- United States

- /

- Biotech

- /

- NYSE:EBS

Benign Growth For Emergent BioSolutions Inc. (NYSE:EBS) Underpins Stock's 31% Plummet

The Emergent BioSolutions Inc. (NYSE:EBS) share price has fared very poorly over the last month, falling by a substantial 31%. Of course, over the longer-term many would still wish they owned shares as the stock's price has soared 132% in the last twelve months.

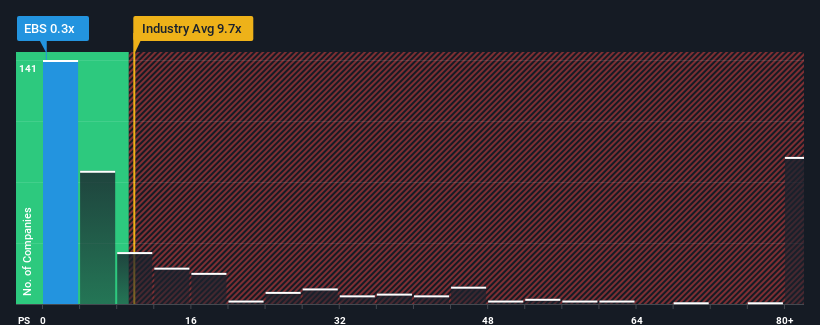

Following the heavy fall in price, Emergent BioSolutions' price-to-sales (or "P/S") ratio of 0.3x might make it look like a strong buy right now compared to the wider Biotechs industry in the United States, where around half of the companies have P/S ratios above 9.8x and even P/S above 55x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

See our latest analysis for Emergent BioSolutions

How Emergent BioSolutions Has Been Performing

Emergent BioSolutions could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Want the full picture on analyst estimates for the company? Then our free report on Emergent BioSolutions will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Emergent BioSolutions' to be considered reasonable.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. Whilst it's an improvement, it wasn't enough to get the company out of the hole it was in, with revenue down 41% overall from three years ago. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue should grow by 7.5% each year over the next three years. Meanwhile, the rest of the industry is forecast to expand by 141% each year, which is noticeably more attractive.

With this in consideration, its clear as to why Emergent BioSolutions' P/S is falling short industry peers. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What Does Emergent BioSolutions' P/S Mean For Investors?

Shares in Emergent BioSolutions have plummeted and its P/S has followed suit. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Emergent BioSolutions' analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

You should always think about risks. Case in point, we've spotted 1 warning sign for Emergent BioSolutions you should be aware of.

If these risks are making you reconsider your opinion on Emergent BioSolutions, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Emergent BioSolutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:EBS

Emergent BioSolutions

A life sciences company, provides preparedness and response solutions for accidental, deliberate, and naturally occurring public health threats in the United States.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026