- United States

- /

- Pharma

- /

- NYSE:BMY

Will the Milvexian Trial Setback Shift Bristol Myers Squibb's (BMY) Cardiovascular Strategy?

Reviewed by Sasha Jovanovic

- In the past week, Bristol Myers Squibb and Johnson & Johnson announced the early discontinuation of their Phase 3 Librexia ACS trial for milvexian in acute coronary syndrome patients after an interim analysis indicated the trial would not achieve its primary efficacy goal, although no new safety issues were identified.

- This outcome has positioned increased attention on the success of Bristol Myers Squibb’s other late-stage cardiovascular programs and the company’s ability to manage pipeline risks.

- To assess how this key clinical setback for milvexian affects the broader outlook, we'll explore the implications for Bristol Myers Squibb's investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Bristol-Myers Squibb Investment Narrative Recap

To own Bristol-Myers Squibb, I believe an investor needs confidence in the company’s ability to offset upcoming patent expiries and revenue concentration risk through a robust late-stage pipeline and new product launches. While the discontinuation of the Librexia ACS trial is a setback for a high-profile cardiovascular program, it does not materially affect the main near-term catalyst: execution and regulatory progress on other late-stage assets and expanding their growth portfolio; the most important risk remains execution on new launches and pipeline advancement.

In light of this, Bristol-Myers Squibb’s recently expanded collaboration with the Sarah Cannon Research Institute stands out. By increasing access to clinical trials and accelerating timelines, this move could help mitigate pipeline risk and strengthen the company’s position for future product launches, supporting the growth narrative as it faces competitive and patent-related challenges.

However, investors should be aware that despite a strong pipeline, setbacks in pivotal studies can leave the company vulnerable to...

Read the full narrative on Bristol-Myers Squibb (it's free!)

Bristol-Myers Squibb is projected to generate $41.3 billion in revenue and $9.2 billion in earnings by 2028. This outlook is based on an expected annual revenue decline of 4.7% and an earnings increase of $4.2 billion from the current $5.0 billion.

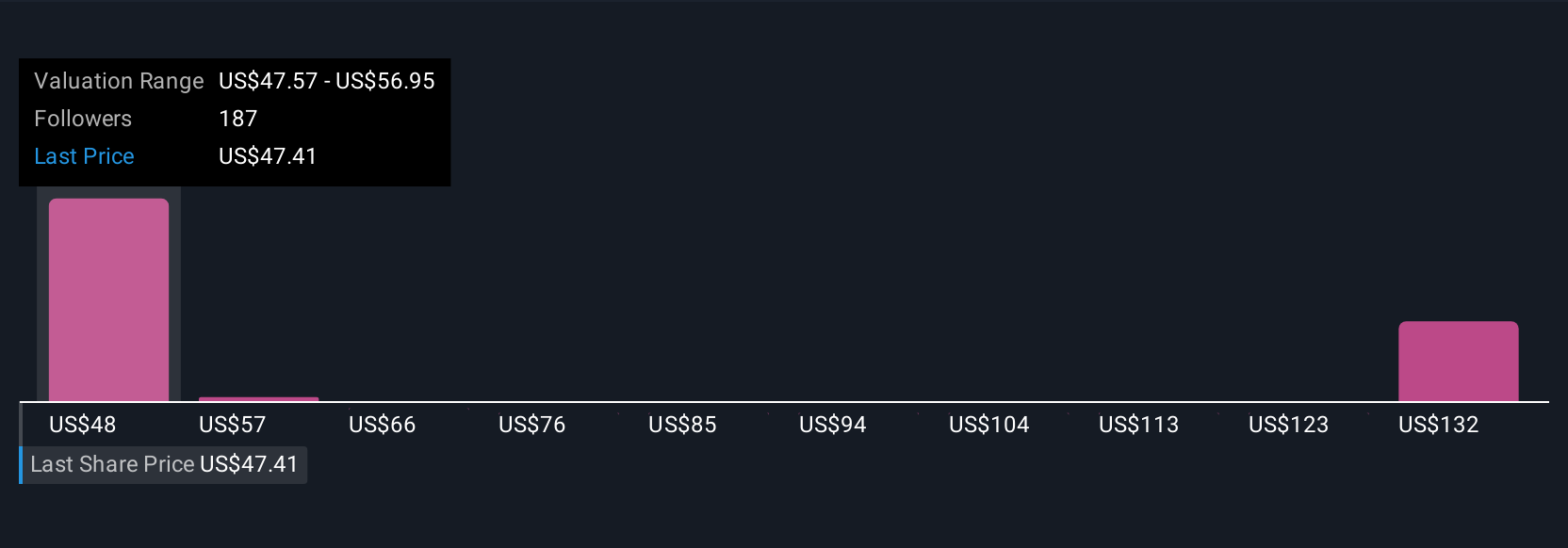

Uncover how Bristol-Myers Squibb's forecasts yield a $53.00 fair value, a 14% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided 11 fair value estimates for Bristol-Myers Squibb ranging from US$50 to US$118.93 per share. With such a wide range of perspectives, it’s clear that future revenue concentration and the risk of setbacks in late-stage clinical programs are key uncertainties influencing how you might assess the company’s outlook.

Explore 11 other fair value estimates on Bristol-Myers Squibb - why the stock might be worth just $50.00!

Build Your Own Bristol-Myers Squibb Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bristol-Myers Squibb research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Bristol-Myers Squibb research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bristol-Myers Squibb's overall financial health at a glance.

Looking For Alternative Opportunities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bristol-Myers Squibb might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BMY

Bristol-Myers Squibb

Bristol-Myers Squibb Company discovers, develops, licenses, manufactures, markets, distributes, and sells biopharmaceutical products worldwide.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives