- United States

- /

- Life Sciences

- /

- NYSE:CRL

Charles River Labs (CRL): Ongoing Losses Challenge Bullish Narrative Despite Forecasted Earnings Growth

Reviewed by Simply Wall St

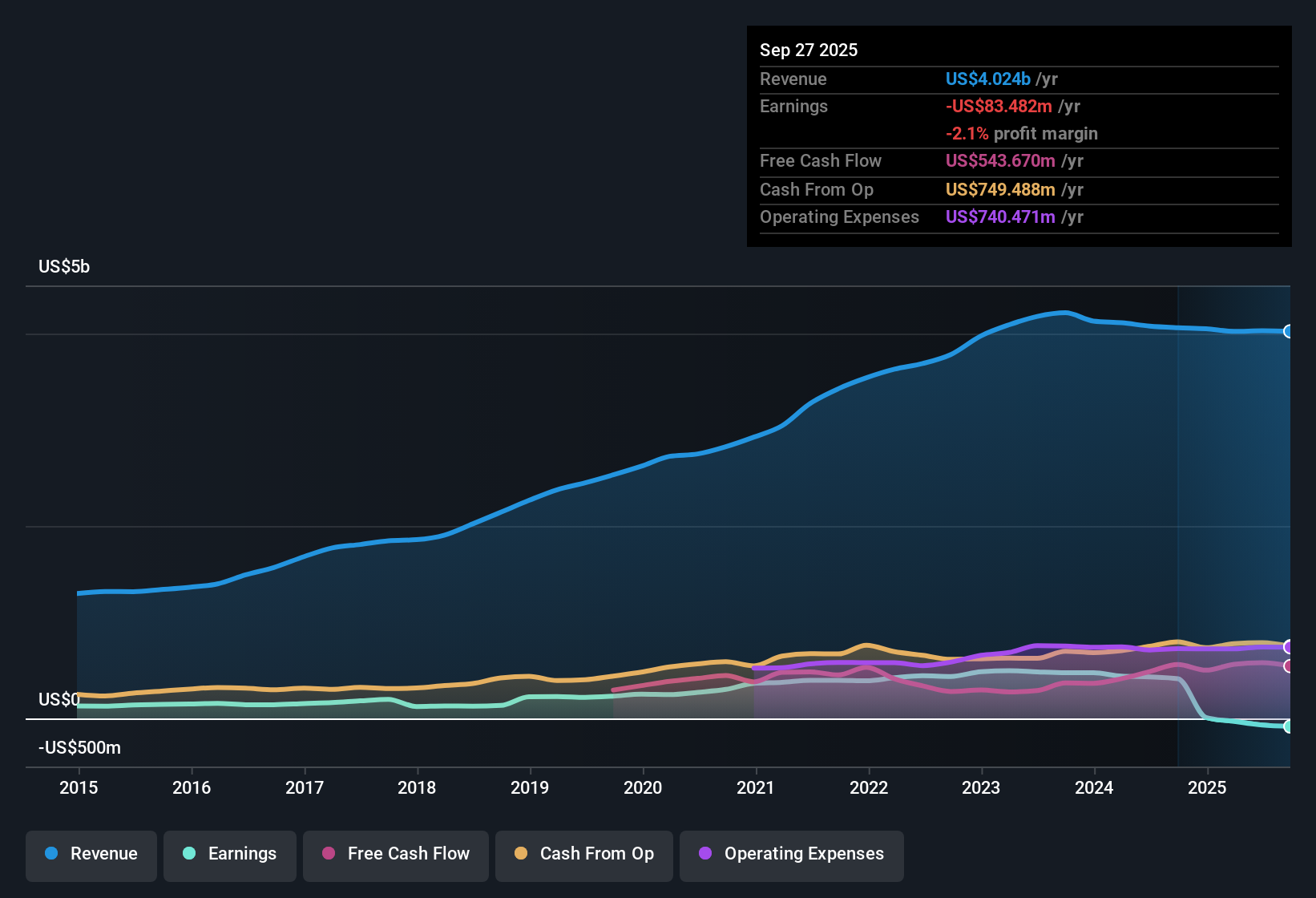

Charles River Laboratories International (CRL) remains unprofitable, with losses rising at an average annual rate of 14.3% over the past five years. Revenue is forecast to grow at 3.6% per year, which is slower than the broader US market's 10.5% projected growth. However, earnings are expected to increase by 21.51% annually, and analysts project a return to profitability within the next three years. Investors see a mix of risks from the company’s weaker financial position and slower revenue growth, balanced by improving earnings forecasts and relative valuation support, given its Price-To-Sales Ratio of 2x compared to an estimated fair value of $246.36 and a current share price of $167.7.

See our full analysis for Charles River Laboratories International.Next, we will put these results in context by comparing them with the main market narratives to see where the numbers stand and where surprises may emerge.

See what the community is saying about Charles River Laboratories International

Profit Margins Seen Rising Toward 11% by 2028

- Analysts forecast profit margins moving upward from the current -1.7% to a much healthier 11.0% within three years, a significant swing in operating leverage that underpins the path to future profitability.

- According to the analysts' consensus view, this profit margin expansion is attributed to several catalysts:

- Strategic investments in automation and digitalization are expected to lift margins as cost savings take hold. Over $175 million in annualized savings is targeted for 2025.

- Capability diversification and more advanced therapeutics offerings should help support pricing power and resilience, even as the company faces ongoing industry regulatory changes.

- See what's driving the margin turnaround in the full consensus narrative. 📊 Read the full Charles River Laboratories International Consensus Narrative.

Share Count Projected to Drop by 3.8% Annually

- Analysts expect Charles River's number of shares outstanding to shrink by 3.76% per year over the next three years. This indicates a planned emphasis on buybacks or accretive capital allocation, which should support earnings per share growth irrespective of top-line expansion.

- The consensus narrative highlights a strategic focus on disciplined capital allocation:

- Improved working capital management and freed-up cash flows from cost reductions are cited as drivers for these buybacks and continued investment into growth areas.

- This approach is seen as key to supporting long-term earnings growth and offsetting slower revenue advances, particularly while profitability metrics are still recovering from prior losses.

Valuation Underscores Discount Versus Peers

- Charles River trades at a Price-To-Sales Ratio of 2x, below both its direct peers (5.9x) and the broader US Life Sciences industry (3.4x). Its current share price of $167.70 is a 32% discount to the DCF fair value estimate of $246.36.

- Analysts' consensus view contends this valuation gap is shaped by a balance of opportunity and caution:

- On one hand, the low relative multiple and forecasted margin expansion support the case for potential upside if the earnings turnaround is delivered as projected.

- On the other hand, ongoing risks from dependence on animal testing and industry pricing pressure remain an overhang, keeping a lid on the stock’s multiple despite improving forecasts.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Charles River Laboratories International on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique angle on the figures? Share your perspective and craft your personal narrative in just minutes with Do it your way.

A great starting point for your Charles River Laboratories International research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Despite promising earnings forecasts, Charles River Laboratories faces challenges with an unprofitable track record, slow revenue growth, and concerns over its weaker financial position.

If you believe stronger balance sheets should come first, our solid balance sheet and fundamentals stocks screener (1979 results) is built to spotlight companies with robust finances and lower risk from debt or volatility.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CRL

Charles River Laboratories International

Charles River Laboratories International, Inc.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives