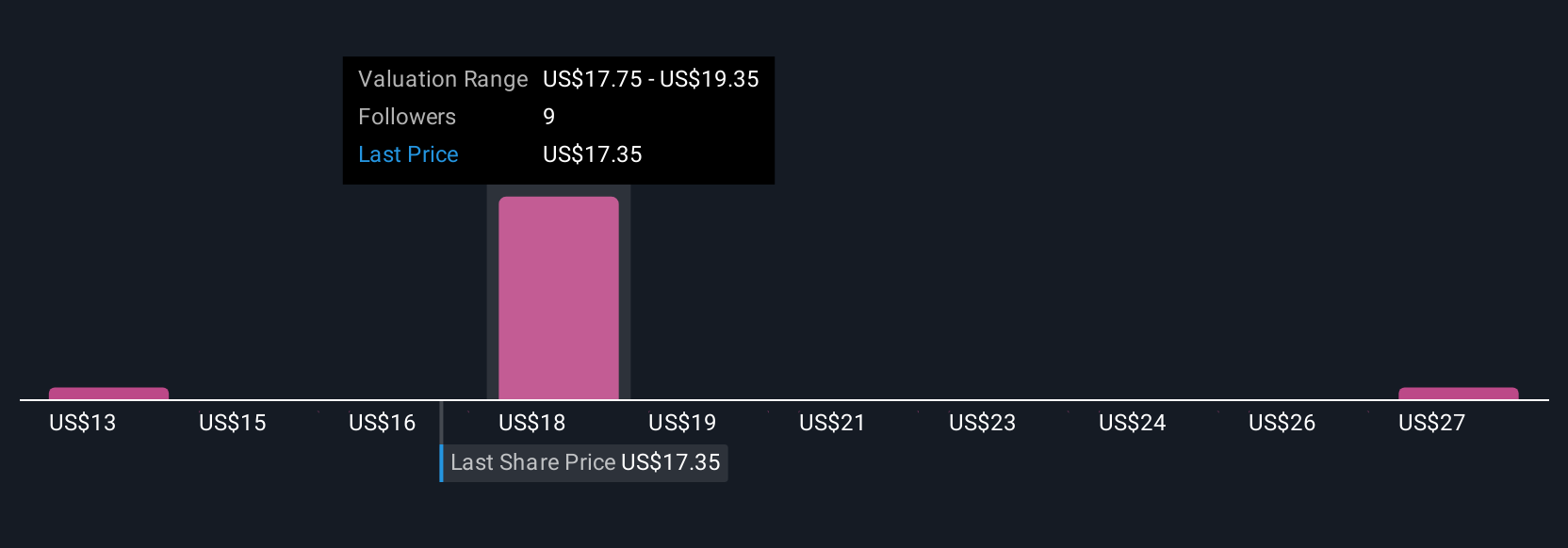

Simply Wall St Community fair value estimates for Elanco range from US$24.08 to US$30.64 across two individual perspectives. In light of continued product innovation as a growth driver, you may find diverse views on what this could mean for long-term performance.

Explore 2 other fair value estimates on Elanco Animal Health - why the stock might be worth just $24.08!

Build Your Own Elanco Animal Health Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Elanco Animal Health research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Elanco Animal Health research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Elanco Animal Health's overall financial health at a glance.

Want Some Alternatives?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Elanco Animal Health might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ELAN

Elanco Animal Health

An animal health company, innovates, develops, manufactures, and markets products for pets and farm animals worldwide.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success