- United States

- /

- Life Sciences

- /

- NYSE:DHR

Danaher’s 19.6% Rally Sparks Debate After Portfolio Moves and Diagnostics Growth in 2025

Reviewed by Bailey Pemberton

If you have been eyeing Danaher stock lately and wondering what to do next, you are certainly not alone. It is one of those names that frequently finds itself at the center of investor debates, especially after sharp price swings. Over the last month, Danaher has bounced back with an impressive 19.6% gain, recouping much of the ground lost earlier this year. In a shorter timeframe, just in the past week, the stock is up another 6.1%. Despite those recent gains, the year-to-date total return is still down by 3.8%, and the one-year numbers sit at a negative 8.9%. Clearly, the sentiment around Danaher has swung back and forth, and sharp reversals like these are often sparked by major catalysts or a shift in investor risk appetite.

Recent headlines have provided fresh context for these moves. Danaher’s ongoing portfolio reshaping and continued innovation in its diagnostics and life sciences segments have made waves in the industry. While the news has not presented a single overwhelming shift, there is a growing consensus that the company is stabilizing in core markets. This could explain some of that renewed optimism among investors. From a valuation perspective, however, the picture is more complex. Danaher currently clocks in with a value score of 1 out of 6. That means it only meets one out of six key undervaluation metrics, so it is a mixed bag for bargain hunters.

Of course, digging into valuation is never as simple as checking a scorecard. Let’s take a closer look at the different valuation methods investors are using right now, and stay tuned for a discussion of one often-overlooked approach that could change the way you see Danaher’s true value.

Danaher scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

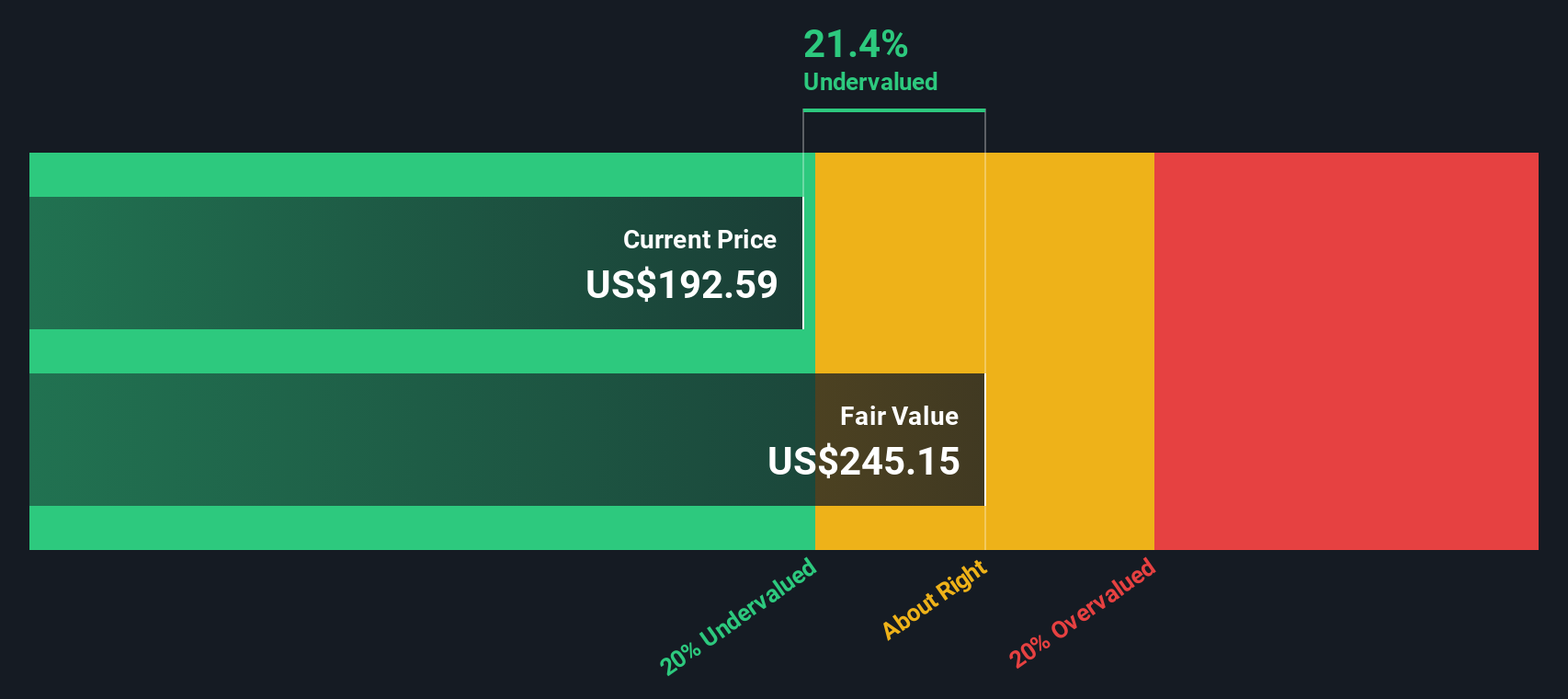

Approach 1: Danaher Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s value by projecting its future cash flows and discounting them back to today's value. For Danaher, the model begins with a look at its current Free Cash Flow, which stands at approximately $5.0 billion. Analysts forecast growing cash flows over the next five years. After this period, further forecasts are extrapolated. By the year 2028, projections show Danaher's free cash flow reaching roughly $7.0 billion. The ten-year outlook extends even higher as growth is gradually tempered in the model.

The DCF model used here is a 2 Stage Free Cash Flow to Equity approach. This reflects both near-term analyst expectations and longer-term, more moderate growth. After discounting these future flows to present value, the model arrives at an estimated intrinsic value of $233.27 per share. This suggests Danaher is trading at around a 5.3% discount compared to its fundamental cash flow value.

With a discount this narrow, the numbers point to Danaher being valued about in line with its long-term cash generating potential.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out Danaher's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

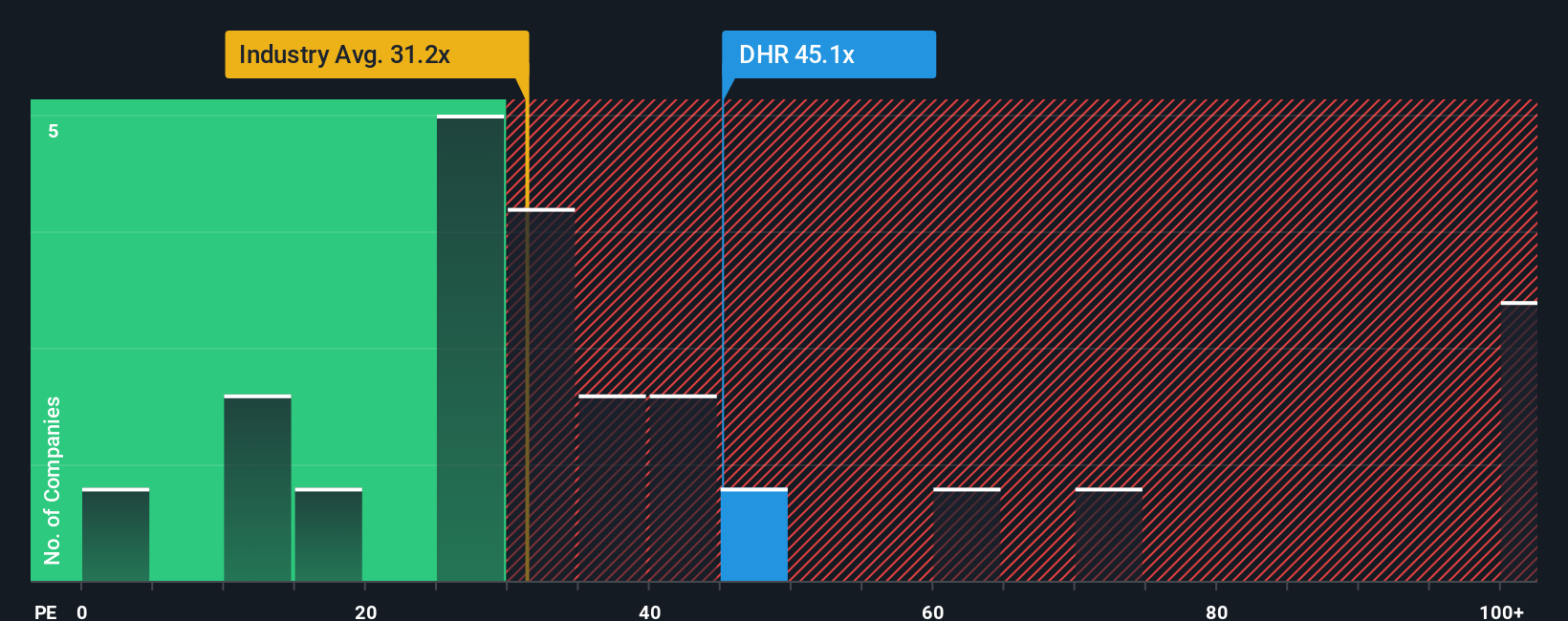

Approach 2: Danaher Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is widely regarded as a go-to valuation tool for profitable companies like Danaher. Since Danaher is generating consistent earnings, the PE multiple provides a direct, intuitive way to gauge how much investors are willing to pay today for each dollar of current earnings.

However, using the PE ratio in isolation can be misleading. Growth prospects and risk profiles matter; companies expected to grow rapidly, or those with particularly stable earnings, often justify higher PE ratios. Conversely, companies facing headwinds or elevated risks should trade at a discount to sector norms.

Danaher trades at a PE of 44.6x. For context, the industry average among Life Sciences peers is 34.1x, and Danaher’s direct peer group sits at 32.9x. On the surface, that premium suggests the market expects Danaher to deliver better-than-average growth or stability.

But what should a fair multiple really be? Simply Wall St's proprietary "Fair Ratio" steps in here, taking into account Danaher’s earnings growth projections, risk profile, profit margins, industry dynamics, and its market cap. Unlike simple peer or industry comparisons, the Fair Ratio method adapts to company-specific factors that matter most for long-term value.

For Danaher, the Fair Ratio is estimated to be 29.0x. With Danaher’s actual PE at 44.6x, that is well above what is justified by its underlying fundamentals and risks, according to this analysis. This suggests the stock is currently priced at a notable premium, and investors should be cautious about paying such a high multiple without a clear, accelerating growth story.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Danaher Narrative

Earlier, we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives. A Narrative is more than just a set of numbers; it is the story you believe about a company, your view on where it’s headed, why, and what it is worth. Narratives let you connect your expectations for Danaher’s future revenue, profit margins, and risks to a dynamic financial forecast, producing an estimated fair value that is uniquely yours.

Narratives are an easy, accessible tool available on Simply Wall St's Community page, trusted by millions of investors. By creating or reviewing Narratives, you can instantly see whether Danaher’s fair value, based on your story, is above or below today’s price. This gives you a clearer signal on when to buy or sell based on your convictions, not just consensus opinion.

Best of all, Narratives update automatically as new news or earnings are released, so your view is always in sync with the latest developments. For example, some investors see Danaher’s premium valuation as justified given strong recurring revenue and its leadership in diagnostics, resulting in high estimates. Others focus on sector headwinds and assign considerably lower fair values. In short, Narratives help you move from debating analyst targets to taking control of your own investment case, with evidence and forecasts that evolve alongside the business.

Do you think there's more to the story for Danaher? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DHR

Danaher

Designs, manufactures, and markets professional, medical, research, and industrial products and services in the United States, China, and internationally.

Excellent balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives