- United States

- /

- Life Sciences

- /

- NYSE:DHR

Danaher (DHR): Examining Valuation as Shares Decline 12% Year-to-Date

Reviewed by Kshitija Bhandaru

See our latest analysis for Danaher.

Danaher's share price has slipped nearly 12% year-to-date and logged a 1-year total shareholder return of -24.7%. While short-term moves have been choppy, recent selling suggests investors may be reassessing risk, even as long-term fundamentals remain in focus.

If you're curious about what else is attracting attention, now is a great time to broaden your horizons and discover fast growing stocks with high insider ownership

With Danaher's share price down and trading at a notable discount to analyst targets, the key question for investors is clear: does this create a genuine buying opportunity, or is the market already factoring in all future growth?

Most Popular Narrative: 17.2% Undervalued

Danaher’s last close at $202.46 sits well below the most widely followed narrative fair value of $244.50, hinting at a potential opportunity if the underlying assumptions hold up. This sets the stage for a look into what is fueling this optimism.

The sustained advancement of precision medicine and personalized therapies, including new AI-assisted diagnostic solutions and groundbreaking launches in genomics (like support for in vivo CRISPR therapies), positions Danaher's technology portfolio to capture higher-margin growth and drive long-term EBITDA expansion.

Want to know what is driving this bold price target? The narrative hinges on transformative healthcare trends, some ambitious profit projections, and a future multiple that is in rare territory. Ever wondered what ambitious assumptions analysts are embedding into their outlook? Dive in to discover the unexpected elements behind this fair value calculation.

Result: Fair Value of $244.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent trade tensions or shifting reimbursement policy in China could quickly put pressure on Danaher’s revenue growth and margins and alter this outlook.

Find out about the key risks to this Danaher narrative.

Another View: The Market’s Multiple

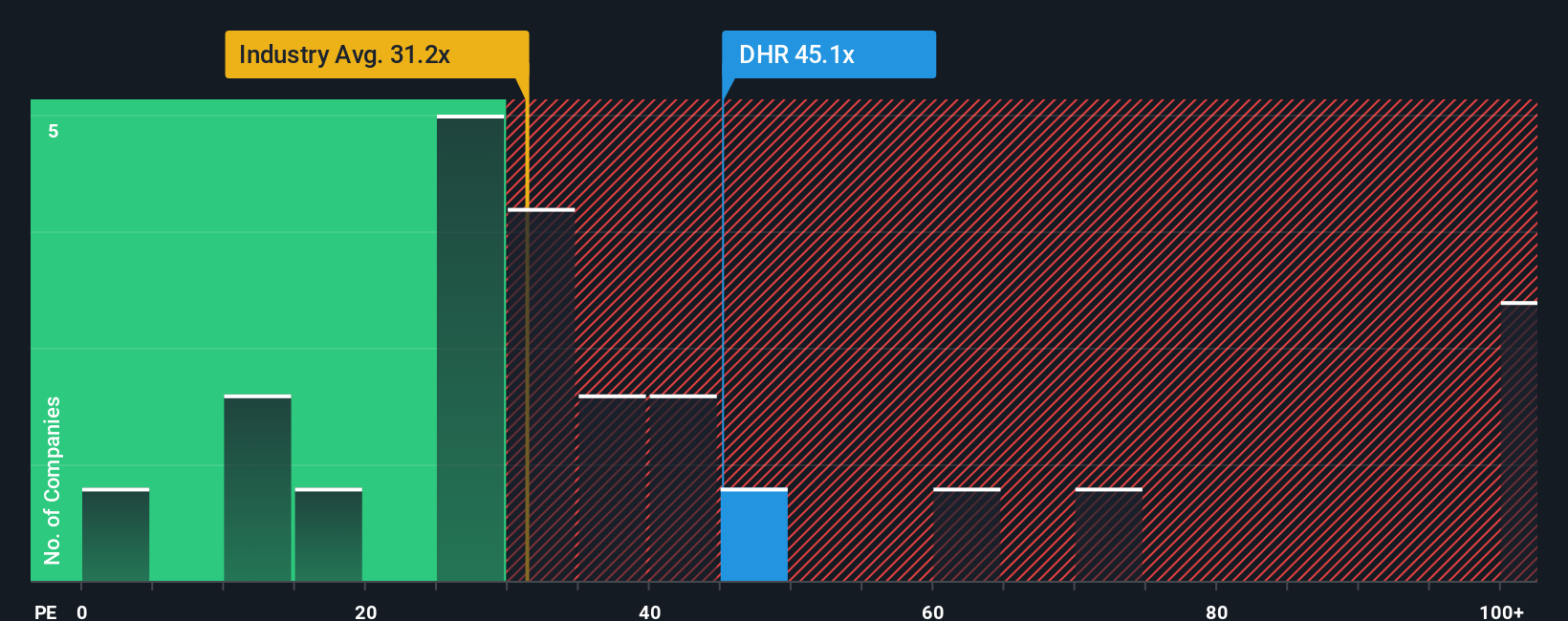

Shifting focus from future cash flows to today’s market multiples paints a different picture. Compared to industry peers, Danaher’s price-to-earnings ratio stands well above average at 42.5x, versus 31.7x for the sector, and against a fair ratio of just 27.9x. This premium raises the risk that the current share price could move lower if growth fails to meet the market’s optimistic assumptions. Could the stock still live up to its high expectations?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Danaher Narrative

If you have a different perspective or want to analyze the numbers yourself, it’s quick and easy to craft your own view from scratch. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Danaher.

Looking for More Investment Ideas?

Great investors know that one smart move often leads to another. Don’t miss these exceptional opportunities. Expand your horizons and give your portfolio a powerful edge with fresh, high-potential stock ideas right now.

- Tap into tomorrow’s technology by checking out these 24 AI penny stocks making waves across industries with artificial intelligence breakthroughs and disruptive solutions.

- Boost your passive income stream and unlock yields with these 19 dividend stocks with yields > 3% steadily rewarding shareholders every year.

- Seize undervalued opportunities overlooked by the crowd and find real bargains using these 898 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DHR

Danaher

Designs, manufactures, and markets professional, medical, research, and industrial products and services in the United States, China, and internationally.

Excellent balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives