- United States

- /

- Pharma

- /

- NYSE:ELAN

A Closer Look at Elanco Animal Health’s Valuation Following Major Debt Refinance and Product Expansion

Reviewed by Simply Wall St

Elanco Animal Health (NYSE:ELAN) just made a strategic move by refinancing a substantial portion of its debt. The company has secured new USD and euro loans that extend maturities into 2032. This step could enhance the company's financial flexibility moving forward.

In addition, Elanco recently expanded the labels for its leading canine parasiticides to address growing concerns around tick-borne diseases in pets and people. These twin developments have put the company in the spotlight for many investors this week.

See our latest analysis for Elanco Animal Health.

Elanco’s string of positive updates, from refinancing its debt to major label expansions for its flagship pet health products, seems to be energizing investor sentiment. Momentum in the share price has built strongly, with a 1-month return of 10.7% and a hefty year-to-date share price gain of nearly 90%. Looking at the bigger picture, Elanco’s total shareholder return over the past year sits at nearly 82%, a major swing compared to its multiyear underperformance.

If news around Elanco’s progress caught your attention, you might want to see what other healthcare leaders are making headlines — See the full list for free.

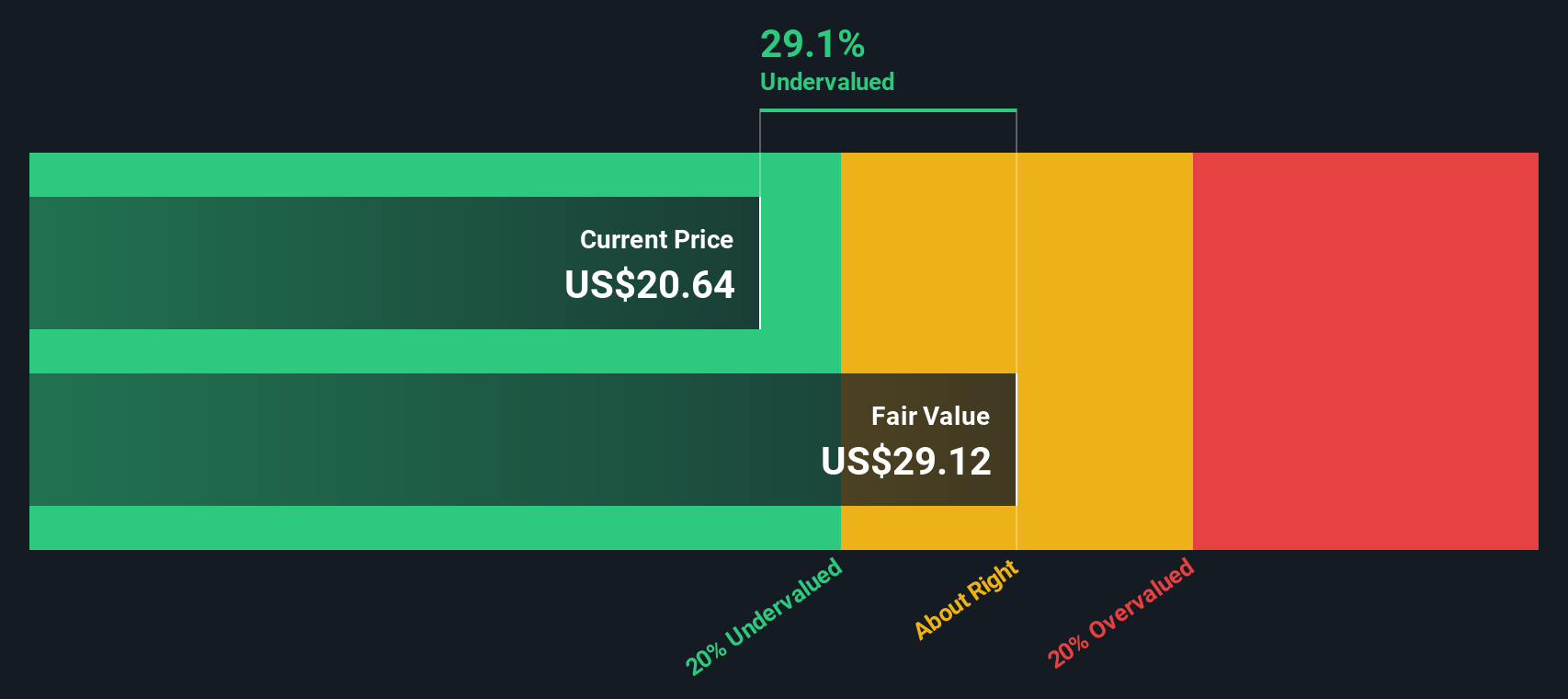

With share price momentum near 90% year-to-date and new strategic advances under its belt, the question now is whether Elanco Animal Health's stock still trades at an attractive valuation or if future growth is already fully priced in.

Most Popular Narrative: 7.9% Overvalued

With Elanco Animal Health’s widely followed narrative assigning a fair value below the current share price, the market appears ahead of consensus expectations, raising questions about the sustainability of this optimism. The fair value calculation uses a discount rate of 6.78%, closely linking price to detailed forecasts for growth, margins, and risk.

Operational focus on strategic product launches and divesting non-core businesses such as the Aqua division has enabled debt reduction and increased investment capacity. This is expected to improve net margins and financial stability. Elanco's strategic focus on leveraging their diversified portfolio and geographic expansion, particularly in key growth markets, is anticipated to maintain balanced revenue growth across both pet health and farm animal markets.

How exactly do product launches and geographic bets fuel such a punchy valuation? What hidden assumptions about future margin shifts are sparking analyst optimism? Find out which bold financial projections have captivated the consensus—read beyond the headlines and see what’s really driving the numbers.

Result: Fair Value of $21.18 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, potential setbacks such as foreign exchange headwinds or challenges in the rapid adoption of new products could quickly dull current optimism around Elanco's outlook.

Find out about the key risks to this Elanco Animal Health narrative.

Another View: Discounted Cash Flow Sheds New Light

While analyst targets suggest Elanco is overvalued, our SWS DCF model points in the opposite direction. According to this cash flow-based method, the stock actually trades 27% below its estimated fair value of $31.40. This raises the question of whether the market is overlooking potential long-term cash flow.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Elanco Animal Health for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 843 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Elanco Animal Health Narrative

If you have your own take or want to dig deeper into the numbers, you can build a unique narrative in just minutes. Do it your way

A great starting point for your Elanco Animal Health research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don't settle for just one opportunity when smarter choices are right at your fingertips. Make your next move confidently and see what you could be missing right now.

- Spot companies with strong cash flows and potential for future gains by using these 843 undervalued stocks based on cash flows to help uncover the market’s hidden bargains.

- Capture the future of medicine and innovation by checking out these 33 healthcare AI stocks, where medical breakthroughs and AI breakthroughs meet real investment potential.

- Boost your portfolio’s income with stability by starting with these 18 dividend stocks with yields > 3% featuring high-yield stocks that can strengthen your returns over time.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Elanco Animal Health might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ELAN

Elanco Animal Health

An animal health company, innovates, develops, manufactures, and markets products for pets and farm animals worldwide.

Fair value with low risk.

Similar Companies

Market Insights

Community Narratives